50 or 25 bps? The Cut that Could Split the Fed

Whatever the Fed will do, it will surprise markets

As the previous graph shows, uncertainty surrounding the size of the Fed cut has increased as we approach the FOMC September, scheduled for this coming Wednesday (18th).

Many analysts have noted that a key factor in shifting market-implied probabilities may have been Nick Timiraos's article published on Friday morning (The Fed’s Rate-Cut Dilemma: Start Big or Small?). Around the same time, a similar piece by Colby Smith was featured in the Financial Times (Federal Reserve wrestles with how aggressively to cut interest rates).

Additionally, some market observers have suggested that the benign PPI reading last Thursday could have influenced the significant change in market pricing on Friday.

Given the June 2022 precedent, I would attribute the market shift primarily to Nick Timiraos and Colby Smith’s articles. While it’s possible that expectations for the next benign PCE inflation reading could have played a role (the input coming from the recent PPI and CPI would suggest a reading of PCE consistent with the Fed’s target), I find it difficult to connect the market shift to data release, especially since the Federal Reserve has already indicated a shift in its attention towards the labor market.

I will explore two key questions:

a) Why is an insightful commentary necessary to shift market expectations?

b) What are the chances of a 50-basis point cut?

Related posts (with links):

Post-FOMC Update: The Fed and the Market Shifts (context post);

Fed update: Is the Troika the Median? (context post);

U.S. August-24 CPI Inflation Report (latest release);

The Case for Front-Loaded Rate Cuts (context post from Pierpaolo Benigno);

Has the Fed Monetary Policy been Restrictive? (first blog on the Fed’s policy stance).

Background: the June 2022’s Tale

The Federal Reserve initiated its interest rate hikes with a 25-basis point increase at the March 2022 meeting. Due to elevated inflationary pressures, the target Fed Funds rate was increased further by 50 basis points in May 2022. Leading up to the June 15th meeting, the consensus was that another 50-basis point increase was expected.

However, a major surprise occurred on Monday, June 13, when an article, by N. Timiraos, suggested that a 75-basis point hike was the most likely outcome.

“A string of troubling inflation reports in recent days is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected 0.75-percentage-point interest-rate increase at their meeting this week. […] Two consumer surveys have also shown households’ expectations of future inflation have increased in recent days. That data could alarm Fed officials because they believe such expectations can be self-fulfilling.”

As discussed in the updated version of the original article, market expectations shifted promptly, and the Fed delivered a 75-basis point hike.

During the June 2022 press conference, Chairman Powell discussed the importance of inflation expectations (including the inflation expectations survey data released the previous Friday by the University of Michigan) as a crucial factor— alongside other key economic indicators —in driving the shift in the rate hike's pace.

Before exploring the current decision dilemma, I will first briefly assess the current U.S. monetary policy stance (a similar exercise was done in a previous blog post).

Background: How Restrictive is US monetary Policy

In a previous post, we discussed the concept of restrictive monetary policy, and the construction of alternative measures of effective real interest rates and the natural real interest rate (see here (BIS paper) as well). As a key polar measure, consider Chairman Powell’s statement about the real Fed funds rate at the November 1st, 2023 press conference in his answer to Nancy Marshall-Genzer:

“The risk of doing too much versus the risk of doing too little are getting closer to balance, because policy is I think clearly restrictive at 5-1/4 to 5-1/2 percent. That range, if you take off a mainstream estimate of the expected inflation, take one year inflation, you're going to see that. You're going to see a real policy rate that is well above mainstream estimates of a neutral policy rate.”

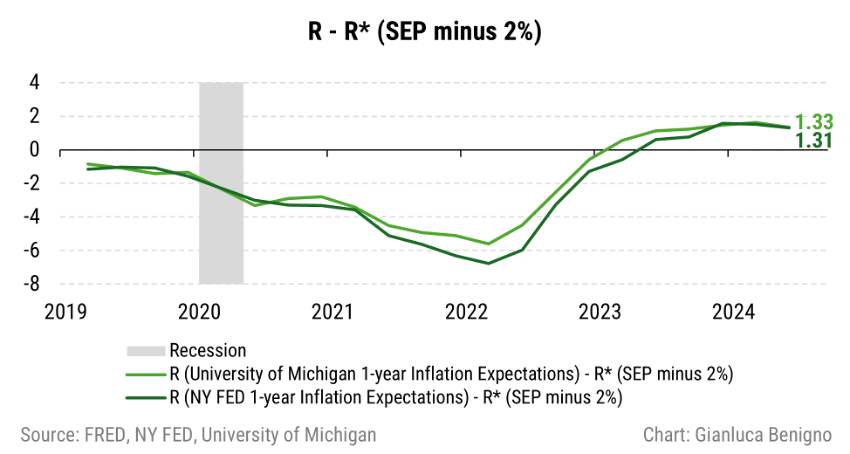

To measure the stance of monetary policy (r-r*), we use one-year ahead inflation expectations from the University of Michigan Surveys of Consumers and the NY Fed Survey of Consumer Expectations.

For the measure of the long-term natural rate, I consider the estimates from Holston, Laubach and Williams, Laubach and Williams, and Matthes and Lubik1. Interestingly, if we look at the Lubik-Matthes measure, the policy stance does not appear to be restrictive yet.

Alternatively, I also consider the implicit long-run natural rate, calculated by subtracting the long-term PCE inflation (which is always set at 2 percent) from the long-run SEP projection (central tendency, midpoint) for the Fed funds rate - note that the central tendency excludes the three highest and three lowest projections for each variable in each year.

Unsurprisingly, as before, the level of restrictiveness varies depending on the measure used. This has been a point of concern for some FOMC participants, who have either raised the issue or questioned just how restrictive the current monetary policy is.

The Role of the Wall Street Journal and the Financial Times Articles

Heading into the weekend and following the CPI release, it looked almost certain that the Federal Reserve would cut the policy rate by 25 basis points. The employment report was in line with expectations, even though it did show some signs of weakness – as revised job gains over the past three months fell short of the number of new entrants to the job market –, consistent with the recent trend increase in the unemployment rate. Additionally, the initial claims data released on Thursday (12th) indicated a relatively healthy labor market.

In summary, it would be challenging — though not entirely impossible — to initiate a discussion about a 50-basis point cut when market expectations were nearly unanimous in favor of a 25-basis point cut.

In this context, the WSJ and FT articles are setting the stage for a lively debate at the upcoming FOMC meeting on the size of the cut to add on the likely significant revisions to the year-end projection for the Fed funds rate in the SEP forecast. This dispute is being reflected in the market’s expectations for the Federal Funds rate cut at the next meeting (based on data from the CME FedWatch tool), as shown in the chart below:

Is a 50bps cut likely?

This is of course a difficult call at this point as more news might come in from today till Wednesday that can steer expectations in either direction.

In terms of the policy decision, one important point we need to take into account is that the composition of the FOMC is different from the voting committee. The FOMC includes 19 participants while the voting committee is restricted to 12 members: 7 members of the Board of Governors of the Federal Reserve System; the President of the Federal Reserve Bank of New York (a permanent voting member); and 4 of the remaining 11 Reserve Bank presidents, who serve as voting members on a rotating basis. The rotation is structured so that each year there is:

- One president from the Boston, Philadelphia, and Richmond banks.

- One president from the Cleveland and Chicago banks.

- One president from the Atlanta, St. Louis, and Dallas banks.

- One president from the Minneapolis, Kansas City, and San Francisco banks.

The non-voting Reserve Bank presidents still participate in the discussions and contribute to policy deliberations.

Currently, the voting members for 2024 are:

1. Jerome H. Powell (Chair), Board of Governors

2. John C. Williams (Vice Chair), New York

3. Thomas I. Barkin, Richmond

4. Michael S. Barr, Board of Governors

5. Raphael W. Bostic, Atlanta

6. Michelle W. Bowman, Board of Governors

7. Lisa D. Cook, Board of Governors

8. Mary C. Daly, San Francisco

9. Beth M. Hammack, Cleveland

10. Philip N. Jefferson (Vice-Chair), Board of Governors

11. Adriana D. Kugler, Board of Governors

12. Christopher J. Waller, Board of Governors.

The non-voting members of the FOMC for 2024 include the Reserve Bank presidents from:

Boston (Susan M. Collins)

Chicago (Austan D. Goolsbee)

Dallas (Lorie Logan)

St. Louis (Alberto G. Musalem)

Kansas City (Jeffrey R. Schmid)

Minneapolis (Neil Kashkari)

Philadelphia (Patrik Harker)

Here are my considerations:

- Obviously, A 25bps cut would not lead to a split committee.

- However, if a 50bps cut is proposed, it is likely to originate from the Troika (as mentioned previously) or from Powell himself, which could lead to dissent among committee members and the voting ones.

The next step is to determine whether there is a majority in favor of a 50bps cut. One source of uncertainty stems from the stance of the newest committee member, Beth Hammack, who has not yet shared her views on the economic outlook and the monetary policy stance.

Given the committee's composition, where the non-voting members have been notably the most hawkish, it is plausible that 6 participants could support a 50bps cut. A narrow majority might also emerge, and if that happens, the final vote could end up being 9-3 or 10-2 in favor of a 50bps cut, particularly if the Troika exerts influence and other members align.

Conclusions

The September meeting is shaping up to be quite exciting. With the SEP projections and the forecasted Fed funds rate for the end of 2024 already on the agenda, there was already plenty to consider.

Recent press articles and data releases have led to rapid market repricing, adding unusual uncertainty surrounding the current policy decision.

My focus here has been on surveying and interpreting accounting of recent events to shed light on the mechanics of the choice and its potential outcomes, i.e., what the Fed could do. A 50bps cut opens the door to several significant considerations. While I've briefly touched on monetary policy restrictiveness, the key issue would probably be in terms of the rationale behind interpreting recent labor market data. For instance, Pierpaolo Benigno has an excellent blog advocating for the need for a 50-bps cut (what the Fed should do). Additionally, financial market vulnerabilities might emerge as volatility increases (see The Bank of Japan’s Put) and potential global implications for policy decisions by other central banks in the wake of such a move might emerge. But that’s a topic for another discussion.

While the implied real Fed funds rate is computed on a monthly basis, the implied SEP real natural rate and the estimated rates from Holston-Laubach-Williams, Laubach and Williams, and Matthes and Lubik are only available on a quarterly basis.

A very good read! The shift in market expectation in the last few days has been remarkable.

Thoughtful and concise.