Suggested companion reading: “Post FOMC update: The Fed and the Market Shifts”.

The Yen-Carry Trade Loop

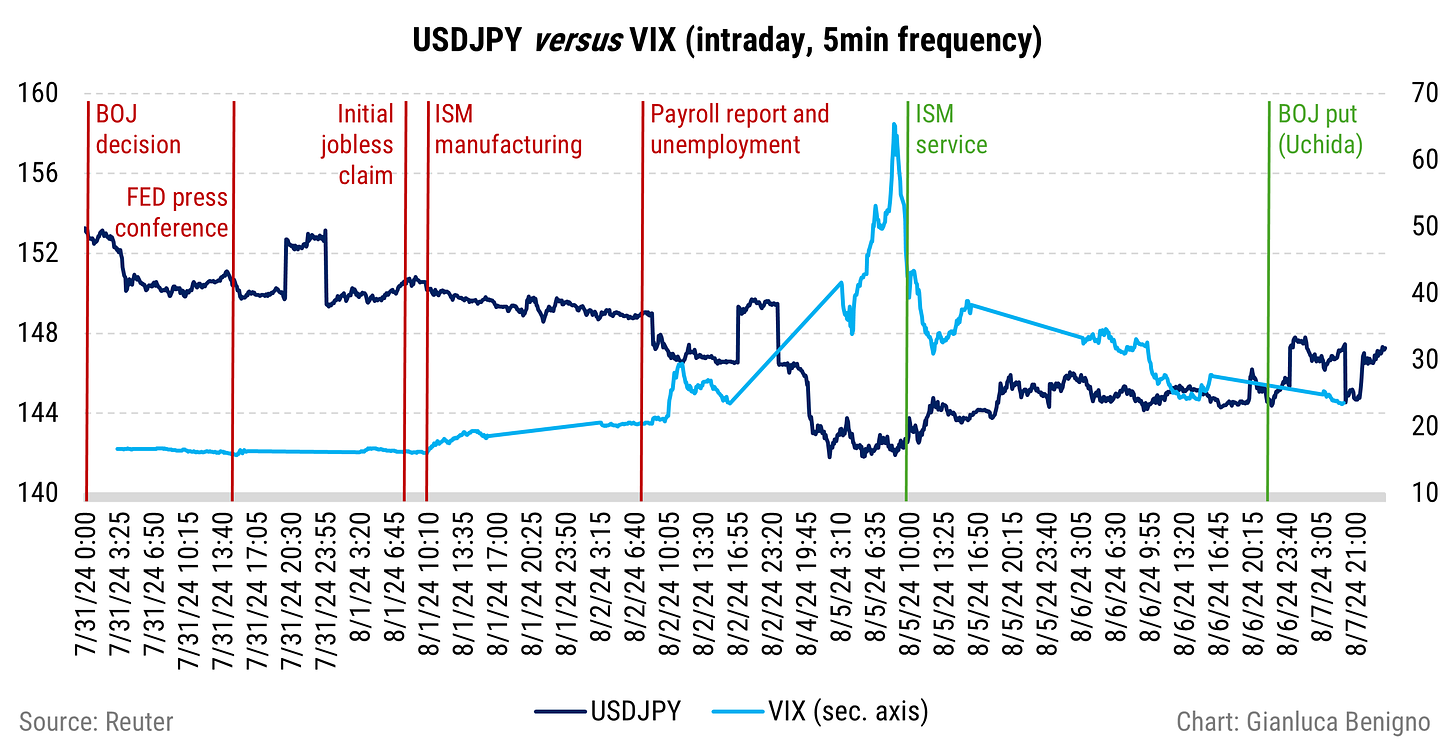

My view on the market dynamic from July 31st to August 5th is that it was characterized by what I refer to as the Yen-Carry Trade Loop (see graph below). I briefly mentioned this mechanism in my previous blog post (“Post FOMC update: The Fed and the Market Shifts”).

I wrote:

“The combination of a hawkish Bank of Japan and weaker-than-expected U.S. labor market data (such as initial jobless claims, the employment component of ISM manufacturing, and the unemployment rate) has created a financial amplification mechanism. Investors, confronted with an appreciating yen (due to interventions) and a narrowing (despite being still high) interest rate differential between the U.S. and Japan (due to disappointing labor market data and a relatively more hawkish BOJ), have been forced to close carry positions. This has amplified the yen's appreciation, the decline in asset prices (sold due to margin calls), and increased financial market volatility.”

As I mentioned above, the backdrop for the Yen Carry-Trade loop has been the Bank of Japan's hawkish stance and weaker-than-expected labor market data in the U.S., as the Federal Reserve has shifted its focus to the labor aspect of its dual mandate. The loop started with the Bank of Japan's hawkishness which led to an appreciation of the yen against all major currencies on July 31st.

On Thursday, August 1st, two weaker-than-expected labor market indicators triggered the Yen Carry-Trade loop: higher-than-expected initial unemployment claims and a low employment component in the ISM manufacturing index.

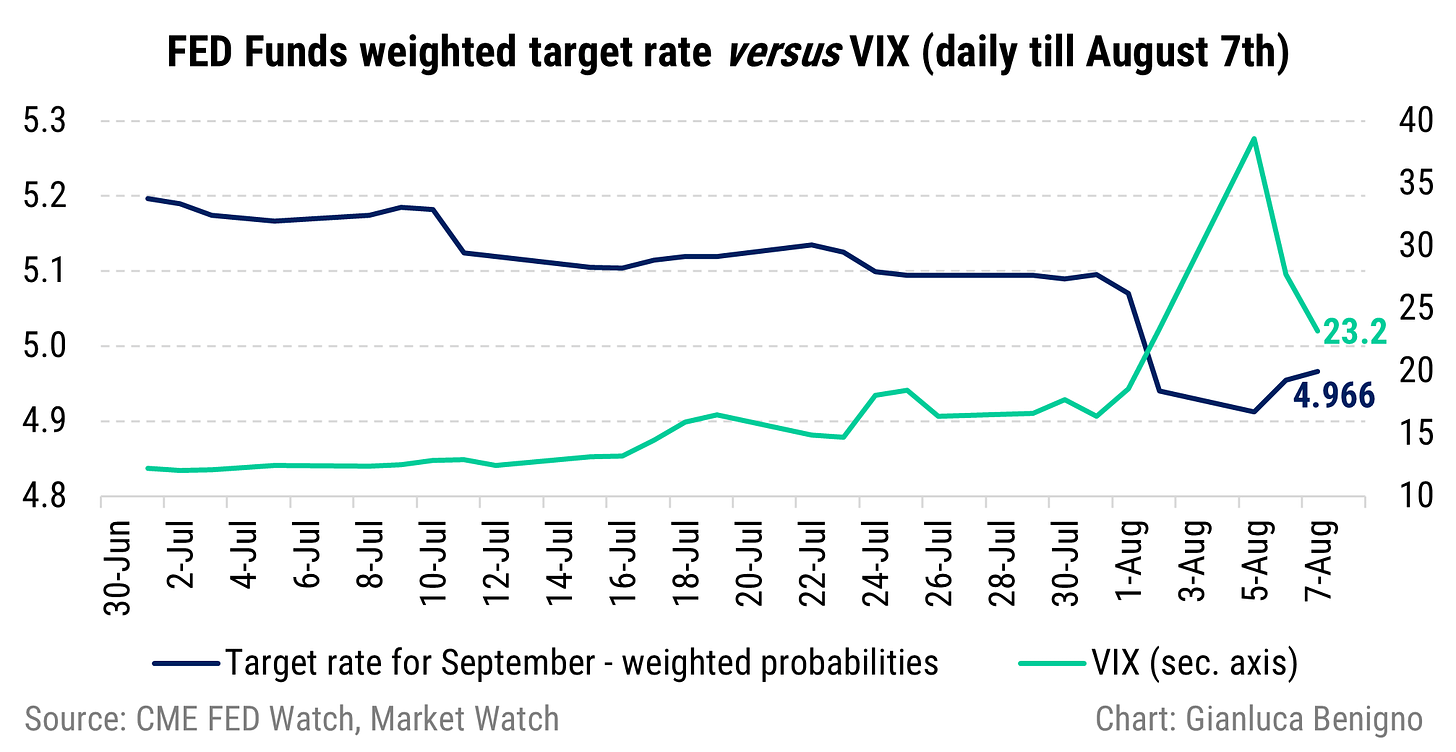

As the yen appreciated further, investors began unwinding carry trade positions, which involved shorting the yen to invest in higher-yielding assets. This unwinding coincided with an increase in the VIX (known as the "fear index," which represents the market's expectations of near-term volatility in the S&P 500 index, and a proxy for investor sentiment and uncertainty), indicating tighter global financial conditions, which in turn led to tighter U.S. financial conditions. These factors, along with weaker economic data and recession fears, put pressure on the Federal funds rate. At one point (before the ISM release), the market began pricing in the possibility of a 75-basis point cut in September 2024.

The problem is that this narrowing interest rate differential, driven by expectations of more cuts in the Federal funds rate, would reinforce the initial effect as the reduction of the interest rate differential would cause additional appreciation of the yen.

What Stopped the Loop?

As I mentioned in the conclusion of “Post FOMC update: The Fed and the Market Shifts”:

“There's a risk that confirming fears of economic slowdown with aggressive rate cuts could lead to increased volatility in financial markets as further yen appreciation might contribute to the unwinding of carry trades and lead to tighter financial conditions.”

Theoretically, the Fed's rate cuts could have exacerbated the problem, particularly by validating the financial market's panic. I believed that recession fears were overblown, and this was confirmed on Monday, August 5th, when the better-than-expected ISM services data was released, showing an expansionary employment component.

As stated earlier, another factor influencing the situation was the relatively hawkish stance of the Bank of Japan, which I will address next.

The Bank of Japan’s Put

On the morning (GMT) of August 7, 2014, Bank of Japan Deputy Governor Shinichi Uchida issued a significant dovish signal amidst unprecedented financial market volatility in Japan. He pledged not to raise interest rates during times of market instability. You can find a link to his speech here. More importantly, he stresses the following:

“as for the conduct of monetary policy, while it will depend on developments in economic activity and prices as well as financial conditions going forward, . . . if the aforementioned outlook for economic activity and prices will be realized, the Bank will accordingly continue to raise the policy interest rate and adjust the degree of monetary accommodation."

He then highlights:

It should be noted that this approach is conditioned by the phrase "if the outlook for economic activity and prices will be realized." On this point, the significant movements in stock prices and foreign exchange rates since last week would be relevant.”

And importantly in terms of the conduct of monetary policy:

“As for the future conduct of monetary policy, in a nutshell, I believe that the Bank needs to maintain monetary easing with the current policy interest rate for the time being, with developments in financial and capital markets at home and abroad being extremely volatile.”

This last paragraph in my opinion defines the Bank of Japan’s put (the Japanese analog of Greenspan’s put, i.e. the monetary policy approach associated with Alan Greenspan, the former Chairman of the Federal Reserve, which was perceived as providing a safety net for financial markets during periods of significant volatility or decline).

Where do we currently stand

Once a more balanced assessment of recession risks in the U.S. has been made along with better data and considering the Bank of Japan's "put"—its focus on financial market developments during its normalization cycle—it is reasonable to expect that the loop will stabilize for the time being.

Looking ahead, monitoring labor market trends in the U.S. and inflation developments in Japan will be crucial for assessing the trajectory of relative interest rates.

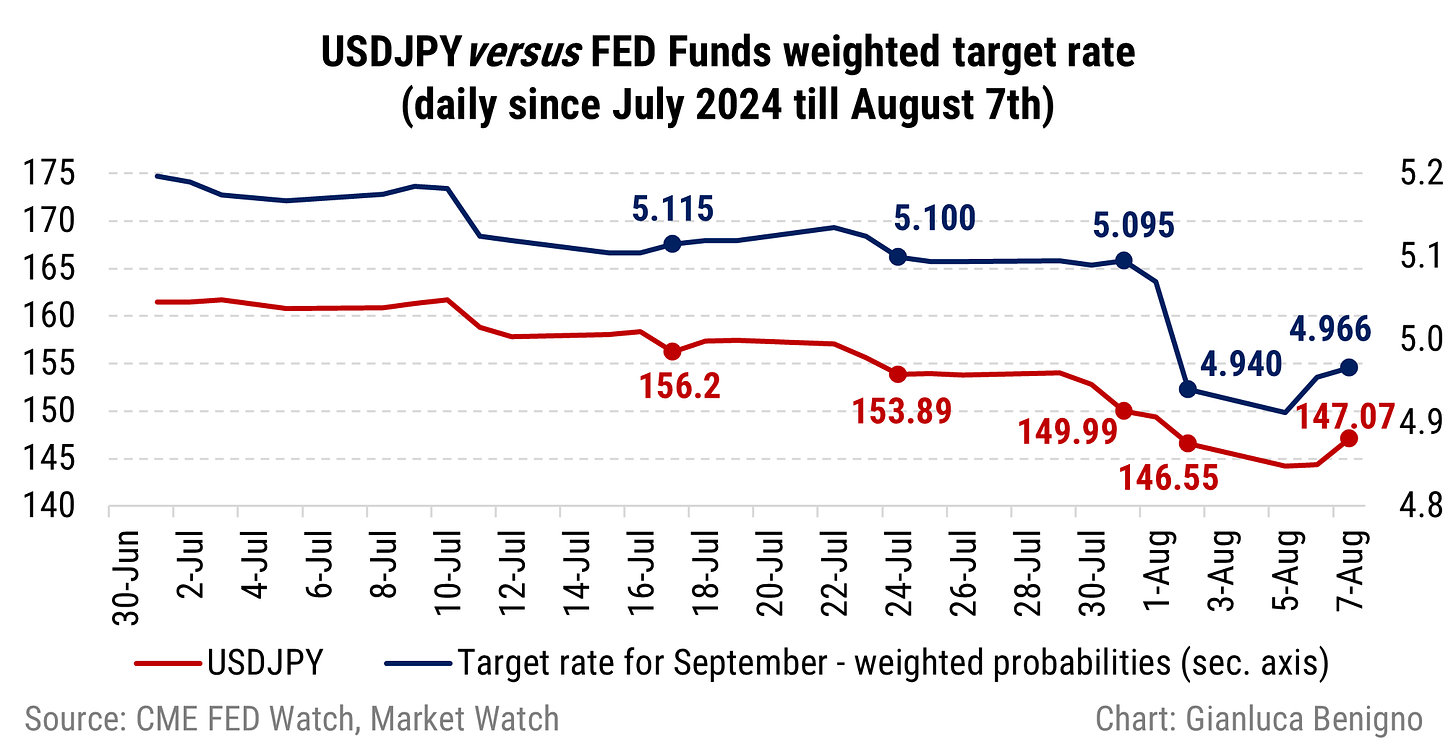

In the next graphs (over the last week) we can see how the USDJPY and VIX development have been linked to the Federal Fund rate expectations.

Conclusions

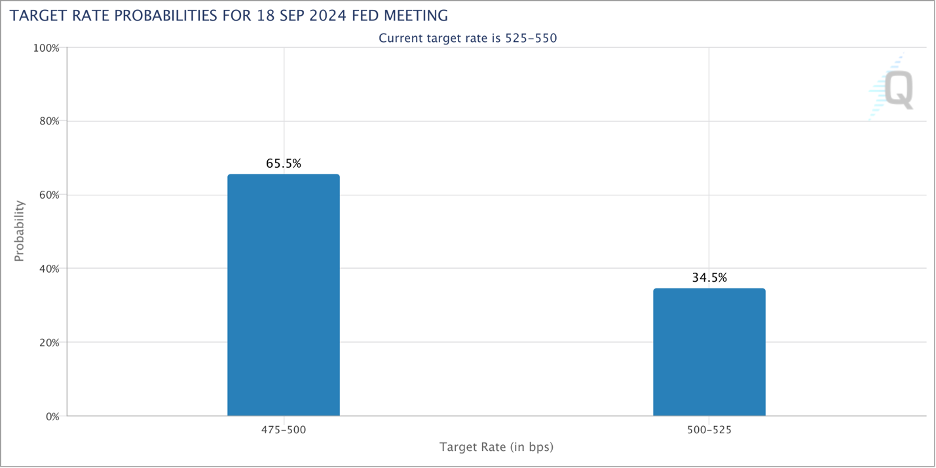

It has been an intense week for financial markets. I anticipate that market conditions will stabilize for now, especially regarding vulnerabilities from the yen carry trade loop. This should lead to a normalization of interest rates (trending upward) and a recovery in the equity market. There has already been a significant rebalancing in expectations for the Fed funds rate in September, and further labor market data will be crucial in determining whether a 25-basis point or 50-basis point cut is warranted.

This is the latest from the CMEFedWatch tool as of the 7th of August around 9:00 AM EDT signaling a rebalancing between the two choices.

An open question is whether other shocks, such as geopolitical events, could trigger a similar loop.