China January-25 CPI Inflation Report

Uptick in consumer inflation but producer inflation continued to be in deflationary territory

Key takeaways:

China Consumer Price Index (CPI, non-seasonally adjusted) increased by 0.5% year-on-year (YoY) in January, higher than the 0.1% YoY observed in December.

Core CPI (excluding all food and energy) increased by 0.6% YoY in January, up from the 0.4% YoY increase recorded in December.

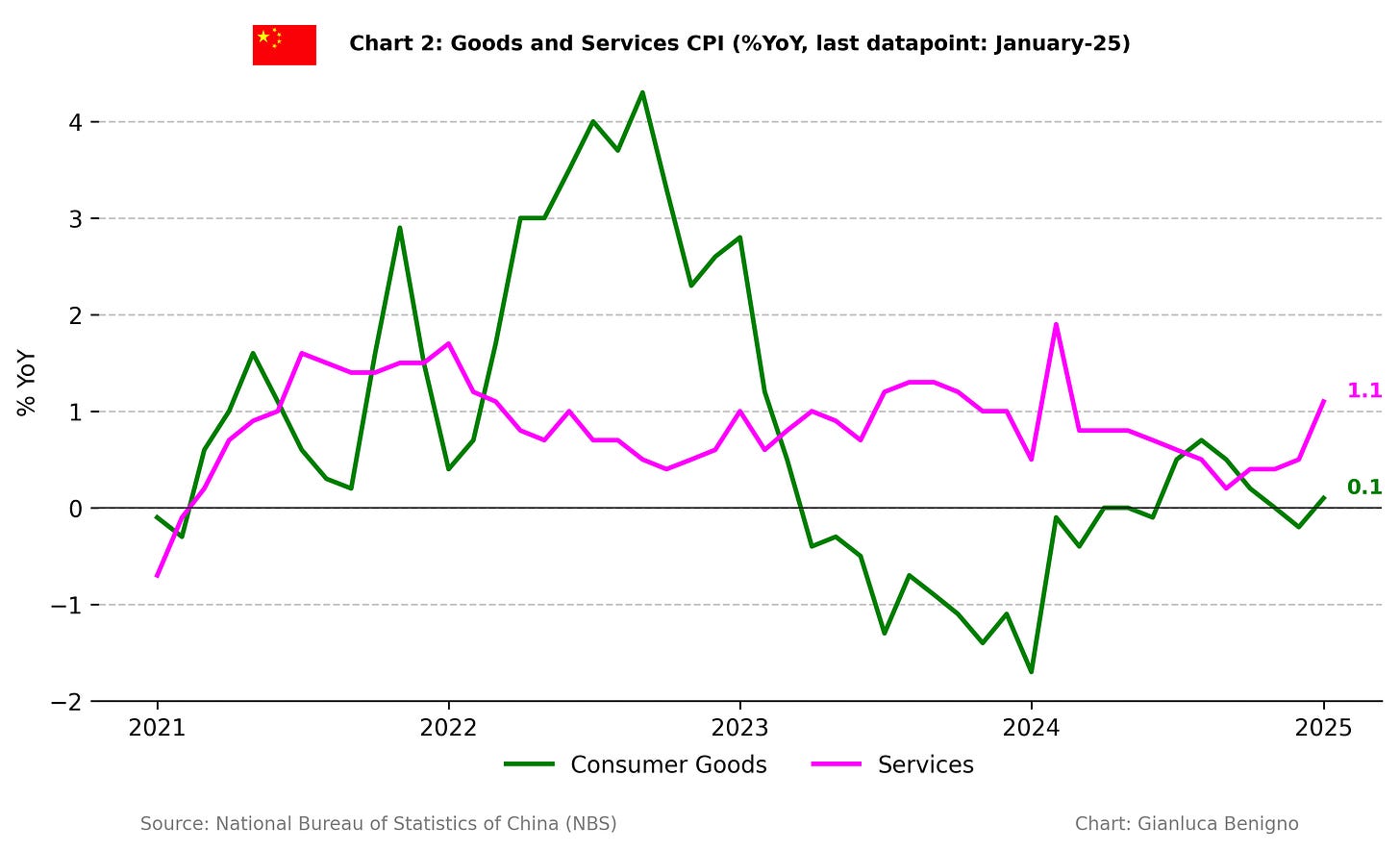

Consumer goods inflation in January increased by 0.1% YoY, an uptick from the -0.2% observed in December. Service inflation increased by 1.1% YoY, significantly higher than the 0.5% YoY figure from December.

Producer Price inflation (all items) continues its deflationary trend of -2.3% YoY in January – the same figure as in December.

Overall, the latest data confirms the relative absence of inflationary pressures at the consumer level (although with a slight uptick in the month, probably resulting from the Lunar New Year spending) and the persistence of deflation at the producer level, reflecting weak demand and excess capacity.

Related Posts

China December-24 CPI Inflation Report (previous release)

Review of the Inflation Release

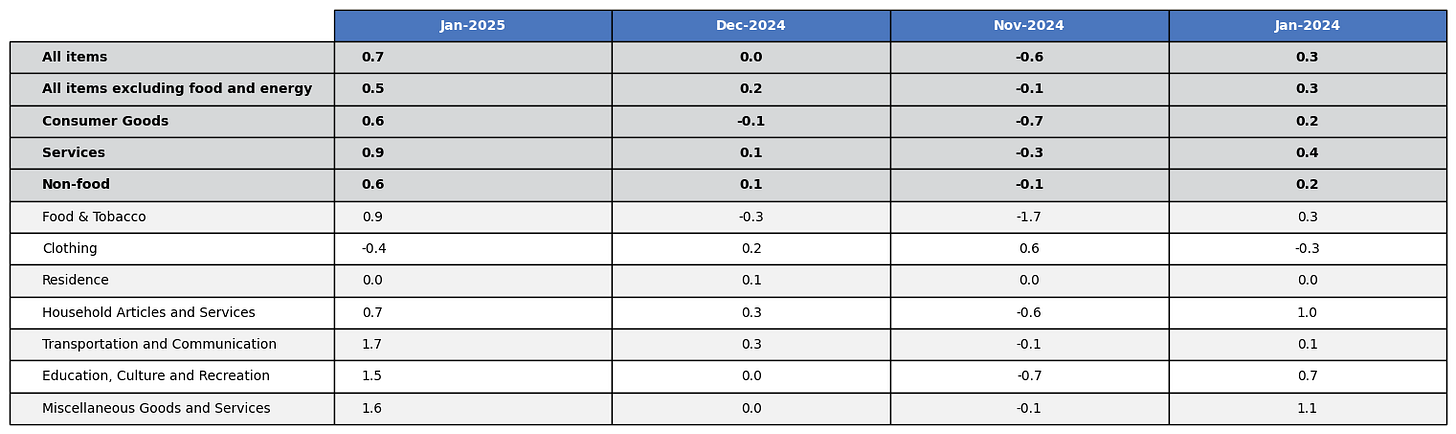

In January 2025, consumer prices increased by 0.5% year-on-year (YoY), higher than the 0.1% YoY reading recorded in December (see Chart 1). On a month-to-month basis, consumer prices increased by 0.7% MoM – in stark contrast to the flat result (0% MoM) reported in December.

In January, core inflation (excluding food and energy prices) rose by 0.6% YoY, higher than the 0.4% YoY observed in December. On a month-to-month (MoM) basis, it increased by 0.5% MoM, again, higher than the 0.2% MoM figure from December.

A relevant split that is provided at the level of China’s release is the distinction between consumer goods and services. In January 2025, consumer goods bounced back by 0.1% YoY, after seeing a decline of 0.2% YoY in December. On a monthly basis, consumer goods recorded a 0.6% increase, following a modest 0.1% MoM decline in December.

Service inflation increased by 1.1% YoY in January, after posting a 0.5% YoY increase in December. On a monthly basis, January jumped up by 0.9% MoM – significantly higher than the 0.1% MoM figure from December.

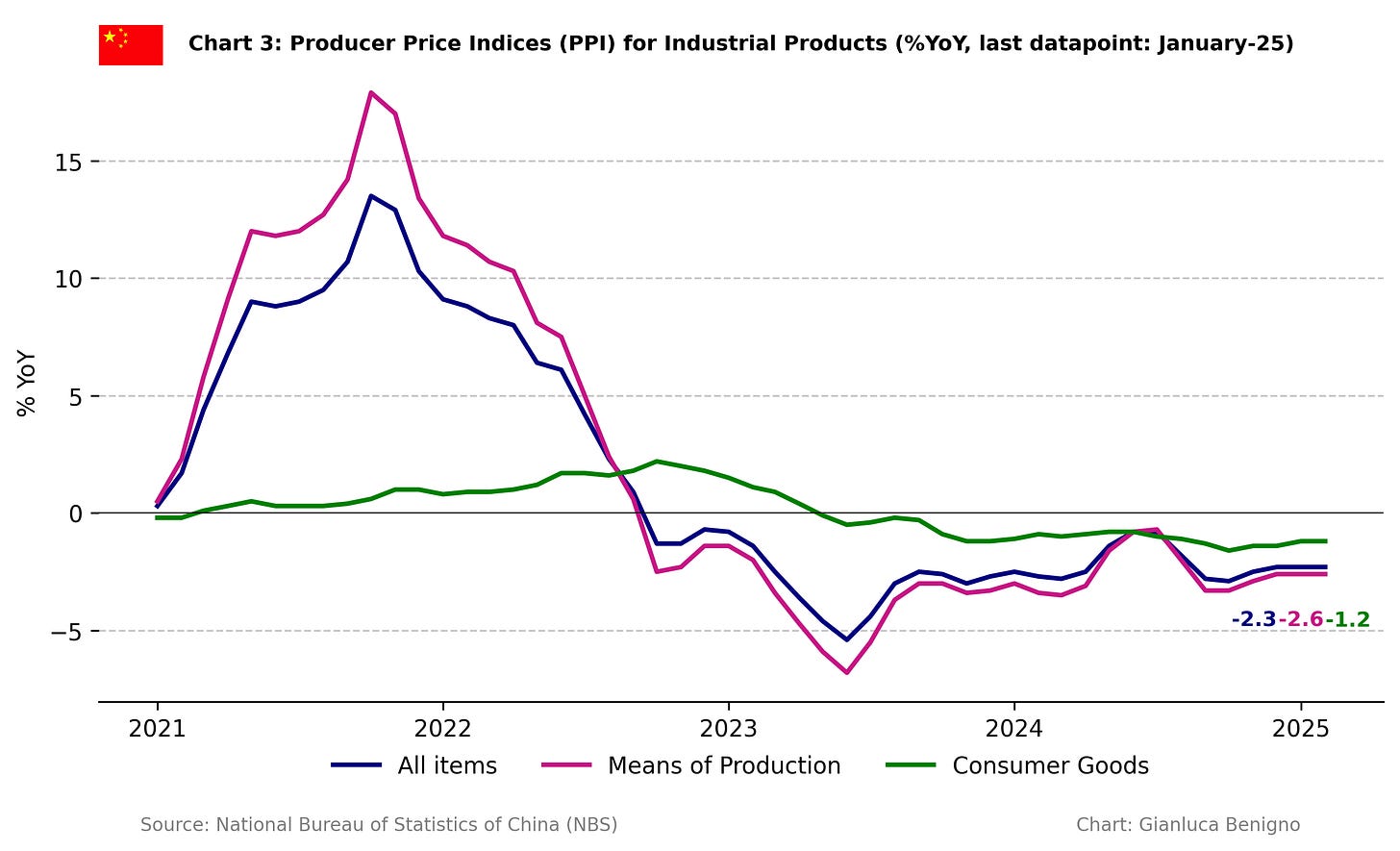

Finally, in the case of China, we also report producer price indexes. Indeed, given China’s prominence in global manufacturing, producer prices provide a good indicator for thinking about global inflationary pressures at the goods level.

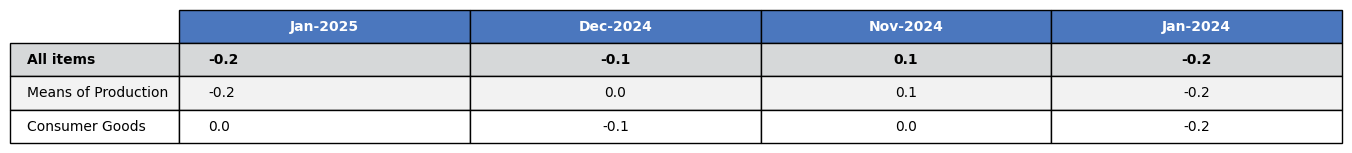

We report three categories: all items, the means of production, and consumer goods.

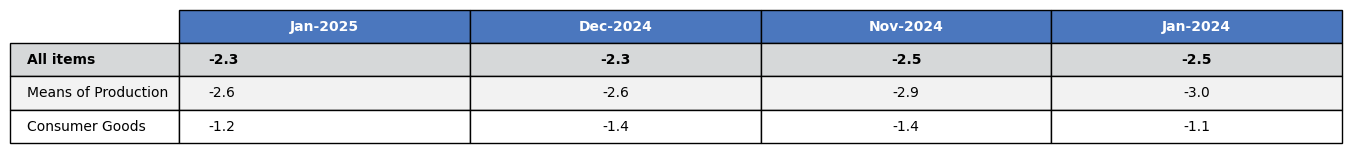

In January 2025, producer prices continued their long-running deflationary streak. Producer prices for all items declined by 2.3% YoY, following the same decline as in December. Similarly, producer prices (Means of Production) fell by 2.6% YoY in January – the same decline as in December –, indicating persistent lower input costs.

Finally, in January 2025, producer prices (consumer goods) declined by 1.2% YoY, slightly improving over the 1.4% decrease from December.

Summary

Overall, the inflationary outlook in China indicates deflationary pressures at the consumer level and confirms the persistent deflationary trend at the level of producer level. This combination is consistent with an economic environment characterized by weak demand and excess capacity. This challenging environment might prompt further policy actions possibly conditional on developments on the tariffs front.

Table 1: CPI by components (% YoY)

Source: National Bureau of Statistics of China

Table 2: PPI by categories (% YoY)

Source: National Bureau of Statistics of China

Table 3: CPI by components (% MoM)

Source: National Bureau of Statistics of China

Table 4: PPI by categories (% MoM)

Source: National Bureau of Statistics of China