U.S. July-24 CPI Inflation Report

Slow moderation consistent with the beginning of the easing cycle

Key takeaways:

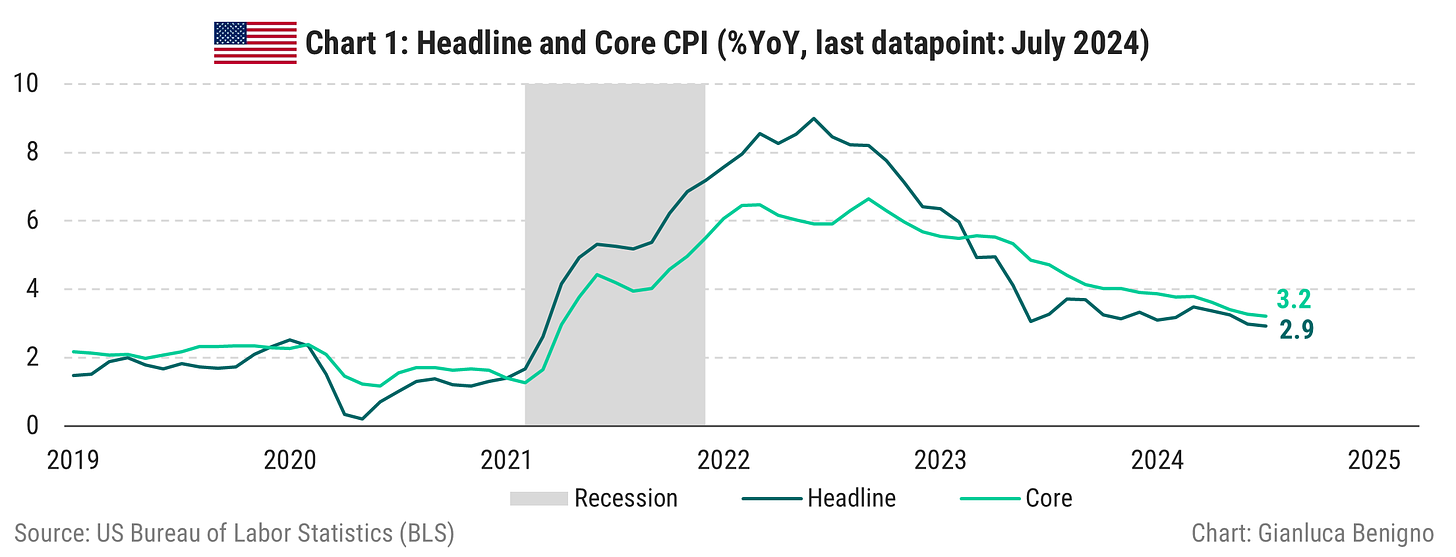

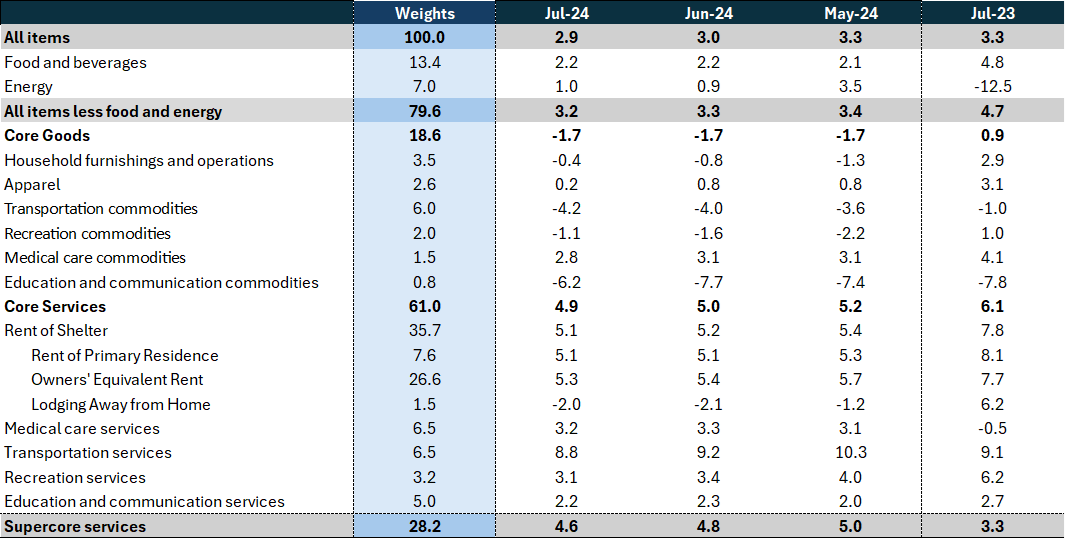

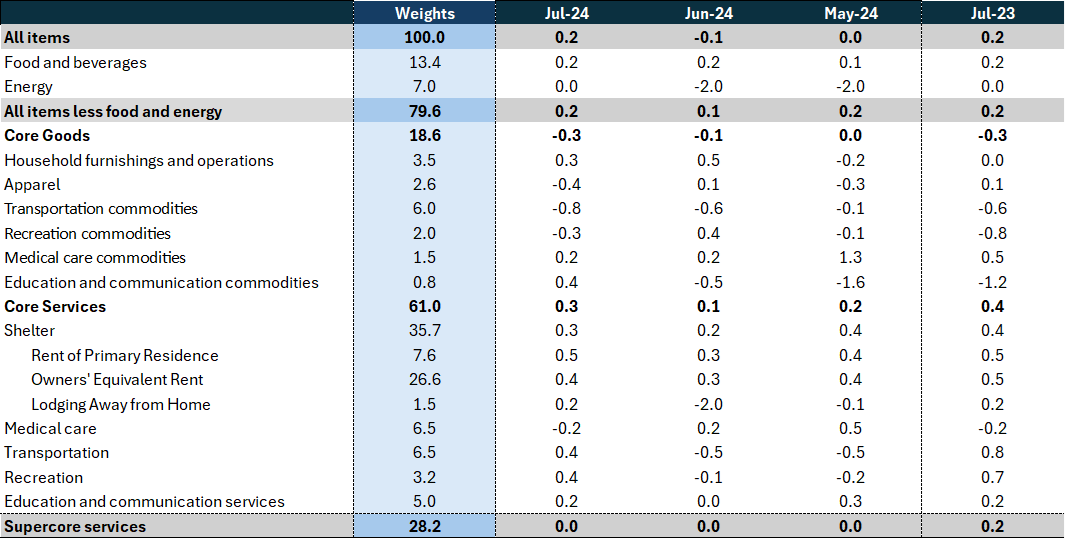

The overall Consumer Price Index (CPI) increased by 2.9% year-over-year (y/y) in July, close to the consensus expectation and June’s reading of 3.0% y/y increase.

Core CPI in July was 3.2% y/y (S.A.), which is in line with consensus, at 3.2% y/y, and marginally below the 3.3% y/y increase seen in June.

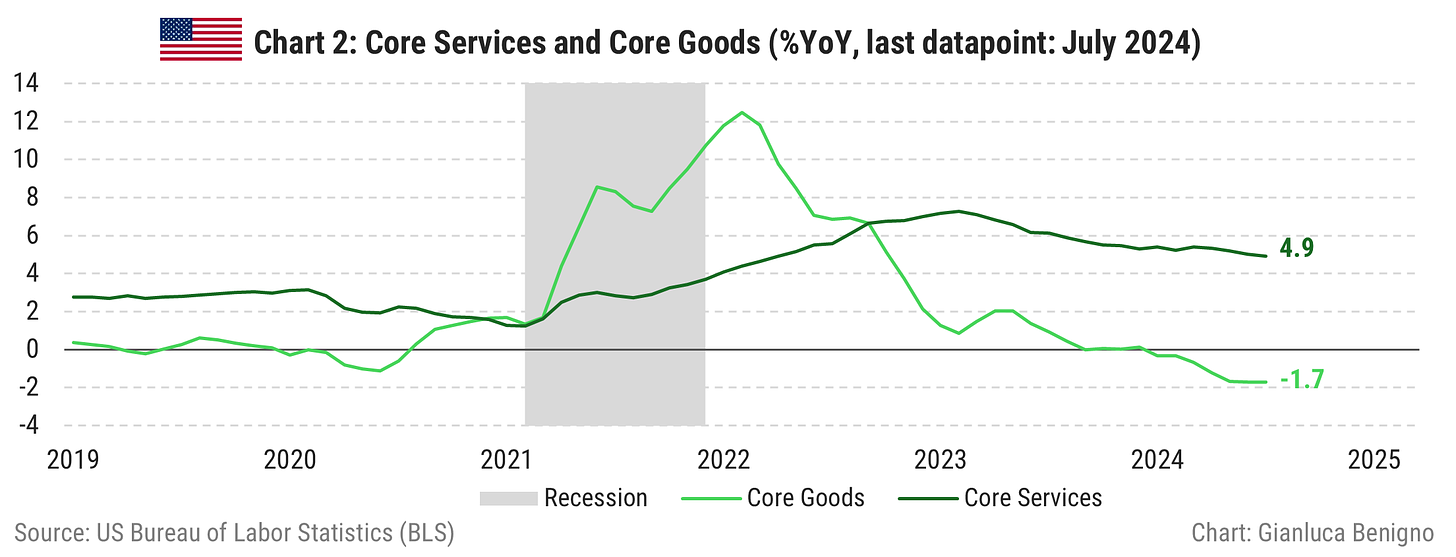

Inflationary pressures are primarily concentrated in the core service sector with an increase of 4.9% year-over-year, lower than June’s 5.0% y/y, whereas the goods sector is experiencing deflation with a decrease of 1.7% year-over-year, the same rate as in June.

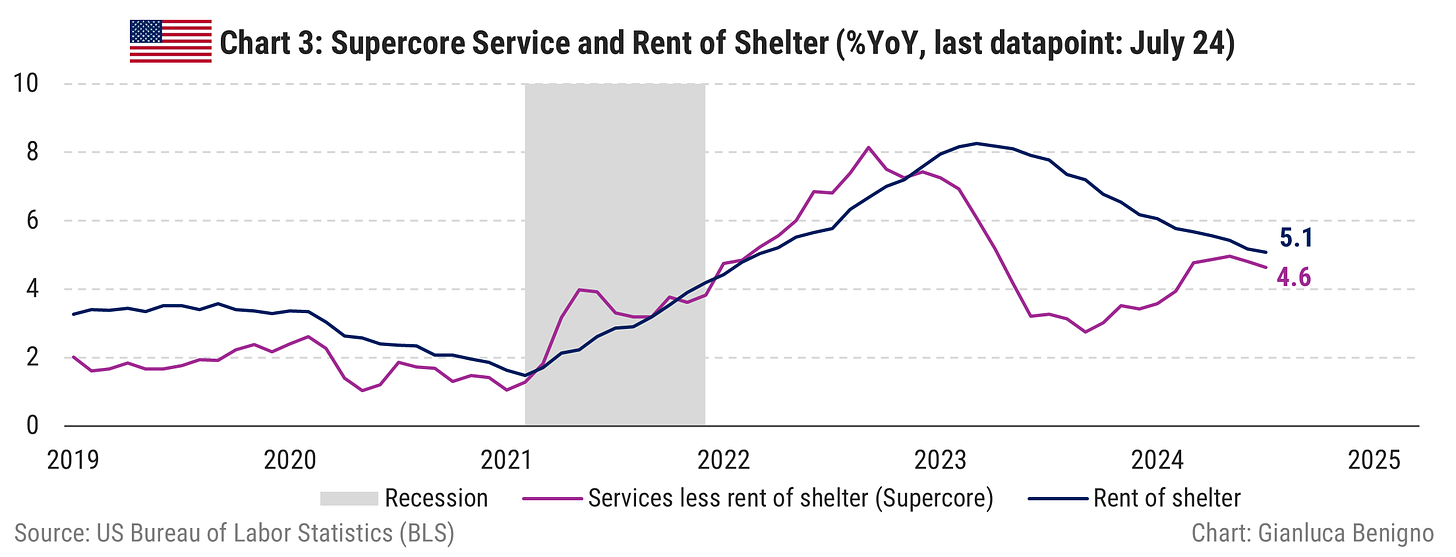

The primary factor behind recent inflationary pressures is still the shelter component of the Consumer Price Index (CPI). Shelter increased by 5.1% y/y in July compared to 5.2% y/y in June. The month-on-month increase was 0.3%, higher than June’s 0.2% m/m.

The current reading is consistent with a benign disinflationary process and the start of the easing cycle by the Fed in September. Labor market conditions would probably determine the choice between a 25bps and 50bps rate cut (see also Post FOMC update: The Fed and the Market Shifts).

Related posts (with links)

US June-24 CPI Inflation Report (previous release);

US May-24 CPI Inflation Report (previous release);

Post FOMC update: the Fed and the Market Shifts (context post);

UK July-24 CPI Inflation Report (other release);

Switzerland July-24 CPI Inflation Report (other release);

Review of the Inflation Release

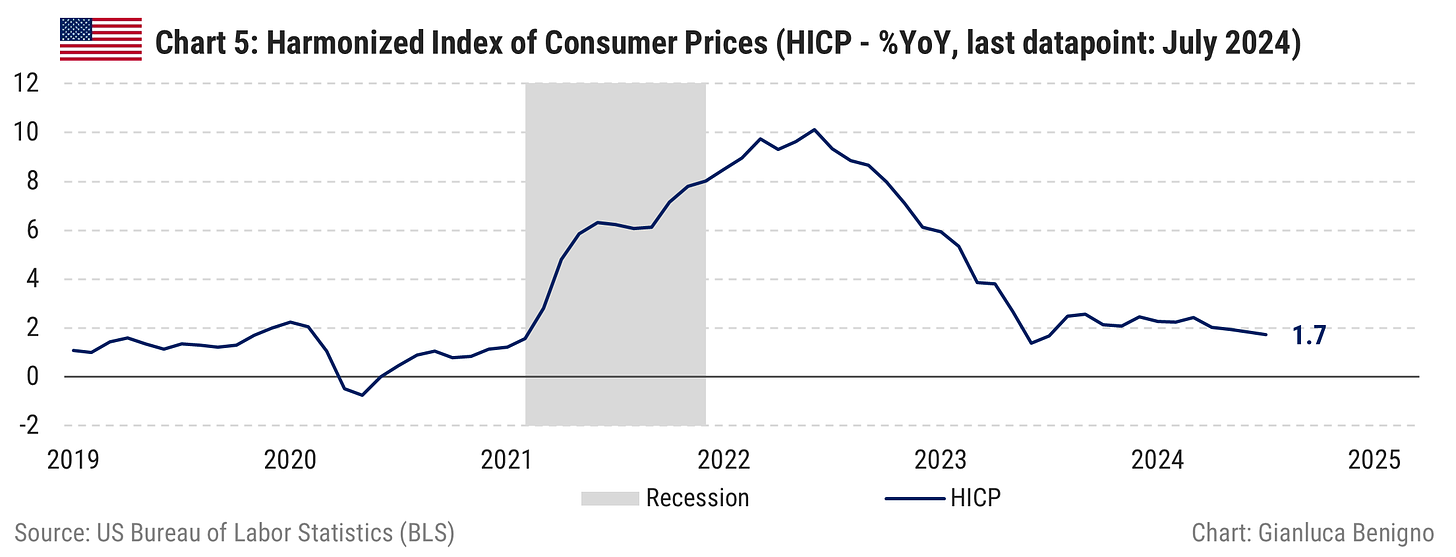

The Consumer Price Index (CPI) rose by 2.9% year-over-year in July (Chart 1), below the market consensus and June’s figure, both at 3.0% y/y. On a month-on-month basis, there was an increase of 0.2%, in line with the market consensus of 0.2% m/m, and higher than the decline of 0.1% m/m recorded in June.

Core CPI (excluding food and energy) increased by 3.2 % year-over-year (Chart 1), in line with the market consensus of 3.2% y/y and below June’s figure of 3.3% y/y. On a month-on-month basis, core CPI rose by 0.2%, higher than the 0.1% recorded in June and in line with the consensus forecast of 0.2% m/m.

Core services (services excluding energy) remain the primary driver of inflationary pressures. In July, core services increased by 4.9% y/y (compared to 5.0% y/y in June), while core goods (goods excluding energy) experienced another decline, by 1.7% y/y (the same rate as in June). The current release confirms the ongoing adjustment of core CPI, albeit at a relatively slow pace.

The following chart (Chart 2) illustrates this dichotomy between core goods and core services:

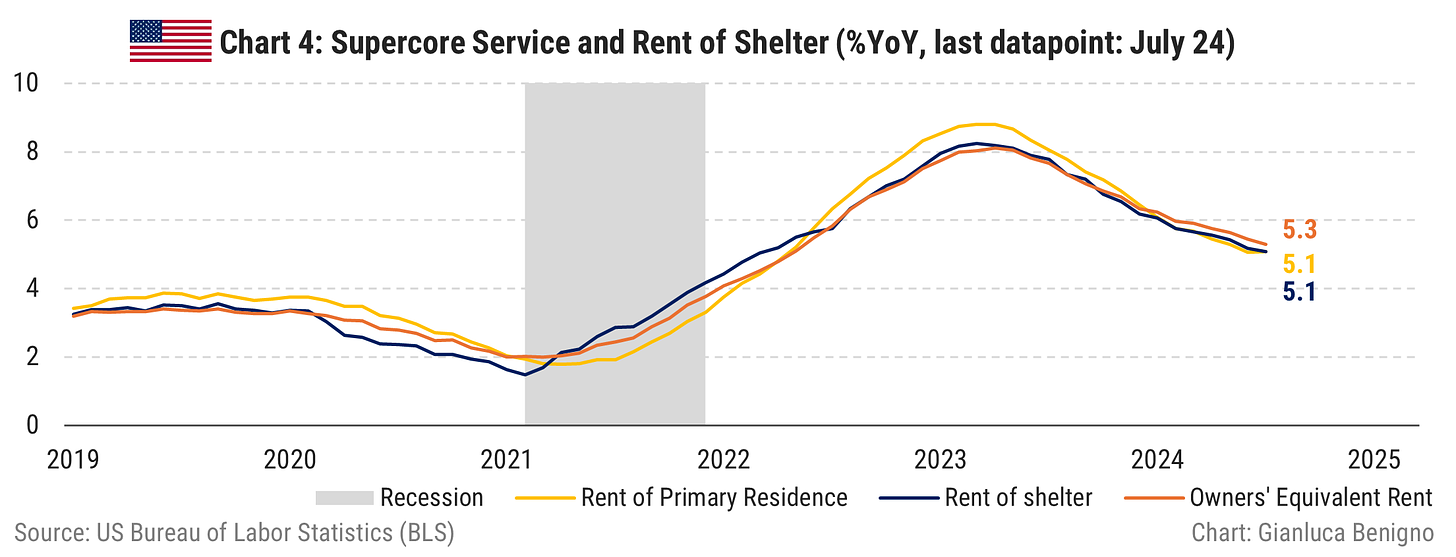

As anticipated, the CPI in July was primarily driven by the housing component (Tables 1 and 2). The overall shelter component rose by 5.1% year-over-year in July, slightly below the 5.2% figure recorded in June.

Supercore services (core services excluding shelter – Chart 3) increased by 4.6% year-over-year, moderating further relative to the 4.8% increase in June. On a monthly basis, this component has been flat at 0% in July, as in June and May.

Core services (excluding energy) prices increased by 4.9% year-over-year in July, slightly below the 5.0% year-over-year rise in June. On a month-on-month basis, core services increased by 0.3%, higher than the 0.1% rise in June, and the 0.2% increase in May.

Core goods (excluding food and energy) prices continued their deflationary trend, declining by 1.7% year-over-year in July, the same rate as the -1.7% year-over-year in June. Most subcategories within core goods registered declining prices on a year-over-year basis. A similar pattern is observed in the month-on-month variation, with core goods decreasing at 0.3% month-on-month in July, compared to the decline of 0.1% m/m in June and no change in May.

The Bureau also published the Harmonized Index of Consumer Prices (HICP), following the ECB’s methodology. According to the BLS: “The HICP differs from the U.S. Consumer Price Index (CPI) in two major respects. First, the HICP includes the rural population in its scope. Second, and probably more importantly, the HICP excludes owner-occupied housing”.

Chart 5 reveals that by excluding the owner-occupier rent component from the CPI, the inflation rate is marginally lower, at 1.7% in July compared to 1.8% year-over-year in June 2024

Summary

The persistence of inflation above target has delayed the Fed's start of the easing cycle. While goods prices have entered deflationary territory, disinflation in core services is progressing more slowly. However, recent month-on-month improvements in core and core services inflation should boost the Fed's confidence to begin easing in September 2024. Labor market conditions would probably determine the choice between a 25bps and 50bps rate cut at the September meeting (see also Post FOMC update: The Fed and the Market Shifts).

Table 1: CPI by components (% YoY)

Table 2: CPI by components (% MoM)