These are background notes for my students in Monetary Economics that are drawn from the SNB’s website.

Mandate

The National Bank Act (NBA), Art. 5 specifies that the SNB is to ensure price stability while considering the development of the economy. The SNB achieves its mandate by managing short-term interest rates and the value of the Swiss franc (CHF).

Key aspects

In what follows I outline the operational framework for monetary policy and liquidity management used by the Swiss National Bank (SNB). These frameworks are characterized by using open market operations, the rates applied to sight deposits, the provision of standing facilities, and the availability of emergency liquidity assistance.

The SNB conducts its monetary policy through the establishment of the "SNB policy rate," which corresponds to the rate charged on sight deposits held at the SNB (adopting the floor system).

The aim is to maintain short-term secured Swiss franc money market rates—particularly the Swiss Average Rate Overnight (SARON), which serves as a key benchmark—closely aligned with the SNB policy rate. This approach was adopted in June 2019, moving away from the previous strategy of targeting a range for the three-month CHF LIBOR, in response to the global move towards alternatives to the LIBOR.

Moreover, the SNB provides a liquidity-shortage financing facility to mitigate unexpected short-term liquidity shortages in the overnight interbank market, along with an intraday facility that supplies interest-free liquidity to support payment settlements throughout the day. As a last resort, the SNB is prepared to offer emergency liquidity assistance (ELA) to banks that find themselves unable to obtain refinancing in the market.

Implementation of Monetary Policy

The Swiss National Bank (SNB) executes its monetary policy through the establishment of the "SNB policy rate," aiming to keep it aligned with the SARON.

The most direct method the SNB uses to influence money market interest rates is by adjusting the interest rate on sight deposits maintained at the SNB. Additionally, the SNB can indirectly influence money market rates or modify overall liquidity conditions by engaging in open market operations. These operations include conducting repurchase agreement transactions (repo), issuing SNB bills, and executing foreign exchange transactions or swaps.

What are sight deposits?

Sight deposits at the Swiss National Bank (SNB) are liquid funds held by both domestic and foreign banks or financial institutions. These deposits are crucial for participating in open market operations with the SNB and for meeting the mandatory minimum reserve requirements set for domestic banks (currently at 2.5%). Sights deposits are subject to a tiered remuneration system:

For sight deposits up to a certain threshold, the SNB policy rate is applied (calculated at an institution-specific approach). Sight deposits above this threshold are remunerated at a rate slightly lower than the SNB policy rate, with a discount of 0.5 percentage points. This discounted

rate aims to incentivize active participation in the money market for institutions holding larger deposits. Since 1 December 2023, sight deposits that are held to meet minimum reserve requirements have no longer been remunerated.

What are open market operations?

The Swiss National Bank (SNB) utilizes open market operations as a strategy to adjust the target interest rate. These operations are defined by the SNB as transactions initiated by itself, unlike standing facilities where the SNB sets conditions for liquidity access but does not initiate transactions.

Open market operations include activities such as repurchase agreements (repos), issuing SNB bills, and conducting foreign exchange transactions or swaps. For an entity to participate in these operations as a counterparty, it must be a domestic bank or another financial institution that plays a role in enhancing the liquidity of the secured Swiss franc money market. Domestic branches of foreign banks can be included among the elected institutions.

As an example, consider the following liquidity-providing repo transaction, where the SNB purchases securities worth CHF 10 billion from UBS and credits the associated sum in Swiss francs to the counterparty's sight deposit account at the SNB (imagine this as a bilateral repo transaction with 1% annual fixed tender interest rate).

At the same time, it is agreed that at the end of the term (suppose 1 month), the counterparty will purchase securities of the same type and quantity from the SNB.

In 1 month, the transaction is reversed, and UBS pays SNB the repo interest rate (1 month at annualized 1% is 8.3 million).

Foreign Exchange Intervention

An important dimension of the operational framework is open market operations in the foreign exchange market. Indeed, in recent years, the SNB has also engaged in foreign exchange interventions to impact the exchange rate and modify overall liquidity conditions. To fulfill its monetary policy mandate, the SNB may purchase and sell foreign currency against Swiss francs on the financial markets. The foreign currency purchased as part of foreign exchange transactions is reported in the balance sheet under foreign currency investments; the Swiss francs sold are credited to the banks' sight deposits. Foreign exchange rate intervention should be interpreted as an open market operation that involves transactions in securities denominated in foreign currency.

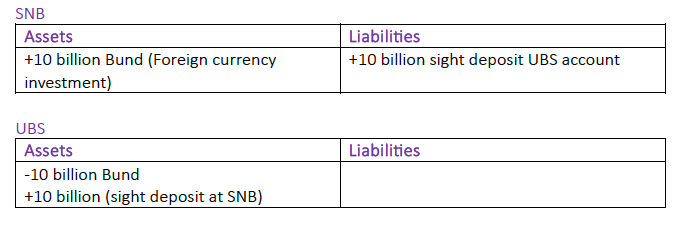

As an example, consider the purchase of German Bund (Treasury bonds) from UBS for a value of 10 billion CHF.

Foreign exchange open market operations entail currency risk (the SNB does not hedge against that) so the value of its assets can change over time if there are changes in the value of the Bund due to interest rate risks or exchange rate fluctuations.

SNB bills issuance

What are SNB bills?

SNB Bills are money market instruments used to manage liquidity. By issuing SNB Bills, the SNB can temporarily absorb Swiss franc liquidity from the banking system. In turn, liquidity becomes scarcer and money market rates increase. The SNB can also repurchase SNB Bills via the secondary market to increase the supply of liquidity to the financial system where necessary.

Besides foreign exchange rate transactions, another tool through which the SNB can influence liquidity in the system (i.e. sight deposits) is by issuance of SNB bills.

The issuance of its debt certificates in Swiss francs (SNB Bills) allows the SNB to absorb liquidity. It can repurchase SNB Bills via the secondary market to increase the supply of liquidity to the financial system where necessary.

Throughout 2023, SNB Bills with various terms were auctioned weekly such that at the end of 2023, the total volume of outstanding SNB Bills was CHF 86.7 billion.

In what follows liquidity is drained by issuing bills as opposed to selling foreign currency holdings.

There is no change in the size of the balance sheet of the SNB but just a change in the composition of its liabilities. Similarly, from the perspective of the financial institution, we observe a change in the composition of its assets.

A summary of recent relevant policy measures

FX intervention

In recent years, the SNB has also engaged in foreign exchange interventions to impact the exchange rate and modify overall liquidity conditions. This strategy was particularly prominent when the SNB set a minimum exchange rate against the euro from September 2011 to January 2015, utilizing foreign exchange interventions as a primary tool for monetary policy during this period. The next figure plots the CHF versus the main bilateral (USD, Euro, and GBP).

Since 2009, the Swiss National Bank (SNB) has extensively used foreign exchange (FX) interventions to curb the appreciation of the Swiss franc, as illustrated in the following figure by buying foreign currency assets and selling Swiss francs.

In general, to carry out interventions in the FX markets, the SNB may buy or sell foreign exchange in the spot or forward markets or engage in FX swaps.

A key period was from September 2011 to January 2015, during which the SNB set a minimum exchange rate of 1.20 Swiss francs per euro, using this rate as a primary tool to prevent the Swiss franc from appreciating too much. This action was taken in response to concerns that a strong Swiss franc posed a severe risk to the Swiss economy, potentially leading to deflationary pressures. Although this minimum exchange rate policy was discontinued in January 2015, causing a significant rise in the value of the Swiss franc, the SNB has continued to be actively involved in the FX market as shown in Figure 3.

The Swiss franc, often seen as a safe haven currency, is prone to sharp increases in value during times of global uncertainty. The SNB sometimes announces plans to intervene or confirms post-event interventions in these situations. The substantial acquisition of foreign currencies by the SNB since 2009 has resulted in a significant growth in sight deposits at the SNB, thereby increasing the system's liquidity. Change in sight deposits can be used as a proxy for foreign exchange intervention. In the following graph, we report the composition of the foreign currency investment based on the type of securities that the SNB purchases.

Negative interest rate

In December 2014, the SNB introduced a policy of charging negative interest on Swiss franc-denominated sight deposits that exceeded a specified exemption limit. This measure aimed to lower money market rates into negative territory and bolster the minimum exchange rate floor against the euro. Initially, the negative rate was set at -0.25 percent, targeting a three-month Libor range of -0.75 to 0.25 percent. However, in January 2015, just as the negative interest policy was about to be implemented, the SNB reduced the rate to -0.75 percent and adjusted the target Libor range to between -1.25 and -0.25 percent. This adjustment was made in conjunction with the decision to abandon the exchange rate floor, serving to prevent an "inappropriate" tightening of monetary policy. Currently, the charge on domestic sight deposits is at 1 percent, aligning with the SNB's revised policy rate and operational framework.

Repo and other tools

Historically, the Swiss National Bank (SNB) primarily used repurchase (repo) operations to inject or withdraw liquidity in the money market, aiming to influence benchmark money market interest rates. Another tool at the SNB's disposal for managing market liquidity includes issuing SNB Bills, which are interest-bearing debt instruments of the central bank. However, it's important to note that in recent years, the use of both repo transactions and SNB Bills has significantly declined. This shift occurred as the SNB's extensive foreign currency acquisitions since 2009 led to a marked rise in sight deposits and consequently, a surge in liquidity within the banking sector. Specifically, in August 2011, the SNB implemented strategies to combat the strength of the Swiss franc. These measures included lowering the target range for the London Interbank Offered Rate (Libor) to between 0.00% and 0.25%, and increasing the amount of sight deposits that banks could hold from CHF 30 billion to CHF 80 billion. Following this, the SNB declared it would stop renewing repos and SNB Bills and would buy back any outstanding SNB Bills.

The following figures provide a summary of the recent evolution of the assets and liabilities side of the SNB’s balance sheet.

Standing Liquidity Facilities

The SNB operates two main standing liquidity facilities: a liquidity-shortage financing facility and an intraday facility. Different from open market operations, the SNB sets the terms for these facilities but does not initiate transactions.

The liquidity-shortage financing facility aims to mitigate temporary liquidity shortages through special-rate overnight repo transactions, like the Federal Reserve's discount window. The rate for these transactions is set daily, based on the Swiss Average Rate Overnight (SARON) plus a markup. The maximum liquidity a counterparty can access is capped by the SNB, and collateral must cover at least 110% of this cap. If the collateral's value dips below the required level, the counterparty has six hours to rectify the shortfall, or its liquidity limit will be adjusted. The same criteria for collateral used in open market repos apply to these transactions.

The intraday facility provides interest-free liquidity to counterparties for the day through repo transactions, facilitating smoother interbank payments and foreign exchange operations. Eligible participants must offer sufficient collateral, meeting the same standards as for repo transactions, to cover at least 110% of the liquidity taken, which must be repaid by the end of the working day.

Emergency Liquidity Assistance

As a last resort, the SNB can provide emergency liquidity assistance to domestic banks that are unable to secure financing through the market. To be eligible, a bank must be crucial for financial system stability, be solvent, and possess adequate collateral as assessed by the SNB.

The SNB determines what collateral is sufficient. To assess the solvency of a bank or group of banks, the SNB obtains an opinion from FINMA.

In addition to its existing liquidity facilities, the SNB deployed two new instruments based on emergency law – ELA+ and the public liquidity backstop (PLB) – in connection with the crisis at Credit Suisse in March 2023. ELA+ is a liquidity assistance loan secured using preferential rights in bankruptcy proceedings. The PLB is also a liquidity assistance loan secured by means of preferential rights in bankruptcy proceedings and additionally by a federal default guarantee.

Covid Refinancing Facility

In March 2020, the Swiss National Bank set up the new SNB COVID-19 refinancing facility (CRF). It is a temporary standing facility designed to cushion the economic impact of the coronavirus (COVID-19) pandemic. The facility allows banks to obtain liquidity from the SNB in the form of a secured loan by assigning credit claims from corporate loans as collateral.

Monetary and Fiscal Interaction

The SNB is also known as the banker to the Confederation. Thus, the SNB conducts payments on behalf of the Confederation, whereby the Confederation's transactions in Switzerland or abroad are conducted via its sight deposit accounts in Swiss francs and foreign currencies at the SNB.

The SNB may not acquire newly issued Confederation, cantonal, or municipality debt securities. It may, however, purchase such bonds on the secondary market.