The SNB sets the time

To depreciate the Swiss franc

In its latest monetary policy meeting the Swiss National Bank lowered the SNB policy rate by 25 bps from 1.75% to 1.50%. This move has caught many analysts by surprise and marks the beginning of the easing cycle by major central banks.

I interpret this policy move as a shift towards favoring exchange rate depreciation.

In this post, I aim to outline the key issues the SNB might encounter in 2024 while shifting its policy stance:

a) Restarting Balance Sheet Expansion: The SNB may have to increase its balance sheet to help lower the value (depreciation) of the Swiss Franc (CHF). With the European Central Bank (ECB) potentially cutting its policy rate more sharply, maintaining the CHF's exchange rate could become more complex.

b) Domestic inflationary pressures: the increase in rent price has been an important factor behind the increase in the domestic component of inflation. Lowering interest rates could help mitigate this channel, even though there are lags in the way the rent channel of monetary policy operates.

A challenge for the SNB is to rebalance inflationary pressures: in 2023 CPI inflation has declined mainly through import price inflation (goods price inflation) while domestic inflation has been higher and stickier. Ideally in 2024, domestic inflationary pressure should ease and goods inflation should make a positive contribution.

Background

Let me first provide a brief background in terms of the monetary policy framework under which the SNB operates. (https://gianlucabenigno.substack.com/p/788ad8e8-ea62-4afa-a4e7-59e1a3c0e128)

One interesting aspect of the SNB monetary policy framework is the explicit attention to the Swiss franc. Exchange rate intervention, together with interest rates, is part of the monetary policy toolbox to ensure price stability.

Not surprisingly, the latest monetary policy statement refers to the strength of the Swiss franc as a key factor behind the decision to cut the SNB policy rate. Indeed, since 2009, the Swiss National Bank (SNB) has extensively used foreign exchange (FX) interventions to curb the appreciation of the Swiss franc, as illustrated in Figure 1.

Note that: to lower the value of the Swiss franc relative to the Euro (depreciation), the SNB buys foreign currency assets (denominated in Euro) and credit sight deposits in Swiss franc to the corresponding financial institution from which it is buying the Euro-denominated assets. This outright purchase results in an increase in the balance sheets in which foreign currency investment (on the assets side) and sight deposits (on the liability side) increase by the same amount.

The Current Policy Decision

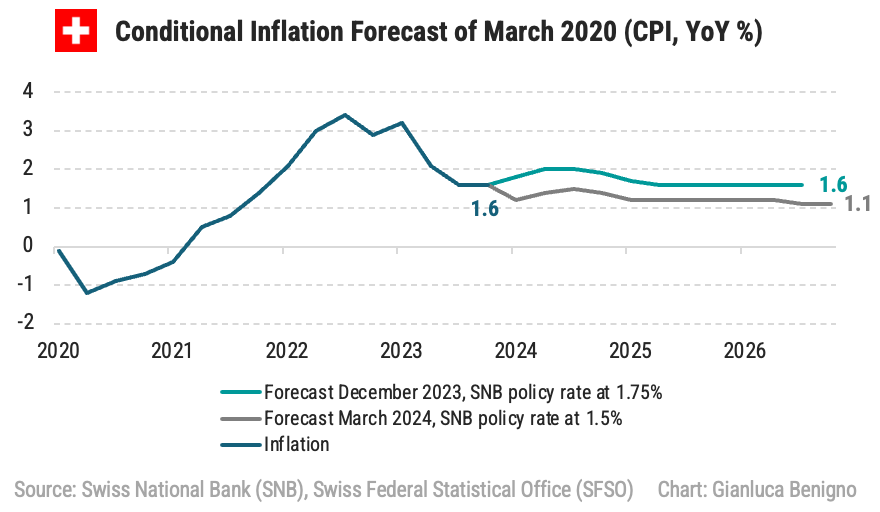

A key component in the communication of policy decisions by the Swiss National Bank (SNB) is the conditional inflation forecast. This forecast illustrates the projected inflation rates, assuming that the SNB's policy rate remains unchanged from the time of the decision. Below is an updated figure showcasing the most recent conditional inflation forecast:

It is interesting to see the sharp reduction in the forecast of inflation despite the decrease in the interest rate from December 2023 to March 2024. In short, lowering the interest rates is now consistent with slower inflation expectations compared to those of December 2023. This is a bit surprising but it could be rationalized in terms of the real appreciation of the Swiss Franc during the past year, as emphasized by the SNB in its introductory statement.

Moreover as discussed in the December 2023 policy meeting, the SNB has stopped the sales of foreign currency investment. Indeed, from December 2023, sight deposits have increased again: it has to be seen if this is the beginning of a buying cycle in the foreign exchange market to depreciate the Swiss franc. During 2023, the Swiss franc has appreciated in real terms contributing the lower imported inflation. The appreciation has been a byproduct of the foreign currency sales up to December 2023. As the next graph shows since then foreign currency holdings have stabilized, sight deposits have increased and the real exchange rate has depreciated (here, a lower real exchange rate index means exchange rate depreciation).

Finally, the SNB has emphasized a common dichotomy among advanced economy central banks in terms of the drivers of inflation: low goods inflation and higher domestic inflation (in its press release: “Inflation is currently being driven above all by higher prices for domestic services”).

The Inflationary Channel of Monetary Policy

The SNB is also very open to discussing the inflationary channel of monetary policy. I emphasized this channel in the post on the Bank of England (Is the Bank of England in a Catch-22 Situation?). As interest rates increase, landlords pass the increase in their costs (mortgages) on tenants contributing to higher inflation.

How does this work in Switzerland?

This is explained in detail in the Annual Report of the SNB (2023). In Switzerland, rent increases often depend on the mortgage reference rate, which, in turn, depends on the SNB policy rate, albeit with lags.

The mortgage reference interest rate corresponds to the volume-weighted average interest rate of all outstanding bank mortgages in Switzerland. As noted by SNB “the reference interest rate only adjusts very slowly to changes in interest rates because a significant part of the mortgages included in the calculation is based on long-term contracts”.

In this context, a rent increase based on the mortgage reference interest rate is allowed if the reference interest rate on which the tenancy agreement is based is lower than the current reference interest rate. Given the steep increase in the SNB interest rate in the past two 18 months it is likely that the rent increase condition is triggered. Indeed, the reference mortgage rate in December 2023 is 1.75%.

The SNB notes (page 43 of the 2023 Annual Report) also that changes in the reference interest rate affect rents with a time lag of several months, as the permitted rent adjustments can only come into effect on the next cancellation date at the earliest, subject to the notice period. In addition, landlords are entitled at any time to pass on 40% of the inflation that has occurred since the last rent adjustment or after the conclusion of the rental agreement, as well as general cost increases. A significant increase in rents in the national consumer price index (CPI), which is likely to be largely attributable to the rise in the reference interest rate in June, was first seen in November 2023.

The SNB considers this feedback mechanism temporary and states that this feedback effect must not be taken as a reason for refraining from policy rate increases that are necessary for monetary policy. On the one hand, an increase in the mortgage reference interest rate only has a temporary effect on inflation. On the other, an increase in the SNB policy rate counteracts inflation overall despite the feedback effect, for example by slowing the growth of bank lending.

What is next?

Foreign economic developments and foreign interest rate policies play a pivotal role in influencing the SNB’s policy outlook. As I discussed earlier, the decision made in March 2024 introduced a bias towards depreciating the exchange rate. Given Switzerland's status as a small, open economy with significant exposure to the Euro area—particularly to Germany—policy decisions by the ECB are important to the SNB.

If the ECB adopts a hawkish stance, it could support the SNB in maintaining a lower exchange rate without heavily relying on foreign exchange operations or expanding its balance sheet. Conversely, a more dovish ECB might prompt the SNB to intervene more in the foreign exchange market to avoid an overappreciation of the CHF, potentially leading to an increase in its balance sheet.

The SNB's current interest rate policy is consistent with keeping projected inflation within its target in the medium term. However, a significant easing by the ECB could pressure the Swiss franc to appreciate, possibly leading the SNB to lower interest rates further and intervene in the exchange market. Lowering interest rates would also help reduce the reference mortgage rate in the long term, easing domestic inflationary pressures and achieving a rebalancing in the drivers of inflation.