US June-25 CPI Inflation Report

Broader moderation in services inflation offsets selected increases in goods' components of the CPI, which may be linked to tariff-related effects.

Key takeaways:

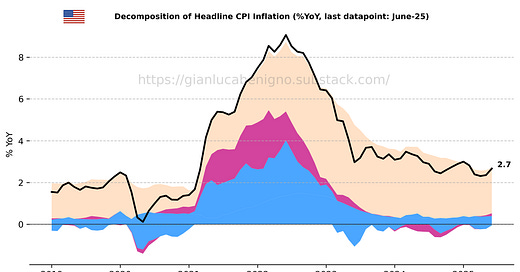

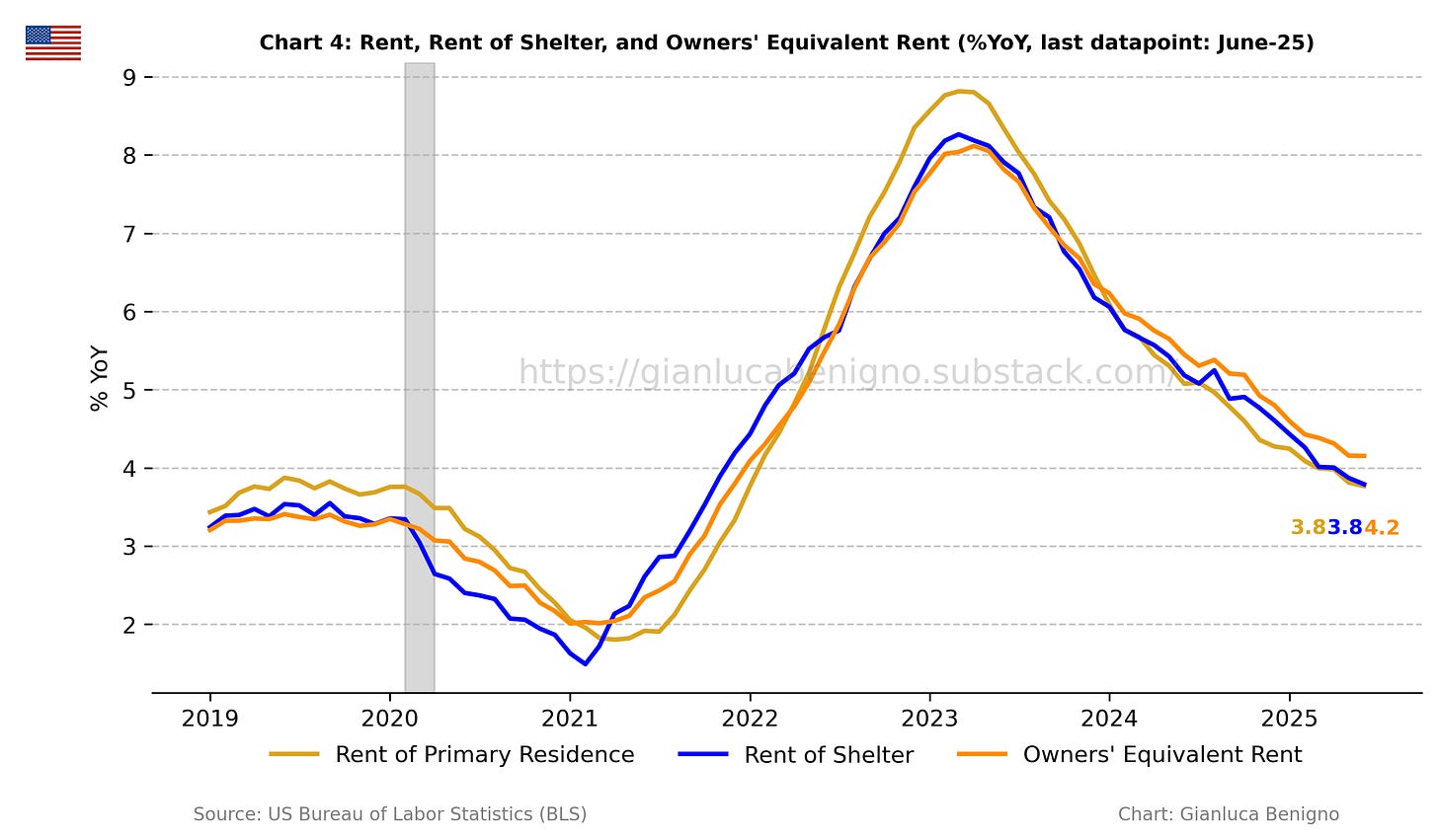

The overall Consumer Price Index (CPI, n.s.a.) increased by 2.7% year-on-year (YoY) in June, in line with the consensus expectation of 2.7% YoY and above May’s reading of 2.4% YoY.

Core CPI in June was 2.9% YoY (n.s.a.), above May’s reading of 2.8% YoY and below the consensus forecast of 3.0% YoY.

Inflationary pressures are primarily concentrated in the core service sector, with an increase of 3.6% YoY in June, the same reading as in May. The core goods sector (ex-energy and food) experienced an increase of 0.7% YoY, compared to May’s 0.3% YoY increase.

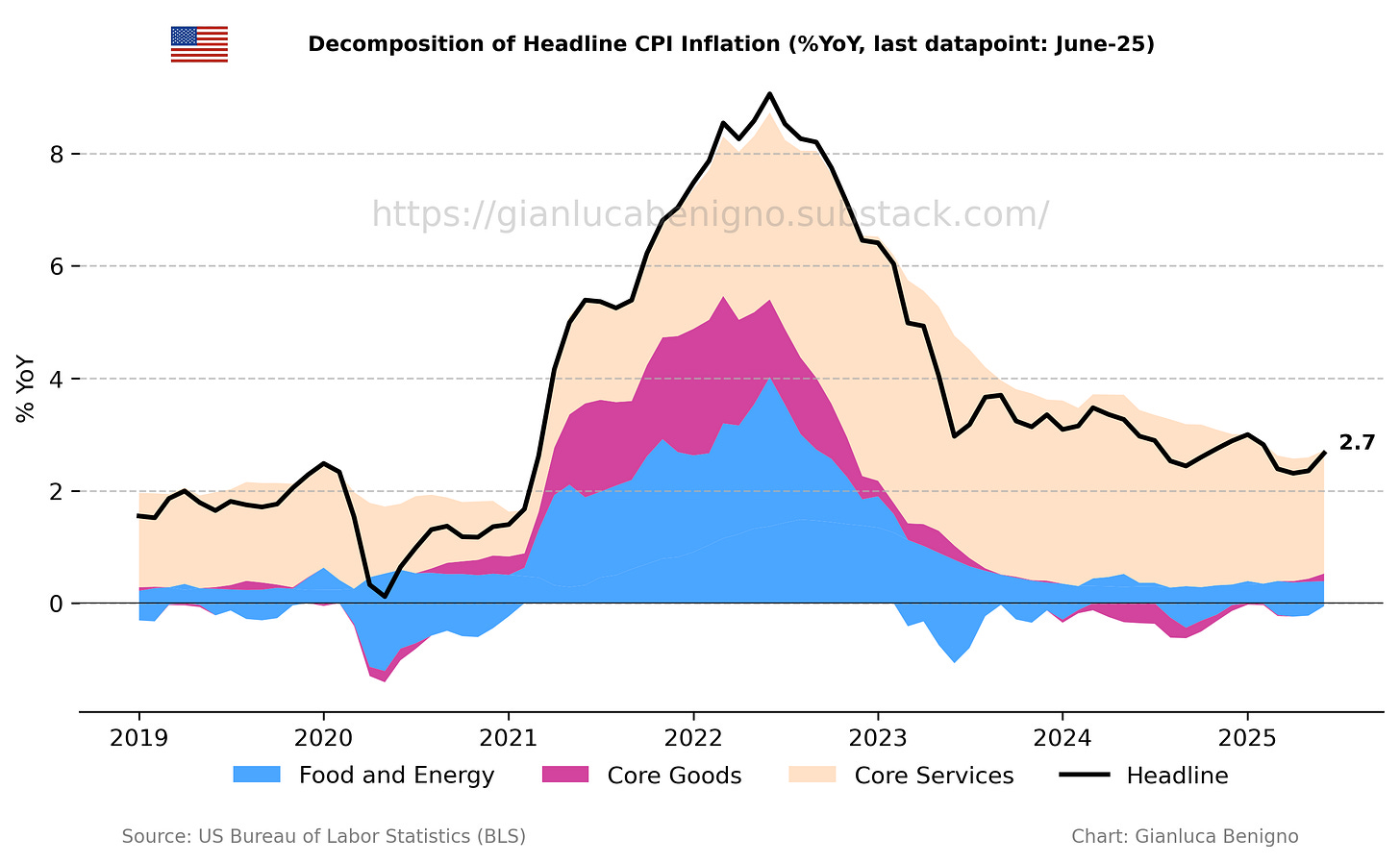

The primary factor behind recent inflationary pressures is still the rent of shelter component of the Consumer Price Index (CPI). Rent of shelter increased by 3.8% YoY in June, lower than the 3.9% YoY recorded in May. The month-on-month increase was 0.2% MoM (n.s.a.), below May’s 0.3% MoM increase.

The slow adjustment of core service inflation and its housing component are the key factors behind the slow adjustment towards the 2% target. Nonetheless, this release offers a promising signal of continued improvement despite tariff-induced inflation. This now marks the fourth time since 2022 that year-over-year services inflation has fallen below 4.0%. The monthly reading rose by 0.2% MoM (n.s.a.) in June, below the 0.3% MoM increase recorded in May.

Goods inflation rose to 0.7% year-over-year, driven in part by a 1.0% month-over-month increase in household furnishings and supplies, and a 0.7% monthly rise in recreation commodities—both of which may reflect tariff-related price pressures.

This inflation report remains broadly consistent with the gradual disinflationary trend seen in recent months. While tariffs imposed on Canada, China, and Mexico before June might have contributed to a pickup in goods inflation and some specific subcomponents, the magnitude of these increases is not yet sufficient to meaningfully shift the overall inflation outlook.

Overall, this report reinforces the wait-and-see approach adopted by the majority of FOMC participants and their intention to keep rates on hold at the forthcoming late July meeting.

Related Posts

U.S. May-25 CPI Inflation Report (previous release)

U.S. April-25 CPI Inflation Report (previous release)

U.S. March-25 CPI Inflation Report (previous release)

U.S. February-25 CPI Inflation Report (previous release)

U.S. January-25 CPI Inflation Report (previous release)

U.S. December-24 CPI Inflation Report (previous release)

U.S. November-24 CPI Inflation Report (previous release)

50 or 25 bps? The cut that could split the Fed (context post)

Post FOMC update: the Fed and the Market Shifts (context post)

Scenario Analysis as a Communication Device for Central Banking (related post)

Review of the Inflation Release

In June 2025, the Consumer Price Index (CPI) rose by 2.7% (n.s.a.) year-on-year (YoY) (Chart 1), in line with the market consensus at 2.7% YoY and above May’s figure of 2.4% YoY. On a month-on-month basis (MoM), CPI increased by 0.3% MoM (n.s.a.), compared to the 0.2% MoM increase recorded in May. The seasonally adjusted monthly change was 0.3% MoM.

Core CPI (excluding food and energy) increased by 2.9% year-on-year in June (Chart 1), below the market consensus at 3.0% YoY and above May’s figure at 2.8% YoY. On a month-on-month basis, core CPI increased by 0.3% MoM (n.s.a.), higher than May’s 0.2% MoM increase. On a seasonally adjusted basis, the increase was at 0.2% MoM, up from the 0.1% MoM increase recorded in May.

Core services (services excluding energy) remain the primary driver of inflationary pressures. In June, core services increased by 3.6% YoY, the same reading recorded in May, while core goods (goods excluding food and energy) experienced an increase of 0.7% YoY, above the 0.3% MoM rise observed in May. The current release confirms the slow disinflationary trend in core services (now firmly below 4.0% YoY).

Despite the downward trend in services inflation, Chart 2 illustrates the contrast between core goods and core services, which is still common to many advanced countries (except for Japan). What’s particularly noteworthy is that goods inflation has now begun to contribute positively to overall inflation—a shift that, in principle, might be further reinforced by the imposition of tariffs.

As for past reports, CPI in June was primarily driven by the housing component (Tables 1 and 2). The rent of shelter components rose by 3.8% YoY in June, below the 3.9% YoY increase recorded in May. Noticeably, the shelter component increased by 0.2% on a month-on-month basis (n.s.a.), below May’s 0.3% MoM reading.

Within this context, supercore services (core services excluding shelter – Chart 3) increased by 3.8% YoY compared to May’s 3.5% YoY increase reading. On a monthly basis, the supercore component increased by 0.6% MoM in June, below the 0.3% MoM increase observed in May.

The rent subcomponent of the rent of shelter increased by 3.8% YoY, the same reading as in May, and similarly, the owners’ equivalent rent rose by 4.2% YoY, also the same reading recorded in May (see Chart 4).

Summary

There are again some encouraging signals in the latest inflation report. Core inflation is still below 3%, while services inflation has eased below the 4% range for few months now. Several key monthly readings point to continued disinflationary momentum.

The current inflation release shows early signs of tariff-related inflationary pressures, potentially reflected in the relatively elevated monthly increases in recreation commodities and household appliances, and supplies. Upcoming monthly data should offer greater clarity on whether these effects are temporary fluctuations or the beginning of a broader, tariff-induced impact on prices. Despite these selected price increases, the overall inflation outlook remains anchored by the gradual moderation in the services component.

From a monetary policy perspective, the recent release of the FOMC minutes and the renewed threat of tariffs following the July 9th deadline are likely to reinforce a cautious stance among FOMC participants. Despite current inflation readings and political pressure on Chairman Powell, it remains highly unlikely that the Federal Reserve will take action at its late-July meeting. While the latest Summary of Economic Projections still points to a median expectation of two rate cuts by the end of 2025, there has been a noticeable shift toward more participants favoring a pause throughout the year.

Table 1: CPI by components (% YoY)

Source: Bureau of Labor Statistics (BLS).

Table 2: CPI by components (% MoM)

Source: Bureau of Labor Statistics (BLS).