At the Core of UK Inflation

Constructing Supercore CPI and Supercore Wage inflation for the UK economy.

In this blog, I construct a measure of supercore service inflation (service ex-actual rent) for the UK and a proxy for the corresponding supercore nominal wage inflation. One reason to build these indices is to assess the role of the labor market and in particular wage growth in generating persistent service inflation.

In this context, it is worth highlighting the following patterns:

In the pre-pandemic period, supercore nominal wage inflation and supercore service inflation overlapped.

From the onset of the pandemic until the last quarter of 2023, the two measures diverged sensibly. Initially, supercore wage inflation exceeds supercore services inflation. However, from the last quarter of 2022 till mid-2023, supercore wage inflation did run below supercore service inflation.

A similar pattern arises once we compare supercore wage inflation with overall wage inflation.

Key takeaways are:

These descriptive observations indicate that the existence and persistence of pandemic-related factors have played a key role in driving supercore service inflation and, more generally, labor market dynamics at the sectoral level.

As the Bank of England suggests in its latest monetary policy report, the correlation analysis between supercore service inflation and wages is sensitive to the selection of the sample. It is then difficult to attribute the persistence of supercore service to wage pressures.

Background

Supercore inflation is a term that refers to a subset of core inflation measures that focus specifically on the prices of services excluding housing. Core inflation measures generally exclude food and energy prices because they are volatile and can obscure the underlying trend in inflation. Supercore inflation traditionally takes this a step further by removing housing-related costs from the service component of the Consumer Price Index (CPI). In our supercore measure, only actual rents are excluded and the other housing components are still included.

This measure is significant for central banks and policymakers because it can provide a clearer picture of inflationary pressures in the economy that are more connected to domestic labor market dynamics. By focusing on non-housing services, supercore inflation aims to capture price changes in areas such as healthcare, education, and personal services, which can be more indicative of the underlying inflation dynamics driven by in particular by wage growth. Another reason to exclude actual rents is that their adjustment is less directly associated with the labor market and potentially more affected by changes in interest rates and mortgage rates (see the blog post).

This concept has frequently emerged in recent speeches by Central Bankers. In the United Kingdom, in its May 2024 Monetary Policy Report, the Bank of England (BoE) uses this concept in its analysis of the persistence of service inflation. The staff proposes a model to correlate core service inflation (excluding rents and other components) to pay growth and input costs (represented by producer prices).

They conclude the following:

Elevated pay growth has contributed to high services price inflation, and given lags in pass-through to prices, that is set to continue in the near term.

More details are provided in the next paragraph

To understand the potential future path of services price inflation, it is important to understand what has driven its current high rate. Chart 3.13 provides a breakdown from Bank staff analysis, based on a simple model utilising the correlation between current and past levels of services price inflation, pay growth and other input costs, represented by producer prices. Pay growth tends to be associated with services price inflation with a lag. Therefore, despite the recent moderation in pay growth, the model estimates suggest pay will continue to be the biggest upward contributor to services price inflation in the near term.

Constructing Supercore Service inflation

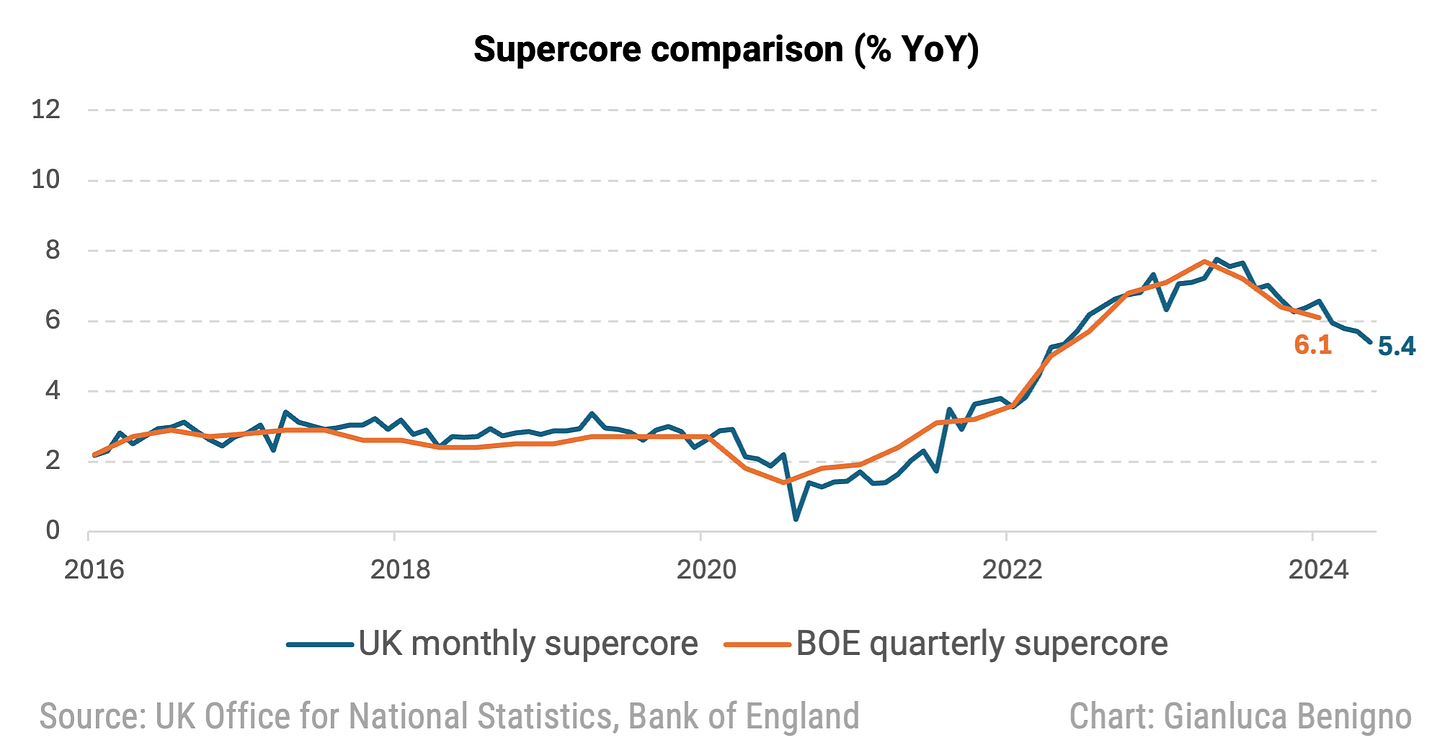

Here we provide a complementary measure of supercore service inflation for the UK. Our measure is monthly - as opposed to the quarterly measure constructed by the Bank of England -and excludes actual housing rents. The Bank of England measure excludes not only rent price inflation (actual rents for housing) but also airfares, package holidays, and education.

To ensure that our service supercore aggregate for the UK is comparable to that of the Office for National Statistics (ONS), we need to follow a similar methodology in its construction. The ONS uses a weighted average approach to aggregate indices from item level up through subclasses, classes, divisions, and all items. It is important to note that, although the monthly CPI indices published by the ONS are chained, the aggregation is done on unchained indices. Therefore, we need to unchain the indices first, perform the aggregation, and then re-chain them for comparison.

The main categories that are included in our supercore service index and their respective weights are represented in the following table:

We first compare our supercore measure with the one constructed by the Bank of England. As it can be easily seen, the two behave consistently.

Next, we compare the pattern of rent inflation versus the one of the supercore measures. Supercore peaked in the first quarter of 2023 slowly declining since. While actual rents for housing have been on an increasing path since the beginning of 2022.

We then examine different measures of inflation (overall index, service, and supercore). Service inflation is now higher than the supercore as actual rents for housing inflation have trended higher during 2024.

Constructing Supercore Wage Inflation

To complement the supercore CPI inflation measure, we construct a supercore wage pressure index using UK ONS data on average weekly earnings by industry and the relative employment share of those industries. This process involves selecting appropriate industry proxies for the categories or sub-categories used in the supercore index. The proxies used are as follows:

- Travel transport services are proxied by Transport and Storage;

- Communication is proxied by Information Communication;

- Recreational personal services are proxied by Arts, Entertainment, and Recreation;

- Miscellaneous services are proxied by Other Service Activities;

- Medical services are proxied by Health and Social Work;

- Education is proxied by Education;

Our approach can be split into two steps. First, since monthly earning tends to be volatile, we compute the 3-month moving average to smooth them. Second, we compute the supercore wage index by weighting each industry component by its employment share. The wage index for the whole economy is computed similarly by including each industry. The next figure shows the evolution of the supercore index and the whole economy index from 2019.

It is interesting to note that since the pandemic there are significant differences in the evolutions of both measures, which probably indicate the existence and the persistence of pandemic-related factors well into 2023. It is only more recently that the two indices have moved at the same rate and direction.

Conclusions

In this blog, we construct supercore service inflation and supercore wage inflation. The most recent pattern indicates convergence between these two measures along with a slow reduction of inflationary pressure. At the wage level, we observe a similar pattern: supercore wage inflation and overall wage inflation are now moderating at the same (relatively high) speed. The particularities of the pandemic period make it difficult to establish the extent to which the most recent core service pressures are mainly the outcome of wage inflation.