The Federal Reserve seems to be caught in the belief that the U.S. economy will, or should, revert to its pre-pandemic trends. However, in this post, I propose that the U.S. economy may have transitioned to a different macroeconomic norm driven by a significant and persistent fiscal policy push. The following animation represents my conjecture:

One way to rationalize the new equilibrium is in terms of the Keynesian growth approach to macroeconomic fluctuations (Stagnation Traps – Benigno and Fornaro, 2018) in which we propose an alternative framework for analyzing the interaction between business cycles and growth. In this approach, policies that stimulate aggregate demand can lead to a virtuous loop that enhances productivity and growth.

The post-global financial crisis equilibrium (GFC point in the graph) represents the scenario featuring higher unemployment, a liquidity trap, and slow growth (the stagnation trap).

The pre-pandemic situation would correspond to a point where the economy is close to full employment but in a low-growth equilibrium and interest rates are close to the effective lower bound.

Finally, the current situation of the U.S. economy would be point E in which higher productivity growth, positive nominal interest rates, and full employment characterize the economy.

More precisely, in this new regime the U.S. economy experiences:

· Higher equilibrium real interest rate (r*).

· Higher potential growth, driven by higher productivity and population dynamics (not discussed in this post).

· Higher nominal wage growth than the pre-pandemic period.

· A barely restrictive stance of monetary policy that could be tuned into a neutral mode as inflation recedes further.

I suggest that the key shifting factor in the transition towards the new norm is the persistent fiscal push and that the main risk looking forward is financial, as high for long interest rates could lead to a building up of financial vulnerabilities.

Background

Most of the structural models adopted in central banking build upon the New Keynesian synthesis that combines the real business cycle (RBC) approach with Keynesian features (slow adjustment of prices and wages). In this synthesis, the growth rate of the economy is assumed to be exogenous to business cycle fluctuations and to aggregate demand.

In the Keynesian growth approach, we integrate growth theory in the Keynesian approach to business cycle fluctuations: in this framework, aggregate demand is one of the key determinants of business investment and productivity growth. For example, companies’ incentives to invest are higher during a protracted economic expansion, because firms anticipate that the profits derived from this investment will be high. As a result, future productivity growth increases, and the economy’s potential output rises.

At the same time, high future growth prospects can stimulate current demand. For instance, an increase in the growth rate of labor productivity raises households’ expected future income and thereby sustains current consumption.

Broadly speaking, policies impacting overall demand—such as monetary and fiscal measures—can also affect the economy's supply side, creating a virtuous loop that enhances economic performance.

Finally, one implication of this approach is the non-neutrality of monetary policy in the medium run (see Ma and Zimmermann (2023) and Jorda et al. (2023) for some empirical evidence supporting this perspective).

Backward thinking

Much of the Federal Reserve's perspective is rooted in a pre-pandemic view regarding long-term equilibrium and conventional economic theories. Let's initially examine the long-term outlook by analyzing the SEP (Summary of Economic Projections) forecast.

I first plot the long-run projection for real GDP growth (both the median and the mid-point of the central tendency).

Interestingly, the median value remains virtually the same as before the pandemic, while the central tendency has shifted slightly downward in 2023. The long-run nominal Federal Funds rate follows a similar trend (next graph). Assuming a long-run inflation target of 2%, this suggests that the median member of the Federal Open Market Committee (FOMC) views the natural interest rate (r*) as being 0.5 %. It's noteworthy that, from the perspective of central tendency, there was a decrease in the latest Summary of Economic Projections (SEP) despite an upward trend in 2023.

The short-term forecast supports the traditional relationship among monetary policy, output growth, and unemployment. Let's revisit the situation at the end of 2022, focusing on the December 2022 Summary of Economic Projections (SEP) forecast.

At the end of 2022, the median predictions for the end of 2023 indicated a reduction in the projections of output growth (slipping from 1.2% in September 2022 to 0.5% in December), a rise in the unemployment projections (ticking up from 4.4% to 4.6%), and an uptick in the Federal Funds rate expectations (increasing from 4.6% to 5.1%). As inflation turned out to be more persistent than initially forecasted, the FOMC shifted to a more hawkish stance.

In turn, at the end of 2023 (December projection), economic outcomes were hardly consistent with a restrictive monetary policy stance. Actual output growth outpaced the 2022 projections significantly (at 2.6% versus 0.5% in 2022), with the unemployment rate settling at 3.8% (versus 4.6% in 2022), which was lower than anticipated. However, the Federal Funds rate was raised to 5.4% (versus 5.1% in 2022), and core PCE inflation lowered to 3.2% (versus 3.5% in 2022), which was generally consistent with the projections from December 2022.

To conclude our analysis, let's examine nominal wage growth, utilizing the Employment Cost Index (ECI) as our reference. The ECI is published quarterly and is arguably a more accurate reflection of wage costs from an employer's perspective. Despite a recent downtrend, the ECI's measure of nominal wage growth is still considered by several policymakers elevated compared to levels that would align with a labor market free of inflationary pressures.

In this respect, an interesting analysis has been conducted by my former colleagues at the NY Fed who construct an indicator of trend inflation and compare the current higher level with the pre-pandemic one suggesting that wage moderation has stalled.

Fiscal Primacy is the New Norm.

Despite experiencing some of the most aggressive monetary tightening measures, the U.S. economy showed remarkable resilience in 2023, characterized by strong growth, low unemployment, and falling inflation rates. A significant development over the past year has been the surge in productivity growth. In a blog series, 'Employ America' has highlighted the circumstances that might be signaling a new wave of productivity enhancement in the U.S.

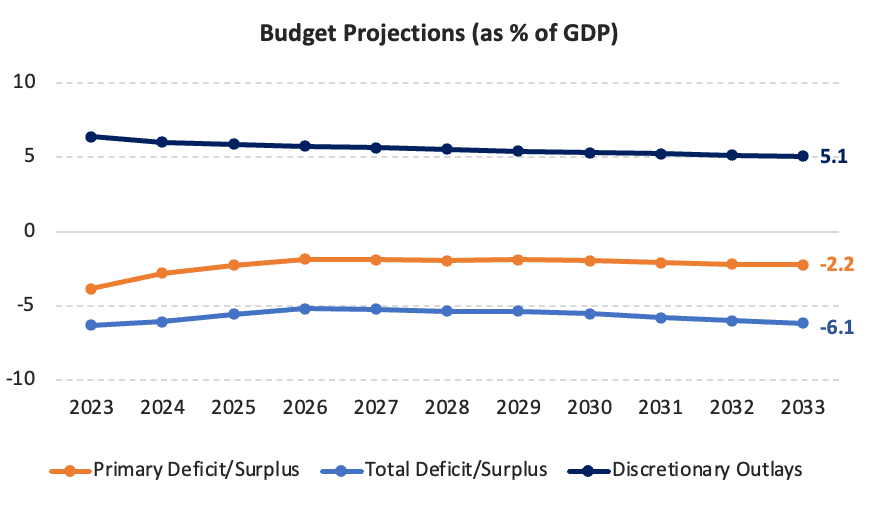

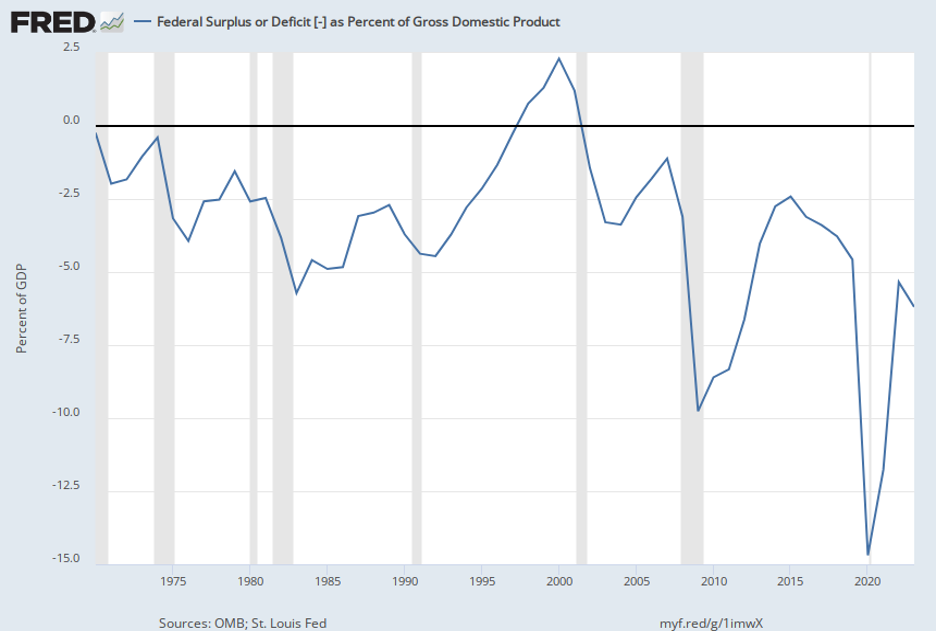

It's crucial to note that a major driver of aggregate demand has been the ongoing large fiscal deficit, which is unparalleled in recent history. According to the CBO, the fiscal deficit over GDP is expected to be around 6% for the next ten years.

In the past forty years, the fiscal deficit has exceeded 6% twice (1982-83, and 2008-2009) and this happened only during recessions (the shaded area in the graph).

In my view, fiscal policy, rather than monetary policy, is the main driver of aggregate demand, particularly in today's context where the monetary policy's transmission appears muted. Within the Keynesian growth approach, a persistent fiscal stimulus can lead to a rise in both innovation and investment, potentially fostering a period of increased productivity.

My hypothesis, therefore, suggests that the U.S. economy has entered a new phase, largely due to fiscal interventions. This new macroeconomic norm differs from the one before the pandemic. Previously, the equilibrium was marked by modest productivity growth at an average of 1.4% per year, real GDP growth hovering around 2%, and unemployment around 4%. If we're now experiencing productivity rising above 2%, this could imply that the trend growth has shifted upwards to about 2.5%, with a natural unemployment rate similar to the level before the pandemic. In this context, the natural interest rate would stand higher, around 1.5% in real terms, which would be equivalent to an equilibrium nominal rate of about 3.5%. In this scenario, current monetary policy may not be restrictive, regardless of how current real interest rates are calculated. Finally, higher productivity could be well consistent with nominal wages growing at least 4 % per year.

Risks

The current business cycle is dominated by fiscal policy; monetary policy has limited effects on aggregate demand, but it becomes more relevant in terms of the financial cycle. The new regime of relatively higher for longer nominal and real interest rates could expose financial vulnerabilities linked to the refinancing cycle.

Given the relative strength of the fiscal versus the monetary tool, inflation will be mainly dictated by fiscal developments and exogenous supply factors.

Conclusions

In this post, I argue that, due to a strong fiscal push, the U.S. economy has entered a new regime. From a monetary policy perspective, this new regime implies higher for longer interest rates, a limited ability to affect inflation, and the monitoring of financial developments.