Japan January-25 CPI Inflation report

Inflationary pressure accelerates, adding further pressures on BOJ’s normalization cycle.

Key takeaways:

Japan's Consumer Price Index (CPI) increased by 4.0% year-on-year (YoY) in January, higher than the 3.6% rise observed in December and in line with market expectations.

CPI excluding fresh food, the Bank of Japan's preferred measure, rose by 3.2% YoY in January, above market expectations of a 3.1% YoY increase, and higher than December’s 3.0% increase.

Similarly, CPI excluding fresh food and energy rose by 2.5% YoY in January, compared to December’s figure of 2.4% YoY.

Fresh food inflation has been a prominent issue in Japan for several months. In January, fresh food prices surged by 21.9% year-over-year, with rice inflation reaching 70.9% YoY—marking the fourth consecutive month above 50% YoY. Meanwhile, fresh vegetable prices rose by 36% YoY, and fresh fruit prices increased by 22.7% YoY.

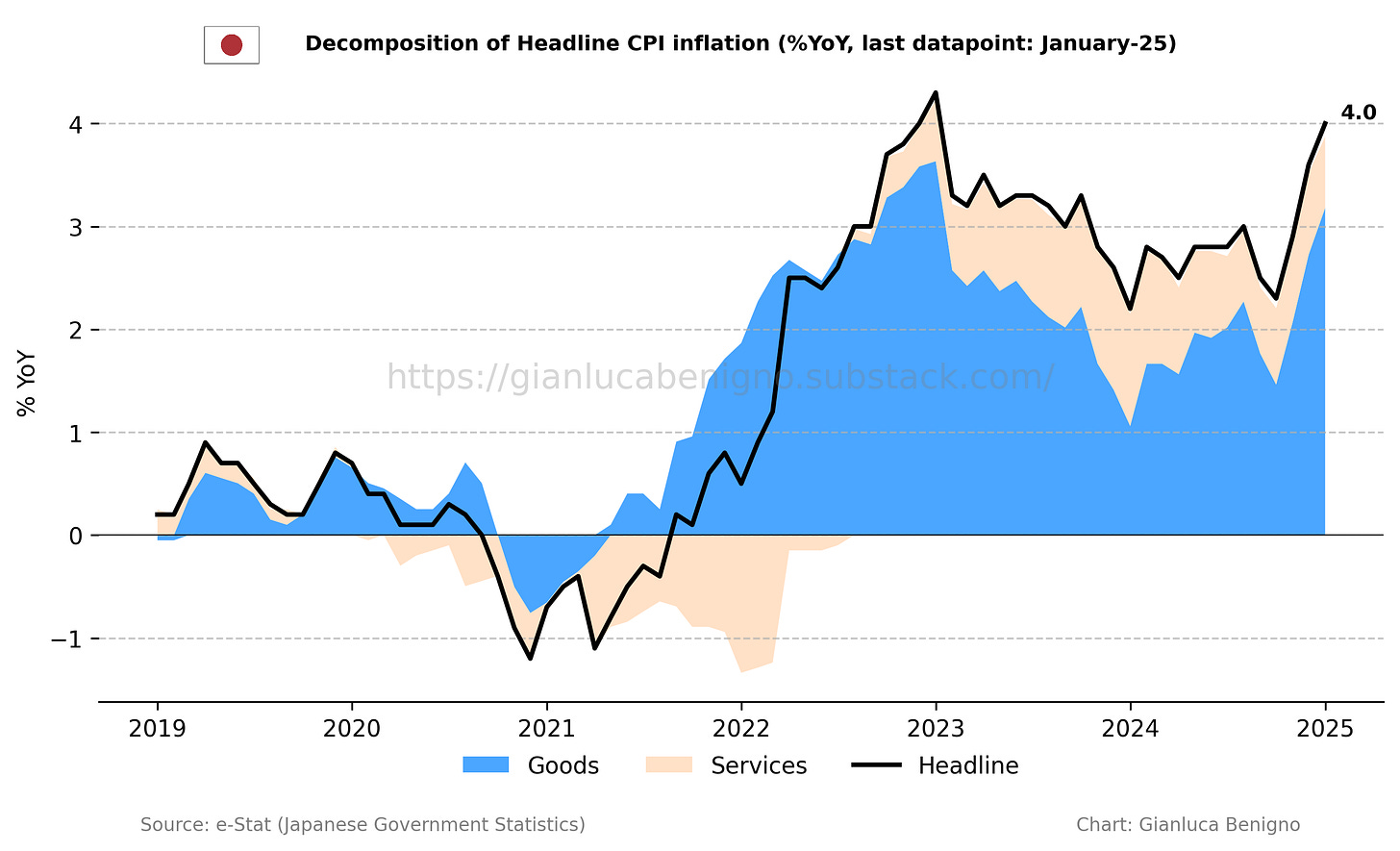

Japan's inflation diverges from patterns seen in other advanced economies. It is primarily driven by the goods sector, which rose by 6.3% YoY in January (versus 5.4% YoY in December), rather than by the services sector, which saw a 1.4% YoY rise in January, versus December’s figure of 1.6% YoY. The Yen’s depreciation over the last quarter (and in 2024 as a whole) was a key driver of goods inflation in the country given the pass-through effect to imported costs.

Inflationary pressures at the level of service inflation seem to be consolidating around 2% for service inflation less imputed rent (increasing by 1.9% YoY in January, lower than December’s 2.3% YoY and November’s 2.1% YoY figures).

The next BoJ policy decision will be on March 18-19. However, the Central Bank is expected to hold rates at 0.5% at its next meeting, with markets pricing the next rate hike later in the year. The persistence of core inflation (excluding food and energy) above 2%, along with its reacceleration since mid-2024, could increase pressure on the Bank of Japan to adjust the pace of its interest rate hikes.

Related Posts

Japan December 24 Inflation Report (previous release)

Japan November 24 Inflation Report (previous release)

Japan October 24 Inflation Report (previous release);

Japan September-24 Inflation Report (previous release);

Japan August-24 Inflation Report (previous release);

Japan July-24 Inflation Report (previous report);

A Quasi-Global Inflation Overview (related post);

The Bank of Japan's Put (related post);

Post-FOMC Update: The Fed and the Market Shifts (related post).

Review of the Inflation Release

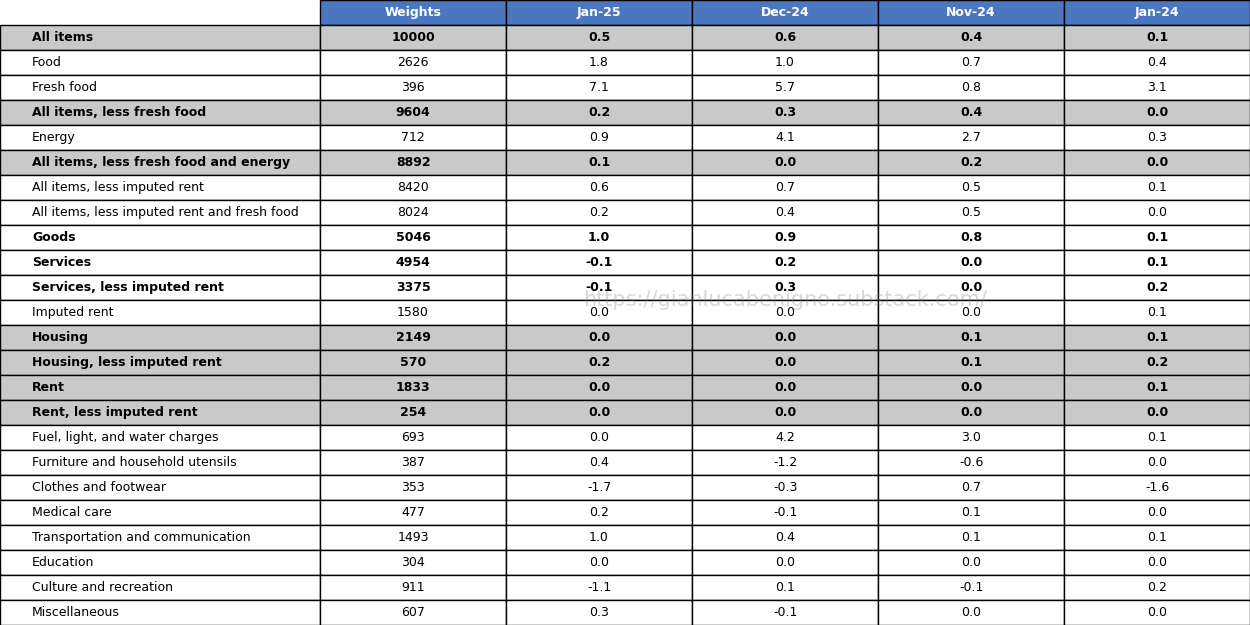

In January 2025, consumer prices increased by 4.0% year-on-year (YoY), in line with consensus expectation but higher than the 3.6% YoY reported in December. On a month-on-month basis (MoM), prices increased by 0.5% in January, compared to December’s 0.6% MoM increase.

Regarding core measures, the Bank of Japan tracks two main core inflation metrics (Chart 1): The Consumer Price Index (CPI) excluding fresh food, and the CPI excluding both fresh food and energy.

The first measure, which excludes fresh food, increased by 3.2% YoY in January, above market expectations of a 3.1% YoY rise and the 3.0% YoY increase recorded in December. On a month-to-month (MoM) basis, January’s figure increased by 0.2% MoM, compared to December’s 0.3% MoM increase.

The second core measure, excluding fresh food and energy, rose by 2.5% YoY, in contrast to the 2.4% YoY increase in December. On a month-to-month basis, core prices rose by 0.1% MoM, compared to the no change (0% MoM) observed in December. Energy prices, a more volatile component by nature, are still consistently driving up inflation in the country: energy prices increased by 10.8% YoY in January, up from December’s increase of 10.1% YoY.

In contrast to many advanced economies, where the services sector is still the main driver of inflation, Japan’s inflation is predominantly fueled by goods inflation (Chart 2). In January, the Goods CPI increased by 6.3% YoY, compared to the 5.4% YoY increase recorded in December. In contrast, the Services CPI rose 1.4% YoY, below the 1.6% YoY figure from December.

On a month-on-month basis (MoM), goods inflation increased by 1.0% in January versus December’s 0.9% MoM figure. On the other hand, service inflation decreased by 0.1% MoM, compared to December’s 0.2% MoM increase.

Further emphasizing Japan's unique position, the shelter component (“imputed rents”) of the CPI increased by 0.2% YoY in January, lower than December’s 0.3% YoY increase. The “imputed rents" measure represents “the rent a person would have to pay to own and occupy a property”, which constitutes the largest part of the CPI's housing component and weighs about 16% of the overall CPI. For a detailed breakdown of Japan's housing and rent components, refer to Tables 1 and 2.

In Tables 1 and 2, we provide a more detailed breakdown of the components of CPI, including CPI inflation excluding imputed rents (Chart 4), which we consider to be the HICP-equivalent CPI. This measure facilitates international comparisons across countries and blocs, a methodology developed by the European Union Statistical Office. In January, HICP inflation rose by 4.7% YoY versus December’s 4.2% increase. As Chart 4 shows, HICP inflation peaked at the beginning of 2023, reaching just above 5%. In contrast, before the pandemic, HICP inflation used to fluctuate between 0% and 1% year-over-year.

Policy Implications

Inflation trends support the normalization cycle initiated last year by the Bank of Japan. Headline inflation, core CPI (excluding fresh food), and CPI excluding fresh food and energy have all amply surpassed the 2% target. From the Bank of Japan's perspective, a positive development is the steady increase in service inflation, which has remained consistently above 1% (in January at 1.4% YoY) — a significant change compared to pre-pandemic levels — and stabilized around 1.5% YoY in the last quarter of 2024. Nonetheless, markets are expecting the Bank of Japan to maintain its policy rate at its current level, with an additional rate hike not anticipated until at least Q3 of 2025.

The overall inflation outlook, with core inflation excluding food and energy now stabilizing above 2%, could lead the Bank of Japan to consider a faster pace of rate hikes.

Table 1: CPI by components (% YoY)

Source: e-Stat (Japanese Government Statistics)

Table 2: CPI by components (% MoM)

Source: e-Stat (Japanese Government Statistics)