Japan September-24 CPI Inflation Report

Inflation broadly in line with consensus with slow pressures at the level of services inflation.

Key takeaways:

Japan's Consumer Price Index (CPI) increased by 2.5% year-on-year (YoY) in September, lower than the 3.0% rise observed in August and in line with market expectation of an increase of 2.5% YoY.

CPI excluding fresh food, the Bank of Japan's preferred measure, rose by 2.4% YoY in September, slightly higher than market expectations of a 2.3% YoY increase, and lower than August’s 2.8% increase.

At the same time, CPI excluding fresh food and energy rose by 2.1% YoY, slightly above the 2% YoY increase in August. Compared to previous releases, the influence of energy prices on inflationary pressures has been more subdued. Indeed on a monthly basis, energy prices have declined by 6.6% in September due to government subsidies.

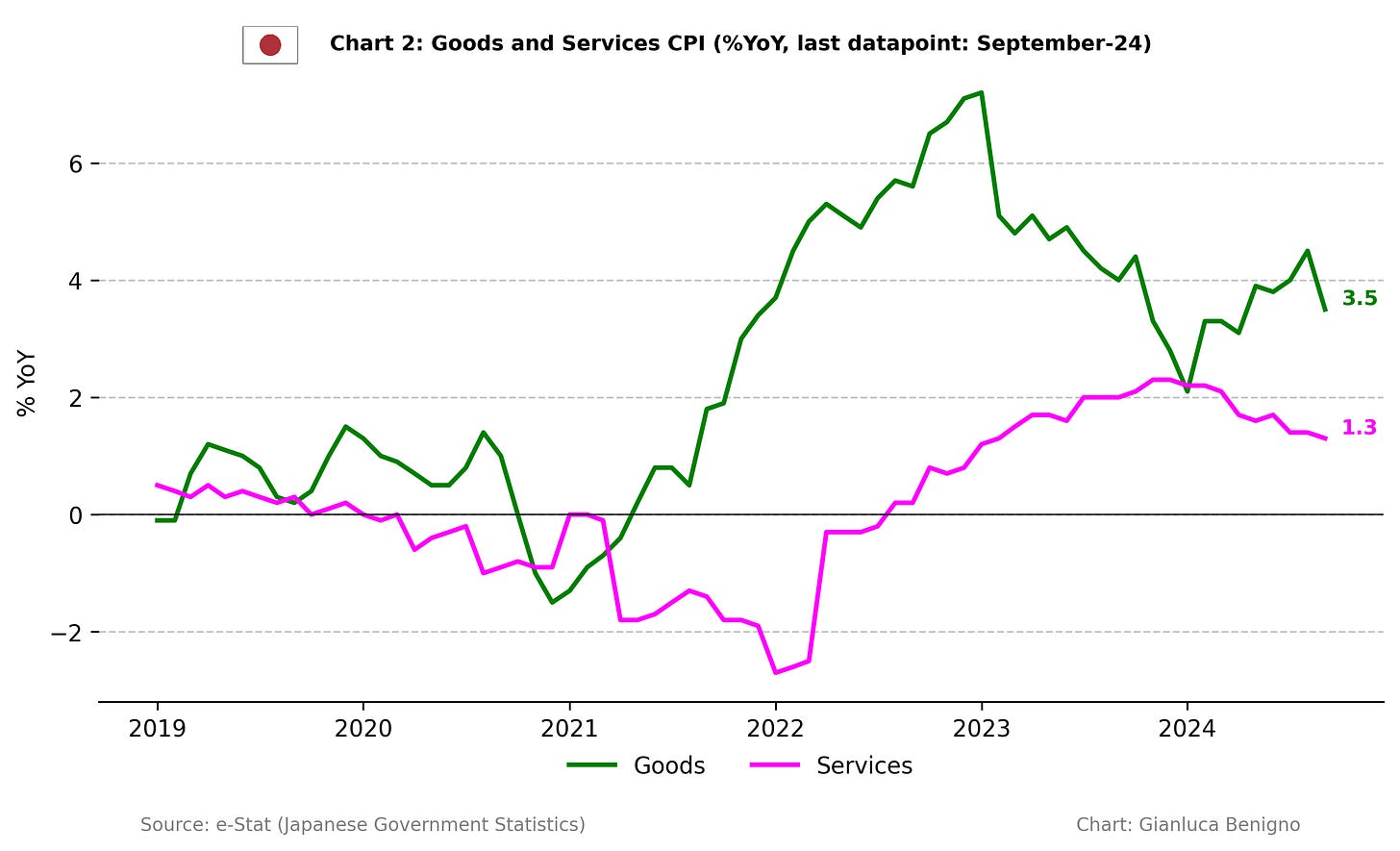

Japan's inflation diverges from patterns seen in other advanced economies. It is primarily driven by the goods sector, which rose 3.5% YoY in September (versus 4.5% YoY in August), rather than by the services sector, which saw a 1.3% YoY rise in September, lower than the 1.4% YoY recorded in August.

One notable aspect of the current release is the decline in both the service and goods components of the CPI on a monthly basis: services decreased by 0.4% MoM, while goods fell by 0.1%. In particular, the decline in services was driven by idiosyncratic factors (a reversal of the service related to the forwarding and communication component from August to September) rather than being broad-based.

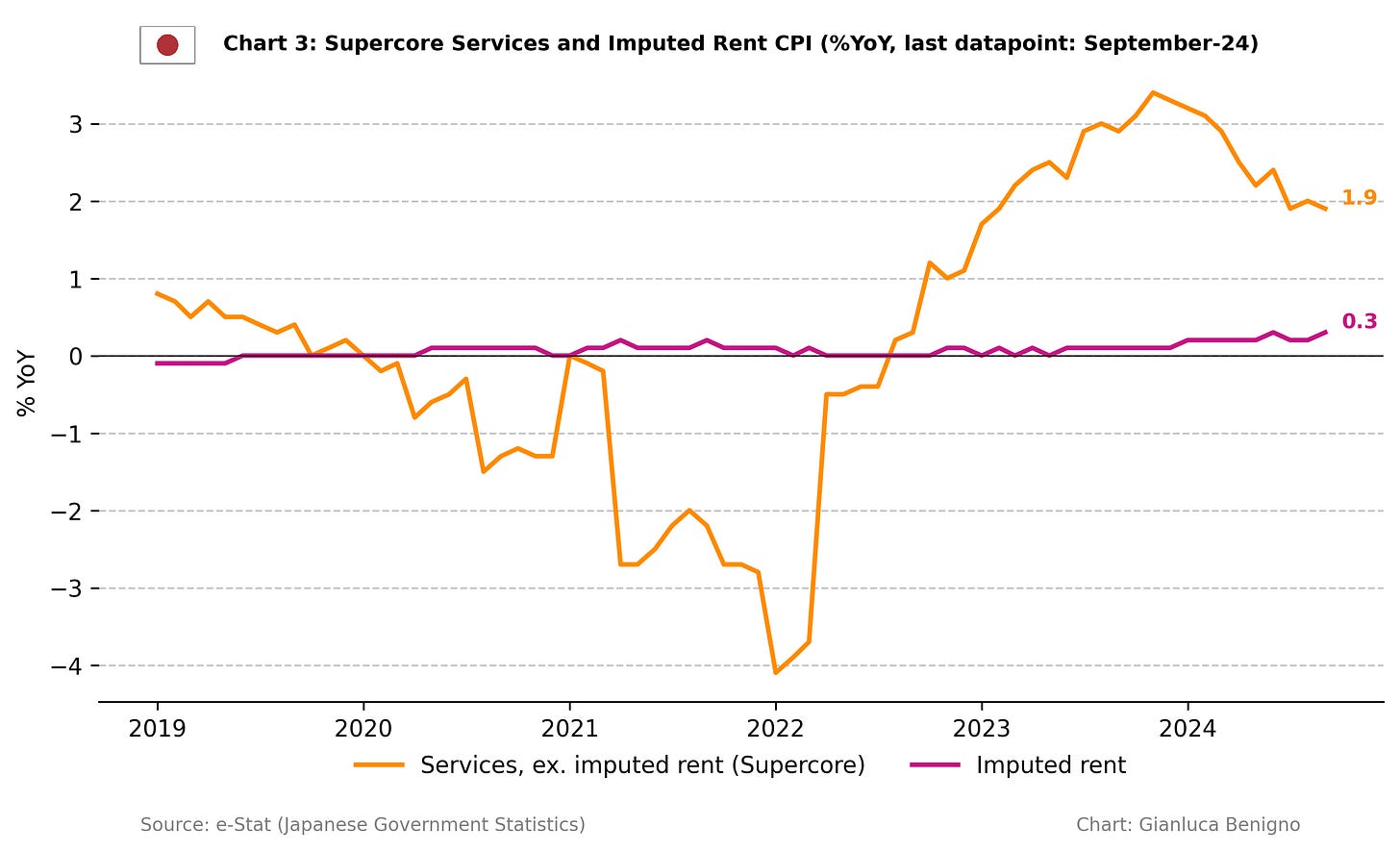

The slowdown in services inflation over the last months is consistent with lower underlying inflationary pressures as measured by the Bank of Japan.

Despite the continued above-target core inflation and the divergence between goods and services inflation, the recent appreciation of the yen from its lows—though partially reversed over the past month—could help rebalance inflation trends. This development supports the Bank of Japan’s strategy to proceed with monetary policy normalization at a gradual pace.

Related Posts

Japan August-24 Inflation Report (previous release)

Japan July-24 Inflation Report (previous report);

The Bank of Japan's Put (related post);

Post-FOMC Update: The Fed and the Market Shifts (related post).

Underlying Inflation (Bank of Japan external link)

Review of the Inflation Release

In September 2024, consumer prices increased by 2.5% year-on-year (YoY), lower than the 3.0% year-on-year reported in August. On a month-to-month basis, prices declined by 0.3%, compared to the 0.5% increase in August.

In terms of core measures, the Bank of Japan tracks two main core inflation metrics (Chart 1): the Consumer Price Index (CPI) excluding fresh food and the CPI excluding both fresh food and energy.

The first measure, which excludes fresh food, increased by 2.4% year-on-year (YoY), slightly higher than market expectations of a 2.3% YoY rise and lower than the 2.8% YoY increase recorded in August. On a month-to-month (MoM) basis, it declined by 0.4%, reversing the 0.4% MoM increase seen in August.

The second core measure, excluding fresh food and energy, rose by 2.1% YoY, slightly higher than the 2.0% YoY increase observed in August. On a month-to-month basis, the increase was 0.1%, much lower than the rise of 0.5% recorded in August.

Additionally, while the services sector is currently the main driver of inflation in many advanced economies Japan’s inflation is predominantly driven by the goods sector (Chart 2). In September, the Goods CPI increased by 3.5% year-on-year (YoY), lower than the 4.5% YoY in August, while the Services CPI rose by 1.3% YoY, slightly below the 1.4% YoY increase recorded in August.

On a month-on-month basis, goods inflation declined by 0.1% in contrast to the 0.5% increase recorded in August. Similarly, service inflation fell by 0.4% MoM, reversing the 0.5% rise seen in August.

Further emphasizing Japan's unique position, the shelter component (“imputed rents”) of the CPI has increased by 0.3% year-on-year (YoY), slightly higher than August’s 0.2% rise. The “imputed rents" measure represents “the rent a person would have to pay to own and occupy a property” which constitutes the largest part of the CPI's housing component and weighs about 15% of the overall CPI. For a detailed breakdown of the housing and rent components in Japan, refer to Tables 1 and 2.

Policy Implications

Inflation trends present mixed signals: while headline inflation and the CPI excluding food remain above target, CPI excluding food and energy is close to the target. We note here a slowdown in service inflation consistent with a decline in the underlying inflation measure constructed by the Bank of Japan. The primary factor driving headline inflation is the price of goods, which are highly sensitive to exchange rate fluctuations.

The yen strengthened from its low in early July 2024 till mid of September but partly reversed this course since. The appreciation could limit the goods inflation component of the CPI in the final quarter of the year. From a policy perspective, the Bank of Japan reaffirmed its commitment to a gradual approach to monetary policy normalization during the latest policy meeting. This intention has been further emphasized through recent speeches by Policy Board members.

Table 1: CPI by components (% YoY)

Source: e-Stat (Japanese Government Statistics)

Table 2: CPI by components (% MoM)

Source: e-Stat (Japanese Government Statistics)