Background

One intriguing aspect of the recent Federal Reserve policy round is the distribution of economic projections. Contrary to what many expected, the median participant of the Federal Open Market Committee (FOMC) anticipated one cut for the Fed funds rate by the end of 2024. However, the dots’ distribution1[1] (see Figure 4 at the end of the post) was so close that one participant could have shifted the median to two cuts.

Beyond the usual uncertainties, in the latest release of the Summary of Economic Projection (SEP), there was one further source of unpredictability: the voting stance of the new president of the Federal Reserve Bank of St. Louis, Alberto Musalem. Musalem’s vote was probably one of the two crucial votes in pivoting the median towards one rate cut.

We claim that:

Contrary to the usual pattern, the median participant did not reflect the preference of the Troika.

Despite this potential divergence, the voting committee decisions still probably reflect the Troika’s preferences.

Considering the recent benign inflation releases (CPI and PPI) and their likely path ahead, the dots are less hawkish than at a first reading.

What is the Troika?

The term "troika" in the context of the Federal Open Market Committee (FOMC) typically refers to the three most influential members who have significant sway over monetary policy decisions. These three members are:

1. The Chair of the Federal Reserve Board (currently Jerome Powell): The Chair is the most influential member of the FOMC and leads the committee. The Chair's views on economic conditions and monetary policy are highly influential in driving asset prices, and they often guide the overall direction of the committee's decisions.

2. The Vice Chair of the Federal Reserve Board (currently Philip Jefferson): The Vice Chair supports the Chair and often plays a critical role in shaping policy discussions and decisions. The Vice-Chair also steps in to lead the committee in the absence of the Chair.

3. The President of the Federal Reserve Bank of New York (currently John Williams): The New York Fed President holds a permanent voting seat on the FOMC and is a key player due to the New York Fed's central role in implementing monetary policy.

These three members are often considered the core leadership of the FOMC, and their perspectives and decisions are crucial in determining the direction of U.S. monetary policy.

An overview of the Summary of Economic Projections (SEP)

The SEP is a quarterly report released by the Federal Reserve, providing forecasts for key economic indicators such as GDP growth, unemployment, inflation, and the federal funds rate. These projections are instrumental in guiding the Federal Reserve's monetary policy decisions.

FOMC members provide projections for three time frames:

1. Current Year: Projections for the end of the current calendar year.

2. Next Year: Projections for the end of the following calendar year.

3. Two-year time: Projections for the end of the period comprising the next two calendar years.

4. Long Run: Projections for the longer-term horizon, usually beyond two to three years, indicating the expected sustainable levels of key economic variables.

Role of the Median: The FOMC median projection is a critical measure that is under the market’s scrutiny. It represents the middle value (50th percentile) of all FOMC members' projections for a particular economic indicator. More specifically, the median projections are the midpoint of the range of forecasts provided by the FOMC members. For each economic indicator, the projections are ranked, and the median is the value that falls right in the middle, with half of the number of projections above and half below.

The reason for which markets focus on this indicator is because it provides a useful summary of the overall outlook of the FOMC since it doesn’t focus on outliers. Therefore, it helps in understanding the consensus view and serves as a benchmark for monetary policy decisions.

Who Provides the Projections?

All 19 participants of the FOMC (the 12 voting members plus the non-voting Reserve Bank presidents) provide input for the SEP. This includes forecasts for GDP growth, unemployment, PCE inflation, and the federal funds rate.

The projections are usually submitted the weekend before the policy decision - in the case of the latest release on June 12th, they were sent on June 8-9th. There is still room for adjusting them before publication, so the CPI release on Wednesday morning (the 12th) could have been a crucial factor in affecting the median distribution, both in terms of inflation and interest rate projections.

Analysis

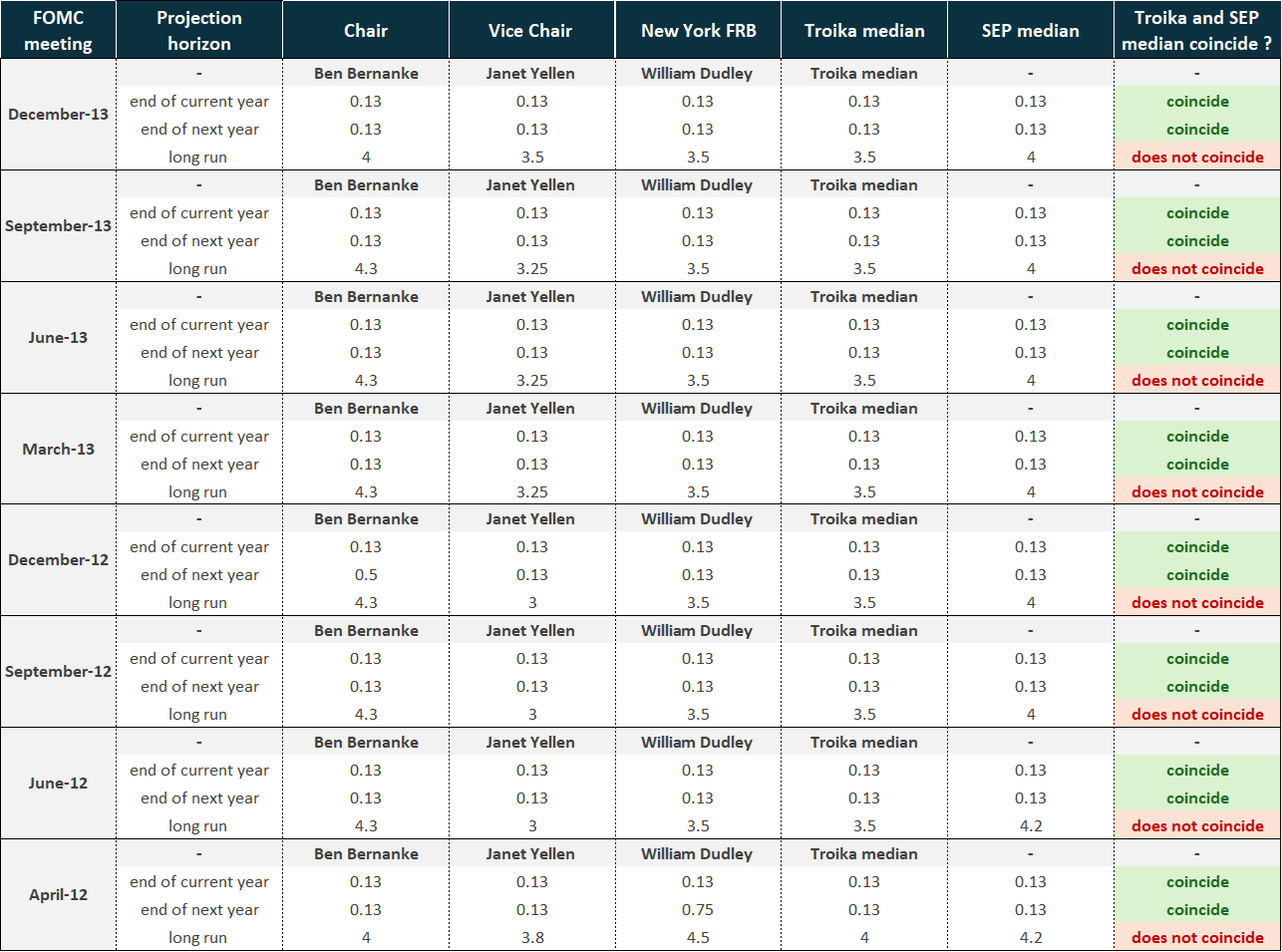

In this post, we analyze the voting patterns of the so-called Troika within publicly available FOMC records based on the Summary of Economic Projections (SEP). Starting from 2015, the identifiers of each participant vote are available after 5 years, while from 2012 they are available after 10 years. This means that we could not identify the voting during 2014 and 2015.

We analyze the voting patterns for the federal funds rate at the end of the current year, the end of the following year, and the long term. We compare the divergence within the Troika and between the Troika and the median SEP for these three periods.

The next table summarizes the divergences between the Troika and the SEP median over different time horizons for each year in which we have public records (a more detailed account is at the end of the post with two tables that cover the 2016-2018 period and the 2012-2013 period):

Focusing on the end-of-year projections:

Divergence within the Troika occurred only once, in June 2016.

There was also a single instance of divergence between the Troika consensus and the median SEP participant, in March 2018.

Focusing on the next year's federal funds rate projection:

Differences within the Troika are more frequent but do not exceed 25 basis points.

The overlap between the Troika consensus and the median SEP remains high, at around 80%.

When we focus on long-run fed fund rate projections, not surprisingly the differences become large in terms of size both within the Troika and between the Troika and the median SEP. The latter projections coincide 20% of the time.

Another divergence in June 2024?

Figure 4: FOMC participants’ assessments of appropriate monetary policy: Midpoint of target range or target level for the federal funds rate. Source: Summary of Economic Projections (SEP) of June 12th, 2024.

We guess that assuming no divergence within the Troika, it would be safe to expect the Troika to place two rate cuts by the end of 2024.

Another important aspect to consider is the distribution of opinions within the voting committee (the 12 members who vote on policy decisions). Based on speeches and interviews, it seems likely that most committee members also support two rate cuts.

Looking ahead, it will be interesting to see if the divergence between the Troika and the median SEP continues. Given that the next SEP meeting is in September, any divergence should be resolved, with the end-of-2024 projection likely showing a convergence of most votes towards the same outcome.

Appendix

Detailed voting patterns.

In this distribution, each dot indicates the value (rounded to the nearest 1/8 percentage point) of an individual participant’s judgment of the midpoint of the appropriate target range for the federal funds rate or the appropriate target level for the federal funds rate at the end of the specified calendar year or over the longer run.

I found it quite interesting that they didn’t bother to update their dots after the downside surprise to May inflation. Rational inattention or did they want to send a hawkish signal that after four unpleasant reports they were going to be steadfast?

Yes but I would agree on a cautious approach given how sticky inflation has been and the relatively poor readings at the beginning of the year.