Central Banks Commentary: Federal Reserve, BoJ, BoE and SNB

Navigating Tariffs Amid Geopolitical Tensions

Last week was eventful in terms of central bank meetings and decisions. However, the event most likely to shape the global economic outlook wasn't a central bank action, but rather the escalating geopolitical tensions in the Middle East. This renewed instability has sharply increased risks surrounding oil prices and potential disruptions to global supply chains, particularly through the strategically crucial Strait of Hormuz. Indeed, as highlighted by recent analysis (see the Brawl Street Journal), a higher geopolitical risk premium is already influencing critical costs within the oil shipping industry.

But as events unfold, I would like to offer a brief overview of these Central Bank meetings. I will focus on the decision, the inflation outlook, their perspective on the impact of tariffs, and what to look at, sharing my perspective along the way. If you are interested in more in-depth analysis, please feel free to get in touch.

Federal Reserve (Fed): in a waiting mode as it anticipates the inflationary effects of tariffs to emerge. Meanwhile, interesting internal dynamics within the committee are surfacing.

Latest inflation report: US CPI-May 25 Inflation Report

Decision: Kept interest rates unchanged at 4.25%-4.50%. No dissent but dot plots signal divergent outlook in terms of monetary policy with more FOMC participants penciling in no rate cut in 2025 (see my note for a short summary of the Summary of Economic Projection-June 2025), but the median still points to a 50bps cut this year.

Inflation Outlook: Looking at recent CPI trends, core inflation has remained below 3%, and headline inflation below 2.5%, consistently over the past three months. Notably, core services inflation continues to ease gradually, now below 4%, though the pace remains slow. During the press conference, Chair Powell emphasized that inflation could see upward pressure later this year due to tariffs, specifically referencing the consensus among professional forecasters supporting this outlook. The Fed is adopting a forward-looking stance in terms of the impact of tariffs on inflation.

Attitude towards Tariffs: The impact of tariffs on inflation has not yet fully materialized, with Powell possibly expecting to see more in the next inflation prints during the summer. Tariffs have shifted the economic outlook by raising projected median PCE headline inflation (from 2.5% in December 2024 to 3% in June 2025) and lowering median GDP growth (from 2.0% in December 2024 to 1.4% in June 2025).

Risks: Continued uncertainty regarding the size of tariff pass-through effects, coupled with potential oil price spikes due to geopolitical instability.

Things to note: Governor Waller specifically advocates a "look-through" approach, interpreting tariffs as a one-time price adjustment rather than a persistent inflation risk, and he is advocating for a proactive approach of the Fed in relation to possible risks emerging in the labor market. He also advocates a cut in July. As I write this piece, Bowman is also suggesting this possibility of a July cut, and Daly is not excluding it, conditional on labor market developments.

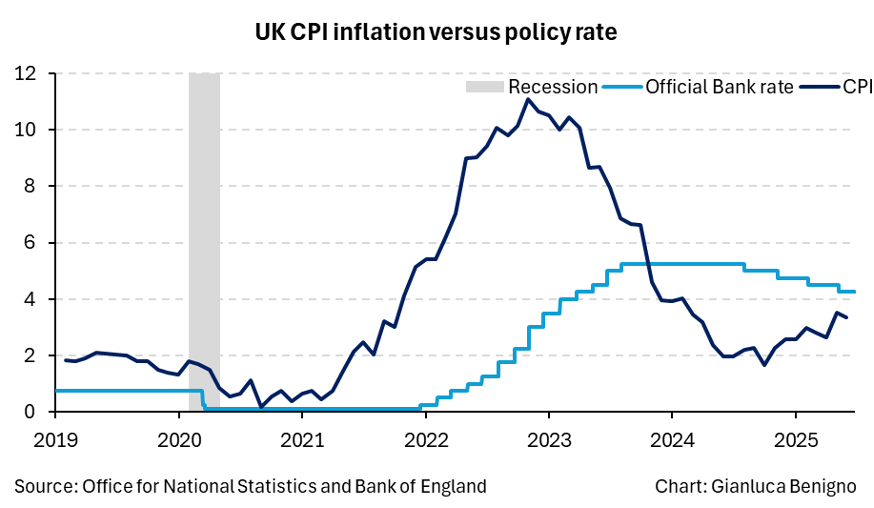

Bank of England (BoE): Waiting for inflation to moderate

Latest inflation report: UK CPI-May 25 Inflation Report

Decision: Held rates at 4.25%, with a slight surprise of a 6-3 vote, indicating growing dovish sentiment (Ramsden joined Dhingra and Taylor voting for a 25bps cut).

Inflation Outlook: Inflation rose moderately to 3.4%, mainly due to regulated and energy prices. BoE remains primarily concerned with persistent services, wages, and food inflation. Notably, goods inflation has shifted from disinflationary to inflationary (now running at 2%).

Attitude Towards Tariffs: According to the Monetary Policy Summary, the BoE maintains a neutral stance on tariff-driven inflation, viewing tariffs as likely having limited persistent effects, but remains cautious about their potential negative impact on global growth and noting potential effects in the UK on investment and trade flows.

Risks: Neutral stance towards tariff-driven inflation, keeping into account the US-UK trade deal, but attentive to broader global growth risks. In particular, geopolitical shocks with higher energy prices could weigh in, impacting the inflation outlook by adding upside pressures. August’s Monetary Policy Report will be crucial for future guidance.

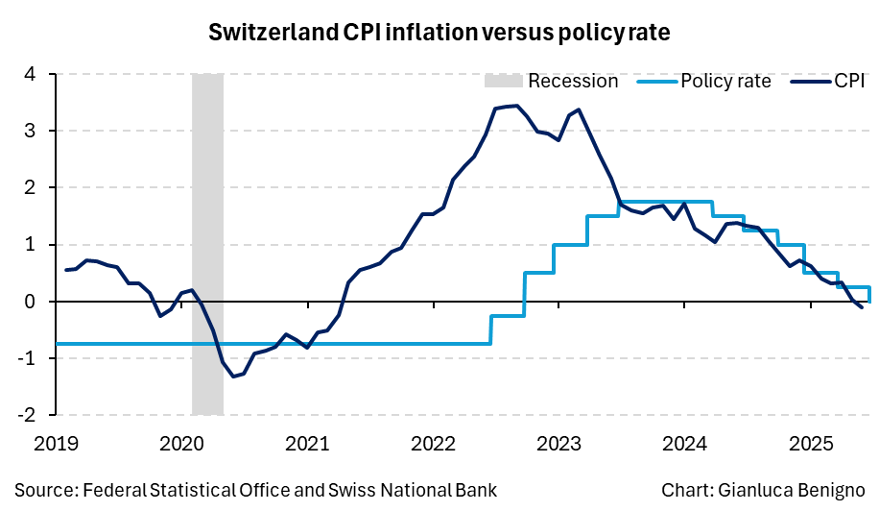

Swiss National Bank (SNB): Waiting for disinflation to end

Latest inflation report: Switzerland CPI-May 25 Inflation Report

Decision: Cut policy rates by 25 bps to 0%, continuing the easing cycle initiated in March 2024.

Inflation Outlook: Inflation has turned negative (-0.1%), driven largely by declines in tourism and oil prices. Persistent imported inflation remains challenging because of the Swiss Franc's strength.

Attitude Towards Tariffs: The SNB acknowledges the risk coming from higher US import tariffs on global trade and trade uncertainty on global investment. However, there is no mention of tariffs in Swiss inflation analysis

Risks: Heightened geopolitical tensions and potential disruptions in oil supply could exacerbate deflationary pressures, forcing SNB to potentially tread into negative rate territory again.

Things to note: since March 2024, the SNB has lowered the inflation forecast corresponding to the new policy rate, suggesting that without lowering the policy rate inflation path would have been even lower. Interestingly, persistent deflation from imported inflation has persisted despite lowering the policy rate. The geopolitical outlook can put further strain on the Swiss Franc and the inflation outlook.

Bank of Japan (BoJ): Cautiously Monitoring Underlying Inflation and Yen Weakness

Latest inflation report: Japan CPI-May 25 Inflation Report

Decision: Maintained policy rate at around 0.5%, with a gradual reduction in bond purchases planned through 2027.

Inflation Outlook: Elevated current inflation (3.5%) driven mainly by food and wage growth, but expected to stabilize around the target of 2% in the medium term.

Attitude Towards Tariffs: The BoJ notes tariffs as a potential risk factor, particularly affecting Japan’s export-dependent economy, notably sectoral tariffs that target autos, steel, and aluminium. Tariffs are seen as creating short-term price increases, but the BoJ remains focused on underlying inflation trends rather than temporary tariff impacts.

Risks: Key risks arise from the weakening of the yen, which could intensify inflation pressures if geopolitical instability pushes oil prices higher. The BoJ remains vigilant of tariff implications for export-oriented sectors.

Things to note: the tapering program proceeds as announced back in 2024. But looking forward, it will be important to monitor potential pressure on yields. Trade deals could clear the way as trade uncertainty is resolved towards further rate hikes.

Summary of Risks and Policy Implications

Each central bank faces unique challenges, but all share a common uncertainty driven by tariffs (from different perspectives), geopolitical tensions, and potential disruptions in energy markets.

One-sentence summary

Fed: Waiting for tariff-driven inflation to fully manifest, coupled with risks from oil-price volatility.

BoE: Persistent domestic inflationary pressures and global economic uncertainty.

SNB: Imported deflationary pressures possibly intensified by geopolitical instability.

BoJ: Currency weakness and inflation risks heightened by potential oil shocks and sectoral tariff shocks.

Great, thorough overview! Given the mounting geopolitical risks and their potential to disrupt energy markets and supply chains, how do you think central banks might adjust their communication strategies to manage market expectations and avoid overreacting to short-term volatility, especially around oil prices?

Thanks Alexander for your feedback and question. My guess is that, given their thinking, they will pay more and more attention to different measures of inflation expectations. One way to think in a simple way about a possible reaction function is, conditional on size of shock and volatility, to look through when expectations are anchored and to react otherwise. This is to the extent to which their main focus is inflation. The other aspect to keep in mind is that realisation of the risks you are referring to might have also implications for GDP and unemployment that could weigh as well.