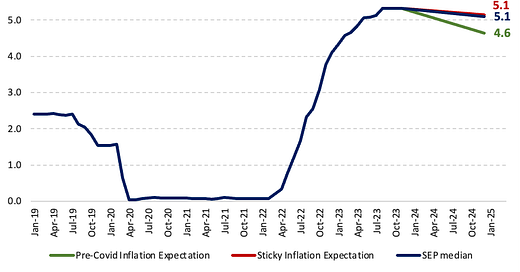

Chart 1: Nominal FED Funds Rate (Median) - Scenario Analysis for 2024 (EoP)

Source: FOMC Summary of Economic Projections, September 20, 2023. Michigan University Survey. NY FED.

After this month's CPI’s release financial markets are pricing two rate cuts by the Federal Reserve by the end of July despite policymakers ruling out any discussion about rate cuts (see Powell’s November press conference):

“So it's, it’s – the fact is the Committee is not thinking about rate cuts right now at all. We're not talking about rate cuts. We're still very focused on the first question, which is, have we achieved a stance of monetary policy that's sufficiently restrictive to bring inflation down to 2 percent over time, sustainably?”

In this post, we conduct a simple scenario analysis to illustrate one reasoning behind the Fed’s dilemma by using the stance of monetary policy (measured by the real interest rate gap, i.e., R-R*) as a guideline.

Background

From the Fed's perspective, monetary policy should be restrictive if inflation does not return to the 2 percent target (current more hawkish perspective). The way Chair Powell evaluates the stance of monetary policy is by examining the gap between the actual federal funds rate and the long-run neutral rate (see “Has the Fed Monetary Policy been Restrictive?).

As I discussed in a previous post, this reasoning is grounded in the New Keynesian approach to monetary policy stabilization. There are many reasons to think why this approach might not be the best or that the R* is not measurable but the fact that policymakers resonate within that framework is important for understanding their thinking and strategy.

Monetary policy is considered restrictive when the real federal funds rate (R) exceeds the neutral rate (R*), i.e. when R-R*>0. Conversely, when R-R*<0, monetary policy is deemed accommodative. The real rate is determined by subtracting the expected one-year-ahead inflation (usually from the University of Michigan and New York FED surveys) from the nominal federal funds rate.

Many commentators suggest that as inflation eases, inflation expectations will likely fall, leading to an increase in real interest rates (R) if the Federal Reserve maintains the current nominal interest rate. Consequently, the Fed may feel comfortable reducing rates to maintain an unchanged monetary policy stance, provided that the estimates of the neutral interest rate (R*) do not rise.

A resilient economy (economic activity and labor market are better than expected) could indicate that R* is currently above present estimates (i.e., the interest rate necessary to stabilize the economy – lower inflation and output gap – would be actually higher than current forecasts), and it is likely that the December 2023 [1]Summary of Economic Projections (SEP) will revise the median value upward to reflect this strength. Here, we remind that (Holston, Laubach, and Williams, 2017):

The natural or “equilibrium” real interest rate provides a benchmark for measuring the stance of monetary policy, with policy expansionary (contractionary) if the short-term real interest rate lies below (above) the natural rate.

Our preliminary calculations of R* using the Holston-Laubach-Williams (HLW) and Laubach-Williams (LW) methodologies yield a value of 0.66 for HLW and 1.14 for LW. In comparison, the central tendency reported by the SEP in September stands at 0.9 (see Figure 1).

Indeed, in principle, when calibrating the monetary policy stance, it is important to consider that higher neutral rates (R*) could counterbalance the effects of higher short-term federal funds rates as inflation continues to moderate.

Scenario Analysis

I consider the following scenarios conditional on inflation being sticky and not returning to the target (i.e. ranging between 2.5 percent and 3 percent).

a) Inflation expectations back to normal

Suppose that (median) inflation expectations reach the pre-Covid levels. For the Michigan survey that would be equivalent to around 2.6 percent and for the Federal Reserve Bank of New York survey that would be around 2.5 percent.

For the given policy Fed-fund rate of 5.3 percent, the implied policy stance (R-R*) would become more restrictive (higher) by 180 bps for the Michigan survey (current one year ahead is 4.4 percent) and by 110 basis points for the NY Fed inflation expectations (currently at 3.6 percent).

Current monetary policy stance R-R* 1 percent (what matters here is that the Fed is happy with the current stance). Then we have quite a simple formula (basic Fisher equation): if inflation expectations decline by 1 percent and the nominal policy rate does not change (higher for longer) then R will rise by the same 1 percent. Therefore, to keep the monetary policy stance (R-R*) constant, one possibility would be that R* would also rise by 1 percent.

Therefore, if policymakers are happy with the current stance of monetary policy the required adjustment of the long-run neutral rate would be substantial given the much lower inflation expectations (nowadays around 4% versus 2.5% pre-Covid).

In this sense, improvements in the inflation expectation reading should lead to a lower policy rate.

b) Higher inflation expectations

Suppose inflation expectations are also sticky around 3 percent. Then monetary policy stance would become more restrictive by 140 basis points and 60 basis points in terms of the real fed funds rate measured by using inflation expectations from the Michigan survey and from the NY Fed survey, respectively.

Even in this case, if policymakers are happy with the current stance, the Fed funds rate could be cut, unless there is an adjustment of more than 50 bps in the long run to neutral rates during the same period (which we think to be unlikely).

Figure 1: Distribution of participants’ judgments of the midpoint of the appropriate target range for the federal funds rate or the appropriate target level for the federal funds rate, at the end of 2024.

Source: FOMC Summary of Economic Projections, September 20, 2023.

Conclusions

Inflation expectations heading back toward pre-Covid level could be accompanied by cuts in the Fed-fund rate to keep the monetary policy stance at the current level. The previous statement is conditional on relatively minor adjustments in the long-run neutral rate.

One side effect to keep in mind is that the anticipation of a lower fed fund rate could loosen financial conditions fueling a further boost to the economy.