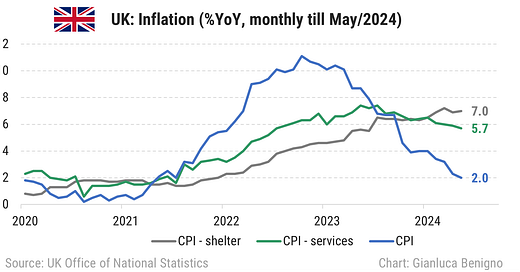

Today’s UK CPI release (June 19th) confirms the mechanism that we emphasized in the previous posts. The increase in interest rates is feeding into rental inflation contributing to sticky service inflation (see previous post for an extended discussion).

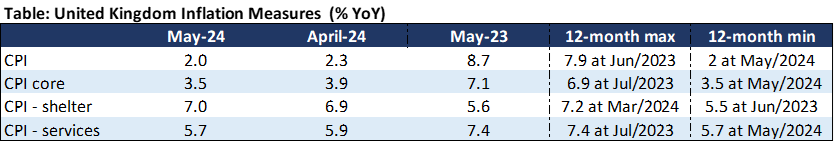

Actual rentals for housing increased in March to 7% on a year-on-year basis. Service inflation is sticky at 5.% year-on-year.

Here is a summary of the latest release (key figures)

What are the policy implications?

One of the channels through which interest rates transmit to the economy is by pushing up rental prices as the mortgage rate rises, albeit with a lag when monetary policy tightens. Thus, the rapid and sizeable increase in interest rates increases landlords’ costs and the likelihood that they will be passed on to tenants.

By keeping rates higher, service inflation adjustment could be further delayed: rather than taming inflation the Bank of England might exacerbate the problem that it is trying to address.

What should the BoE’s next steps be?

Consider cutting rates sooner rather than later.

Thanks for sharing - how do you see the recent wage growth stats feeing into their decision making vs what you lay out here re. service/rental inflation? Seems like no straightforward road ahead tbh.