The previous animation illustrates the trend in inflation rates for both the United States and the Euro area, using PCE and HICP indices for their headline and core measures. Notably, the decline is more pronounced in the headline figures, with the Euro area experiencing a more rapid decrease.

In addition to the inflation trends, various factors in the policy outlook would suggest that the ECB should be leading in cutting rates before the Fed starts its normalization cycle:

· Supply shocks have been the more relevant source of inflation in the Euro area.

· Growth forecasts are lower for the Euro area relative to the U.S. for 2024.

· Against this backdrop in terms of inflation and growth outlook, monetary policy is relatively more restrictive in the Euro area.

· Finally, the Price-Wage Gap is bigger for the Euro Area (-7%) versus the U.S. (-1%): the worry by policymakers in the Euro area about nominal wage growth seems excessive.

Background

It's broadly acknowledged that central banks in advanced economies, except for the Bank of Japan, have reached a turning point in setting interest rates. Monetary policy authorities on both sides of the Atlantic have hinted that a reduction in interest rates is likely the next step, though the timing and pace of this change remain open.

In this post, I will compare the ECB and the Federal Reserve policy outlook along with some key elements. I will review the shocks’ decomposition of inflation, the stance of monetary policy, along with internal forecasts about growth and inflation.

One point to note though is that the Federal Reserve and the ECB have different mandates. The Fed has a dual mandate to maintain price stability and achieve maximum sustainable employment in the United States. In contrast, the ECB's primary objective is to maintain price stability in the Eurozone, with a more singular focus on controlling inflation.

Nevertheless, this analysis will mainly concentrate on inflation trends, setting aside employment factors. The conclusion, even without factoring in employment aspects, suggests that the ECB is positioned to implement rate cuts before the Federal Reserve, contrary to what the market is currently pricing.

Monetary Policy Stance

First, I will examine the monetary policy stance of the Fed versus the ECB.

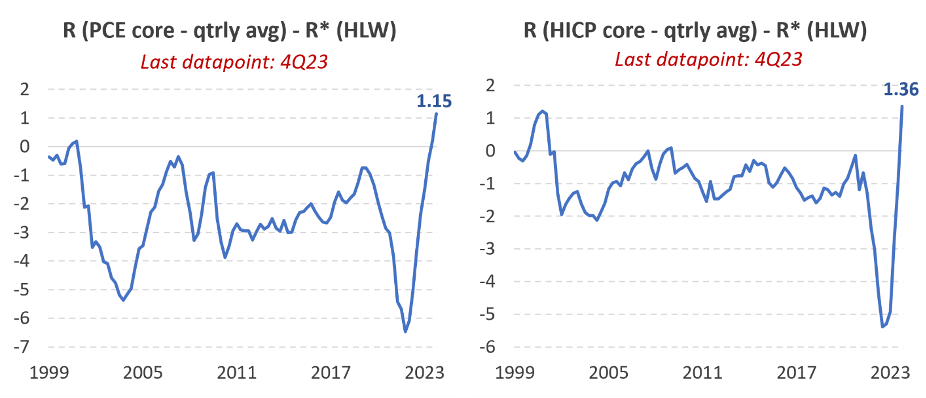

As outlined in the initial blog post, the monetary policy stance is determined by comparing the real interest rate (R) to the neutral interest rate (R*). In this context, Central Banks utilize various models and estimations to gauge R*, without adhering to a single measure. In this analysis, I'll focus on the R* measure derived from the Holston, Laubach, and Williams approach, which provides estimates for both the U.S. and the Euro area economies.

These original estimates extend up to the third quarter of 2023, but here I have updated them to include the last quarter of the year, assuming GDP growth to follow market consensus (namely 2.6% for the U.S. and 0.5% for the Euro Area in 4Q 2023). For the Q4 estimate, among several conditional assumptions about inflation and GDP growth, I selected those that yield the highest R* for the Euro area and the lowest for the U.S. economy (just as a conservative way to proceed in terms of assessing the policy stance).

There's a notable discrepancy between the two R* values obtained through this approach: our estimate shows the Euro area's R* plummeting to -1.2% in Q4 2023, while the U.S. R* stands at 0.5% during the same period.

In the following graphs, I will evaluate the policy stance using the core measure of inflation (although using the headline measure yields qualitatively similar results). It's worth noting that calculating the policy stance in terms of inflation expectations leads to a similar conclusion:

Monetary policy is relatively more restrictive in the Euro area.

The Price-Wage Gap

A critical element closely monitored by policymakers is nominal wage growth, as it's a potential driver of core service inflation. Recently, European Central Bank (ECB) officials, including President Lagarde in her interview at Davos, have emphasized the importance of negotiated wages in the first quarter of 2024 as a determinant in shaping their policy outlook.

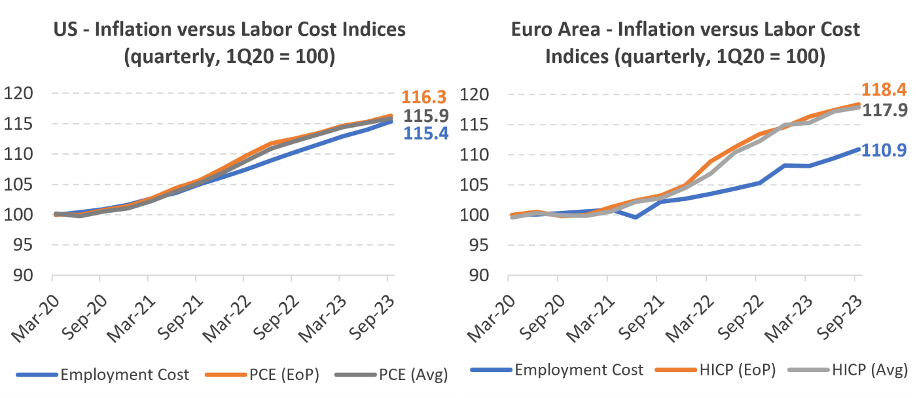

Instead of analyzing wage growth on a year-over-year basis, I will focus on evaluating whether the rise in nominal wages has sufficiently compensated for the increase in prices since the onset of the pandemic up to the most recent data. This perspective allows for a more comprehensive understanding of the real impact of wage changes in relation to inflation.

I normalize the level of prices and the preferred measure of wage compensation to 100 at the beginning of the pandemic.

The wage-price gap is significantly larger in the Euro area compared to the U.S. In the Euro area, there's an approximate 7 percent loss in purchasing power, whereas in the U.S., the loss stands at around 1 percent.

This provides a non-rigorous first-pass perspective on the claim that nominal wage growth has not been a primary driver of price increases in either economy.

Inflation drivers

The European Central Bank (ECB) released a bulletin in 2023 that offers a comparative analysis of the inflation drivers in the U.S. and the Euro area, utilizing the same methodology. Although this study was conducted at the end of 2022 and is thus a year old, it remains a useful reading for retrospectively examining the factors that influenced inflation in these two economic blocs as the disinflationary process started.

From that bulletin (that reports data up to November 2022 for the Euro area and October 2022 for the U.S.):

“Energy and food price inflation have played a key role as drivers of the higher headline inflation recorded in the euro area. In November energy inflation alone accounted for 38% of headline inflation in the euro area – but only for 14% in the United States. Together, energy and food inflation make up around two-thirds of headline inflation in the euro area, but only around one-third of headline inflation in the United States (Chart A).”

And then when focusing on the decomposition of inflation in terms of demand versus supply the bulletin reports:

“Focusing on goods inflation, the contribution of supply remains higher than the contribution of demand in both the United States and the euro area. For services, supply factors have played a more important role in the United States, while in the euro area demand factors have been more prominent”.

In parallel, the decomposition of inflation into supply and demand factors, as analyzed using the method developed by A. Shapiro, provides a more nuanced view. Overall though, given the more significant influence of energy prices in the Euro area, it is reasonable to conclude that supply factors have had a larger role in driving inflation in Europe compared to the U.S.

Growth Forecast

Finally, it is useful to review the latest growth forecast for GDP for both the U.S. and the Euro area.

The Eurosystem staff's macroeconomic projection, updated in December 2023, revised the GDP growth forecast for the Euro area in 2024 downward to 0.8 percent, a decrease from the 1 percent forecast in September 2023. Additionally, the latest ECB Survey of Professional Forecasters aligns with this view, predicting a GDP growth of 0.9 percent in 2024 for the Euro area.

In contrast, for the U.S., the most recent median Summary of Economic Projections (SEP) from the Federal Open Market Committee (FOMC) members in December indicates a forecasted GDP growth of 1.4 percent in 2024, slightly down from the 1.5 percent forecast in September. The survey of professional forecasters offers a more optimistic outlook, suggesting a GDP growth of 1.7 percent for the U.S. in 2024.

Overall: The U.S. is expected to grow faster than the Euro area in 2024.

Conclusion

In the context of a relatively more restrictive monetary policy stance, a dynamic of inflation mainly driven by supply shocks, a bigger wage-price gap, and lower growth prospects, the ECB has recently pushed back market expectations for a rate cut to the second quarter of 2024 and possibly in June. In the U.S. current market pricing suggests a rate cut for the May meeting.

The aforementioned factors should prompt the ECB to act faster rather than waiting so long.