This is a short piece where I summarize the analysis I carried jointly with Boris Hoffman, Galo Nuno, and Damiano Sandri at the Bank of International Settlements.

As a background, several policymakers (see the ECB January 2024 bulletin, the Bank of England February 2024 Monetary Policy Report, and several speeches by FOMC members (for example, Williams’ Axios interview) have recently discussed the level of r*, i.e. the equilibrium real interest rate at which the economy neither experiences inflationary nor disinflationary pressures and operates at full capacity.

Understanding r* (see my blog post on the Fed) is crucial for current monetary policy cycles as it indicates the nominal interest rate adjustment needed when inflation trends towards the Central Bank's targets, typically a 2 percent headline inflation. Ideally, when inflation stabilizes at 2 percent and the economy operates at its potential, the policy rate should align with this expression:

i = r* + 2%

For example, suppose that inflation in the Eurozone reaches 2 percent consistently, then if r* is zero percent that would imply an equilibrium nominal interest rate of 2 percent.

This would imply a reduction in the main refinancing rate by the ECB of about 250 basis points (2.5 percent) from its current 4.5 percent.

If r* is two percent then the implied reduction would be by only 50 basis points.

Here is the link to our Quarterly review article.

I report here the key takeaways:

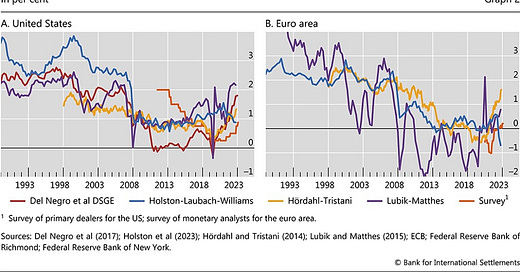

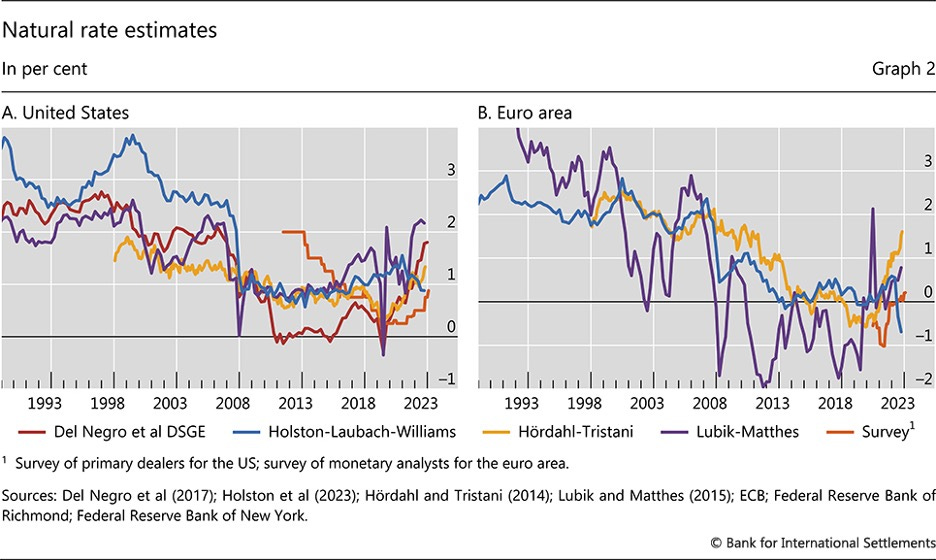

Several estimates of the natural rate of interest (r*) suggest that it may have increased relative to pre-pandemic levels.

Potential shifts in the saving-investment balance and a more inflationary environment, which elicited a strong monetary policy response, may have raised r* and perceptions thereof.

Assessments of the level and direction of r* are surrounded by very high uncertainty, making it a blurry guidepost for monetary policy, especially in the current context.

Let me emphasize a couple of points of interest (just my personal view and not the ones of my coauthors or the BIS).

An often overlooked aspect is the potential influence of monetary policy in determining the long-term equilibrium, a topic we explore in the article.

Another consideration is the interaction between financial and macroeconomic stability. I plan to focus more on this topic in a forthcoming post, elaborating on why this aspect may be more relevant in the current times.

.