UK July 24-CPI Inflation Report

Marked decline in supercore inflation would justify continuation of easing cycle in September

Key takeaways:

UK Consumer Price Index (CPI) increased by 2.2% year-over-year (y/y) in July, slightly below market consensus (at 2.3% y/y), and slightly higher compared to June's figure of 2.0%.

Core CPI in July increased by 3.3 % y/y, below the consensus forecast of 3.4% and lower than June’s figure, of 3.5%. This confirms a slow reduction of core inflationary pressures in the UK.

Inflationary pressures are primarily concentrated in the service sector, with an increase of 5.2 % year-over-year, lower than the 5.7% recorded in June. Meanwhile, the goods sector is experiencing deflation, with a decrease of 0.6% year-over-year, a lower decrease compared to June’s figure of -1.4% year-over-year.

The primary factor behind recent inflationary pressures is the housing component of the Consumer Price Index (CPI) (see previous post). In July, actual rents for housing increased by 7.1% y/y (versus 7.2% y/y in June and 7.0% y/y in May).

Our supercore service inflation, which removes actual rents for housing, increased by 4.8% y/y in July, much lower than June and May both at 5.4% y/y.

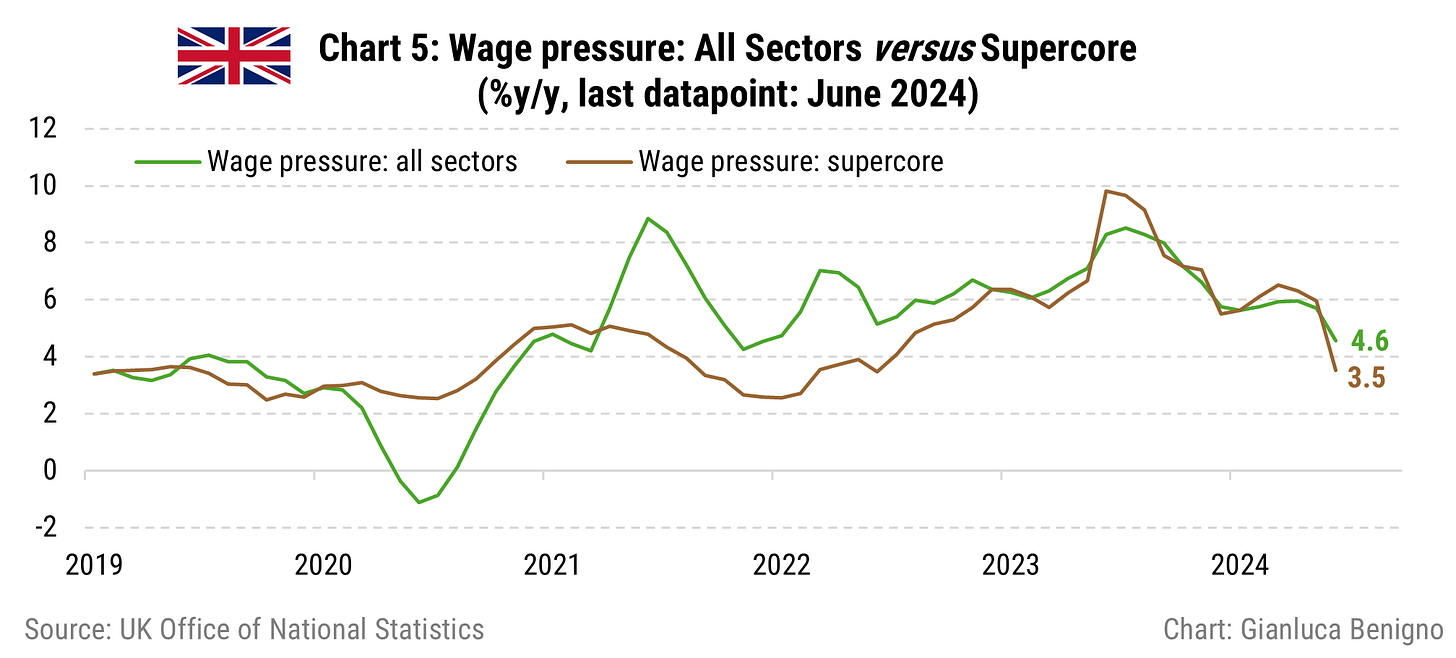

In June 2024, our supercore wage inflation decreased significantly to 3.5%, down from 6.2% in May. This drop is due to a one-off factor related to the NHS bonus payment in June 2023.

The recent improvements in both monthly and yearly service inflation, along with the marked decline supercore inflation, indicate that a further 25 basis point cut in September may be justified. Further easing would also limit the Catch-22 effect on the actual rents for the housing component later in 2025.

As a note, the high reading of restaurants and hotels in June (0.9% m/m and 6.2% y/y) has been partially reversed on a monthly basis (-0.3% m/m in July) and declined sensibly on a yearly basis (4.9% y/y in July) suggesting the presence of the “Taylor Swift” effect in June. The accommodation component decreased by 2.4% m/m in July compared to the 3.3% m/m increase in June.

Related posts (with links)

UK June-24 CPI Inflation Report (previous release);

At the Core of UK Inflation (construction of supercore inflation and supercore wage index);

FT Alphaville on Catch-22 (short version of the Catch-22 effect);

Is the Bank of England in a Catch-22 Situation (long version of the Catch-22 effect);

Switzerland July-24 CPI Inflation Report (other release);

Review of the Inflation Release

In July 2024, consumer prices increased by 2.2% year-over-year (y/y), higher than the 2.0% year-over-year reported in June and May 2024. On a month-to-month basis, prices decreased by -0.2%, compared to a 0.1% increase in June.

Core CPI, which excludes food and energy, rose by 3.3% year-over-year (y/y), matching the consensus forecast of 3.4% y/y (see Chart 2). On a month-to-month basis, it increased by 0.1%, down from 0.2% in June. The services sector remains the primary driver of inflation, with a 5.2% y/y increase in July, lower than the 5.7% y/y in June. Conversely, the goods sector continues to experience deflation, recording a 0.6% y/y decrease in July, lower than the -1.4% y/y in June.

Chart 3 highlights the dichotomy between the persistent inflation in services and the quicker adjustment in goods prices.

Not surprisingly, the Catch-22 effect remained strong in July, with the housing component continuing to be the primary driver of inflationary pressures (Table 1 and Table 2). Actual housing rents rose by 7.1% year-over-year, marginally down from 7.2% y/y in June and slightly up from 7.0% y/y in May. On a month-to-month basis, rents increased by 1.7% (compared to 0.4% m/m in June and May (revised)), reinforcing the upward trend observed since September 2021.

Consequently, supercore services, as previously defined in a previous post (see Chart 4), increased by 4.8% y/y, lower than the 5.4% y/y of June and May 2024, but still at high levels but significantly lower than the previous readings.

On the service and supercore inflation front, there is some positive news with a slowdown in the month-over-month readings. Supercore service inflation rose by 0.3% m/m (rounded from 0.26%), below the 0.5% m/m in June and lower than the 0.7% m/m in May, while service inflation increased by 0.5% m/m in July, lower than 0.6% m/m of June and May.

These current readings confirm the persistence of the service component of inflation but also indicate the downtrend momentum. Overall both on a monthly and yearly basis there is a slow improvement consistent with slow adjustment in service prices. The data suggests that relatively higher inflation rates should be expected well into Q1 2025, assuming no other economic shocks, as rising rental costs continue to impact the economy, particularly the service sector.

Yesterday there was also the release of the labor market update with sectoral earnings data. We could also update our supercore wage index. Our supercore wage measure has declined steeply in June to 3.5% y/y from 5.9% in May. The decline is mainly due to the Health and Social Work industry, which saw a decrease in the year of 11.8% in June 2024 due to the one-off bonus payments made in June 2023.

Summary

The Bank of England's decision to extend the easing cycle will hinge on its evaluation of inflation's persistence in the services sector. The recent improvements in both monthly and yearly service inflation, along with the marked decline supercore inflation, indicate that a further 25 basis point cut in September may be justified.

Table 1: CPI by components (% YoY)

Source: UK Office of National Statistics (ONS).

Table 2: CPI by components (% MoM)

Source: UK Office of National Statistics (ONS).

Thanks for your comment! This is an important aspect of the inflation stabilization problem. Not just in the U.K, but elsewhere as well. Price levels on necessity goods is more important than the disinflation towards the target.

Actual rents for housing still rising at over 6% is a big element of the 'vibecession'. For young people unable to get on the housing ladder, especially in the South East, rents take a huge chunk of their disposable income, so even if the average person is experiencing rapid disinflation, for this important group the vibe is still very negative.

And, of course, the average person wants their grocery bill to go back to where it was in 2019, not just to see it plateauing, or even resuming a 2% long-term average again. I always think this is where central bankers just don't 'get it'. They live in a constant, morbid fear of deflation, a state unique to macroeconomists and bankers.