Japan May-25 CPI Inflation Report

Persistent price pressures could raise the pressure for monetary policy action

Key takeaways:

Japan Consumer Price Index (CPI) increased by 3.5% year-on-year (YoY) in May, lower than April’s 3.6% YoY reading.

CPI excluding fresh food, the Bank of Japan's preferred measure, rose by 3.7% YoY in May, above April’s rise of 3.5% YoY, and the consensus forecasts of 3.6% YoY.

Fresh food inflation turned negative in May, falling by 0.1% year-on-year below the 3.9% YoY increase recorded in April. However, rice prices remain exceptionally elevated, surging 101.7% YoY, marking the eighth consecutive month above 50%. Meanwhile, fresh vegetables and fresh fruit also turned negative, falling by 4.7% and 0.1% YoY, respectively.

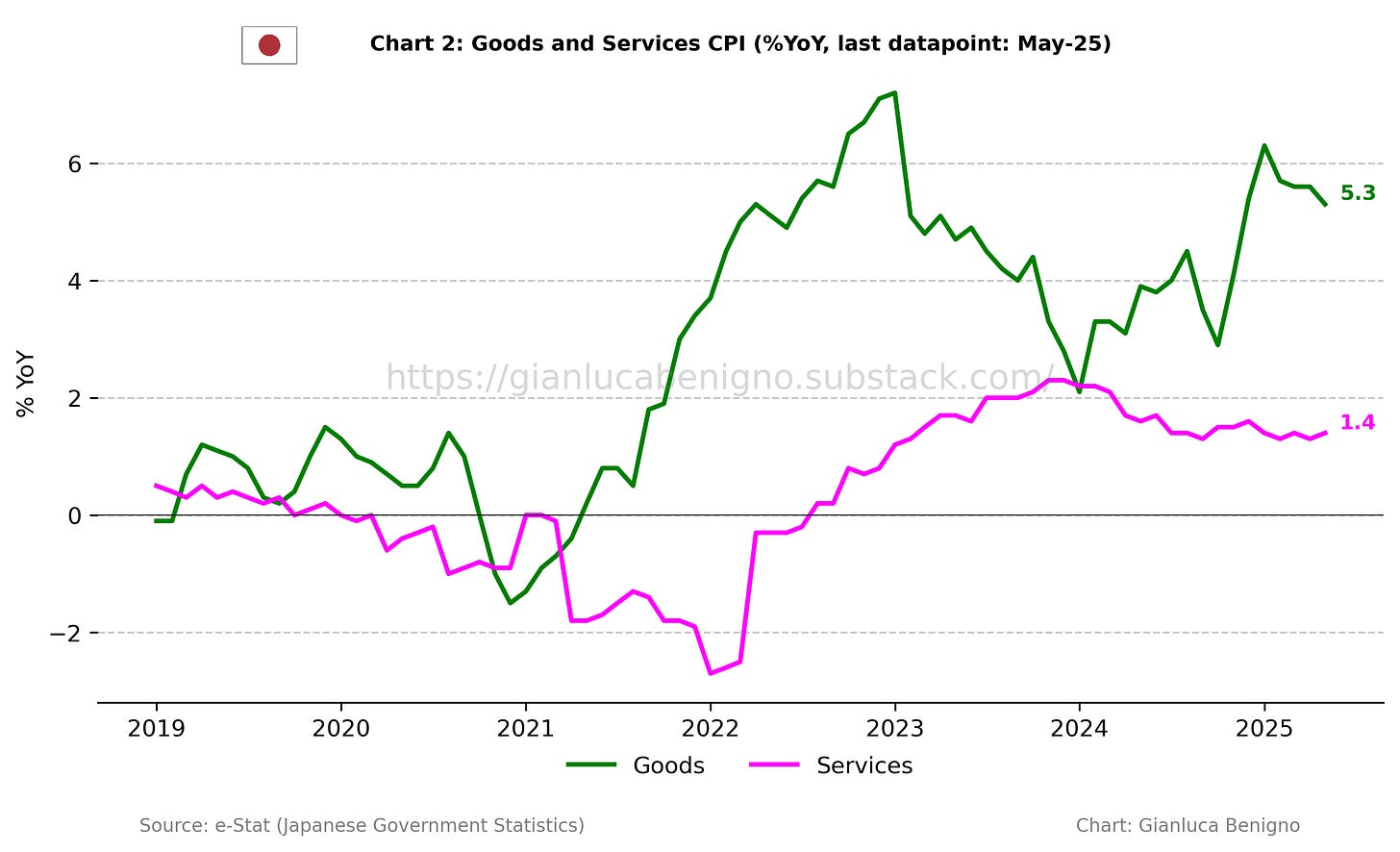

Japan's inflation diverges from patterns seen in other advanced economies. Indeed, it is primarily being driven by the goods sector, which rose by 5.3% YoY in May (versus 5.6% YoY in April), rather than by the services sector, which saw a minor 1.4% YoY rise in May, following April’s 1.3% YoY increase.

The Yen’s appreciation, which began in early 2025, has lost momentum over the past couple of months following the U.S. administration’s moratorium on reciprocal tariffs, and the JPY/USD has stabilized above 140. So far, there is no evidence that the Q1 2025 appreciation has passed through to goods price inflation.

Inflationary pressures at the level of service inflation less imputed rents, have increased to 1.9% YoY in May, compared to 1.7% YoY in April, lower than its peak above 3% in late 2023.

At its June 19th meeting, the Bank of Japan kept its policy rate steady at 0.5%, as anticipated. Recent inflation data indicates that price pressures remain persistent, which could raise expectations for policy action. However, the BOJ has emphasized its focus on ensuring that underlying inflation stabilizes near the 2% target before making further moves. Additionally, the Bank has highlighted global economic uncertainty and evolving trade policy as important considerations in determining the pace and timing of policy normalization.

Related Posts

Japan April-25 Inflation Report (previous report);

Japan March-25 Inflation Report (previous report);

Japan February-25 Inflation Report (previous report);

Japan January-25 Inflation Report (previous report);

Japan December-24 Inflation Report (previous report);

Japan November-24 Inflation Report (previous report);

Japan October-24 Inflation Report (previous report);

The Bank of Japan's Put (related post);

Post-FOMC Update: The Fed and the Market Shifts (related post).

Review of the Inflation Release

In May 2025, consumer prices increased by 3.5% year-on-year (YoY), below the 3.6% YoY increase recorded in April. On a month-on-month basis (MoM), prices increased by 0.3% in May, compared to April’s 0.4% MoM increase.

Regarding core measures, the Bank of Japan tracks two main core inflation metrics (Chart 1): The Consumer Price Index (CPI) excluding fresh food, and the CPI excluding fresh food and energy.

The first measure, which excludes fresh food, increased by 3.7% YoY in May, above market expectations of a 3.5% YoY rise, and above the 3.5% YoY increase recorded in April. On a month-to-month (MoM) basis, May’s figure rose by 0.4% MoM, lower than April’s 0.7% MoM increase.

The second core measure, excluding fresh food and energy, rose by 3.3% YoY, higher than the 3.0% YoY increase recorded in April. On a month-to-month basis, core prices rose by 0.3% MoM, compared to the 0.5% MoM increase recorded in April. Energy prices, a more volatile component by nature, are still consistently driving up inflation in the country: energy prices increased by 8.1% YoY in May, down from April’s increase of 9.3% YoY following the March phaseout of government subsidies for gas and electricity.

In contrast to many advanced economies, where the services sector is still the main driver of inflation, Japan’s inflation is predominantly fueled by goods inflation (Chart 2). In May, the Goods CPI increased by 5.3% YoY, compared to the 5.6% YoY increase observed in April. In contrast, the Services CPI rose by 1.4% YoY, higher than the 1.3% YoY increase recorded in April.

On a month-on-month basis (MoM), goods inflation increased by 0.4% MoM in May, compared to April’s 0.7% MoM increase. Conversely, service inflation increased by 0.1% MoM in May, compared to April’s 0.0% MoM.

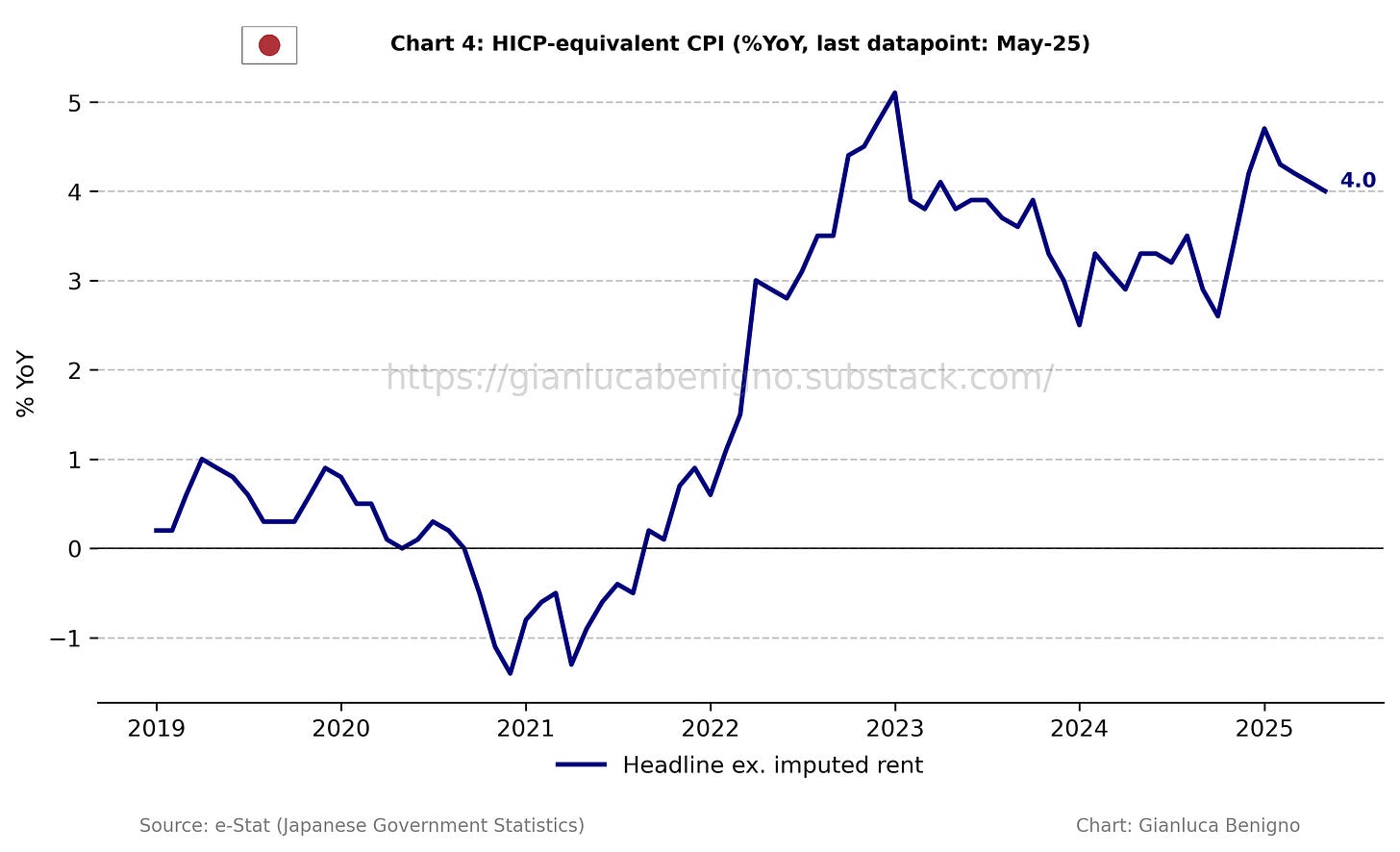

Further emphasizing Japan's unique position, the shelter component (“imputed rents”) of the CPI increased by 0.3% YoY in May, the same increase as in April. The “imputed rents" measure represents “the rent a person would have to pay to own and occupy a property”, which constitutes the largest part of the CPI's housing component and weighs about 16% of the overall CPI. For a detailed breakdown of Japan's housing and rent components, refer to Tables 1 and 2.

In Tables 1 and 2, we provide a more detailed breakdown of the components of CPI, including CPI inflation excluding imputed rents (Chart 4), which we consider the HICP-equivalent CPI. This measure facilitates international comparisons across countries and blocs, a methodology developed by the European Union Statistical Office. In May, HICP inflation rose by 4.0% YoY versus April’s 4.1% increase. As Chart 4 shows, HICP inflation peaked at the beginning of 2023, reaching just above 5%. In contrast, before the pandemic, HICP inflation fluctuated between 0% and 1% year-over-year.

Summary & Policy Implications

Headline CPI, core inflation (ex. fresh food), and even the trimmed measure excluding both fresh food and energy still remain well above the 2% target, supported by high goods inflation readings.

At its latest meeting, the Bank of Japan (BoJ) maintained its policy rate at 0.5%, the highest since 2008. In its monetary policy summary, the BoJ noted that the effects of past import price increases and recent food price rises—such as rice—are expected to diminish, leading to a slowdown in inflation. The Bank projects that underlying CPI inflation will reach its 2% target in the latter half of the April 2025 forecast period.

The most recent inflation data supports this outlook, as fresh food prices have shifted into deflation, falling sharply from a 13.9% annual increase in March. Base effects are likely to further reduce inflation readings later in the year. However, goods inflation remains persistent, with prices rising by 0.4% month-on-month in May.

External factors add complexity to the BoJ’s policy decisions. The Bank’s latest statement highlights the high degree of uncertainty regarding global trade policies and their potential impact on overseas economic activity, prices, financial markets, and Japan’s own economy.

In addition to these international considerations, recent upward pressure on long-term bond yields could complicate the normalization path. Nevertheless, the BoJ has reiterated its readiness to respond swiftly to any sharp rise in long-term Japanese government bond yields.

Table 1: CPI by components (% YoY)

Source: e-Stat (Japanese Government Statistics)

Table 2: CPI by components (% MoM)

Source: e-Stat (Japanese Government Statistics)

Great read