The Swiss National Bank (SNB) is back to buying in the foreign exchange market. In its latest data release, the SNB reported a net buying of about 300 million Swiss francs in foreign currency assets in Q1 2024. This marks a shift from last year's strategy, where the SNB reduced foreign currency asset sales to keep the CHF relatively appreciated. As noted in previous posts (as seen in the figure below), the SNB has now commenced a buying cycle, with expectations for continued net foreign asset purchases in Q2 2024.

This action aligns with the SNB’s latest monetary policy decision (June), which lowered the policy rate by 25 bps – from 1.50% to 1.25%. As of March 2024, this move was partly a surprise, as some analysts were expecting the SNB to hold interest rates steady.

In this post, I discuss the SNB policy move by emphasizing the dichotomy between domestic and imported inflation in Switzerland and the role of the exchange rate (in a previous post, I wrote: “A challenge for the SNB is to rebalance inflationary pressures: in 2023 CPI inflation has declined mainly through import price inflation (goods price inflation) while domestic inflation has been higher and stickier. Ideally in 2024, domestic inflationary pressure should ease and goods inflation make a positive contribution.”).

Undoubtedly, lowering the policy rate can have several effects:

a) It can reduce domestic inflation, primarily starting from the second quarter of 2025 (lagged effect), as rental inflation stabilizes (reversing the Catch-22 effect).

b) It may increase imported inflation if the exchange rate depreciates.

c) Additionally, it has fiscal benefits by reducing the remuneration on sight deposits, thereby lowering costs for the SNB.

Looking ahead, the SNB will face renewed challenges:

Cutting interest rates might not be sufficient and the SNB might be forced to intervene more actively in the foreign exchange market expanding its balance sheet.

Political uncertainties on both sides of the Atlantic as we enter the second half of 2025 could further strengthen the Swiss franc. Consequently, more interest rate cuts and foreign exchange interventions cannot be ruled out.

There is a risk of reverting to a pre-Covid environment characterized by low interest rates and deflationary pressures.

Background

Let's first review the most recent inflationary developments in Switzerland (the summary follows the Quarterly Bulleting release).

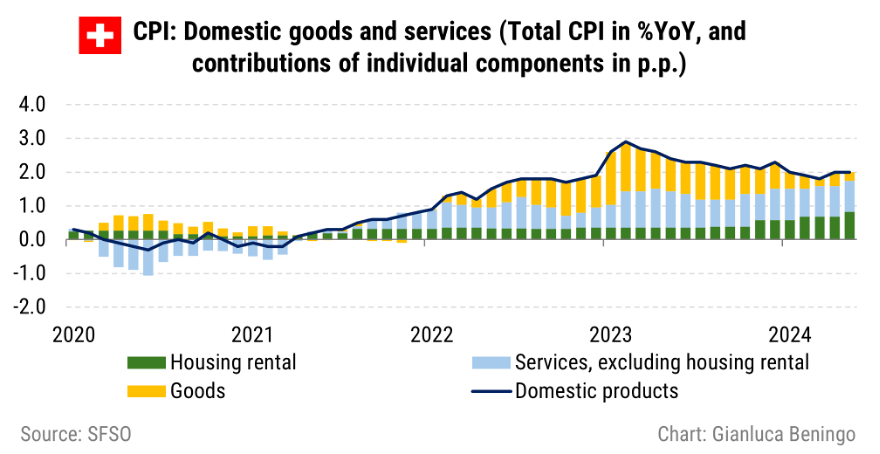

Consumer price inflation in Switzerland stood at 1.4% year-on-year in May 2024, the latest data available before the SNB's policy decision. In recent months, domestic inflation has been the primary driver of inflationary pressures in Switzerland, with minimal negative impact from imported products. The next chart focuses on the determinants of domestic inflation.

Compared to the peak of around 3% year-on-year at the beginning of 2023, domestic inflation has moderated to less than 2% year-on-year. The contribution of goods inflation has decreased over time, while service inflation, excluding housing rental, has remained relatively constant. As previously noted (see the "SNB sets the time"), the contribution of housing rental has increased in recent months, reaching 3.4% year-on-year in May 2024.

Housing rental inflation increased to around 3.4% in May 2024 from 2.8% seen from February to April 2024, reaching its highest level since 2009. This 1.6 percentage point rise is attributed to the increase in the mortgage reference rate, which has been at 1.75% since December 2023. The latest adjustment in the reference mortgage rate is likely starting to impact rent inflation, with its full effects expected to become more evident in the latter part of 2024 and early 2025.

We should anticipate further increases in rent inflation, contributing more significantly to domestic inflationary pressures before likely stabilizing in the second half of 2025. Given the SNB's focus on the exchange rate, it is also important to review recent exchange rate developments.

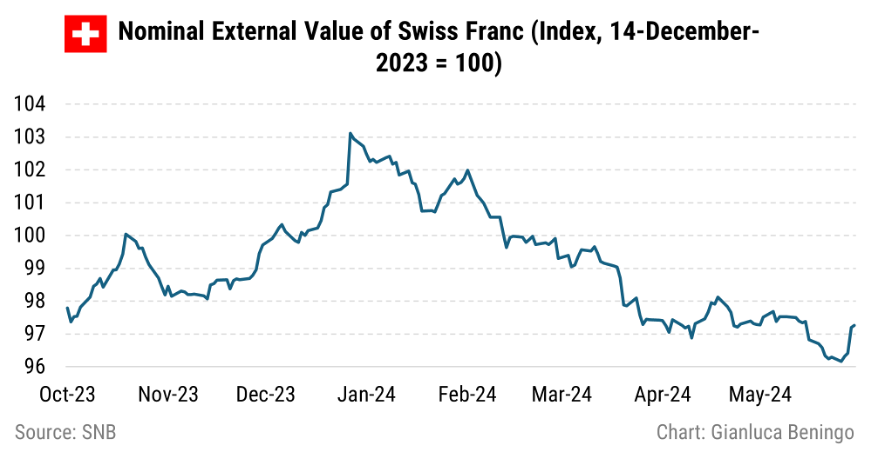

As noted in the latest Quarterly Bulletin, the effective nominal Swiss franc exchange rate initially depreciated (index decreased) following the policy decision in March. However, by the end of May, after Jordan’s speech in Seoul, the Swiss franc began to appreciate, returning to its mid-April level. Jordan’s speech was interpreted as hawkish, suggesting that the SNB would hold its position in June, which fueled the strengthening (appreciation) of the Swiss franc.

The Current Policy Decision

The conditional inflation forecast is a crucial element in the Swiss National Bank's (SNB) communication of policy decisions. This forecast projects inflation rates based on the assumption that the SNB's policy rate remains unchanged from the time of the decision for 3 years. Below is an updated figure presenting the latest conditional inflation forecasts:

It is noteworthy that the inflation forecast has reduced despite the interest rate cut from March 2024 (1.5%) to June 2024 (1.25%). Another interesting aspect is that the SNB does not anticipate this rate cut to have any significant impact on inflation in 2024. The conditional forecasts for March and June only diverge in 2025, with the latest forecast being slightly lower than the one in March.

Regarding the transmission of monetary policy, two components are relevant in explaining the conditional inflation path: a) Lowering the interest rate would limit the appreciation of the Swiss franc, and then reduce deflationary effects from imported inflation. b) Lowering the interest rate would eventually lead to a lower reference mortgage rate and consequently to a stabilization of rent inflation.

Thus, one interpretation of the SNB’s policy decision and its future path is to rebalance the two components of inflation: increasing imported inflation while decreasing domestic inflation.

The rebalancing effort would necessitate active purchases in the foreign exchange market. As a result, sight deposits have stabilized in 2024, and foreign currency investments have increased. Due to the limited scale of net foreign asset purchases, the rise in the foreign currency investment component of the balance sheet is primarily attributed to valuation effects, meaning the value of the assets increased due to the appreciation of the Swiss franc.

The Rebalancing Challenges

The SNB faces two main challenges in its rebalancing efforts. First, domestic inflation is close to 2%, driven primarily by the rent component, which has risen to 3.4%. Since rent measurements are taken every three months and adjust slowly, this increase is expected to persist for at least another six months, with similar high readings likely.

The significant rise in the policy rate during the tightening cycle has exacerbated rent inflation, creating a Catch-22 effect where this mechanism tends to generate persistent rent inflation.

The second challenge is limiting the appreciation of the Swiss franc. While Switzerland enjoys a stable political climate, the same cannot be said for neighboring Europe and the United States. Political uncertainties and geopolitical tensions typically favor safe-haven currencies like the Swiss franc. The latter half of 2024 will likely be marked by these uncertainties, which could further appreciate the Swiss franc.

Increased intervention and further rate cuts might replicate the pre-Covid context.

As an added benefit of the recent policy action, lower remuneration on sight deposits and the implied valuation effect from Q1 2024 would improve the SNB's operative income.

Conclusions

While the SNB's current interest rate policy aims to keep projected inflation within its target in the medium term, external factors could strengthen the Swiss franc despite increasing interest rate differentials. Additionally, the rent component of domestic inflation is expected to continue until early 2025.

Good deep dive into the murky world of central banks.

Gianluca Benigno has an interesting angle on SNB policy: the Swiss central bank is attempting to rebalance the sources of inflation between domestic and foreign.

I wonder if there's a political economy dimension to this. For a given "headline" inflation rate, higher imported inflation is essentially a transfer of income abroad; higher domestic inflation, to the extent that it is the result of higher rental inflation, is a domestic redistribution of income to property owners.