Japan April-25 CPI Inflation Report

Sticky core and goods inflation keep pressure on the BoJ’s cautious stance.

Key takeaways:

Japan Consumer Price Index (CPI) increased by 3.6% year-on-year (YoY) in April, the same rate as the one observed in March and slightly below the consensus forecast of 3.7% YoY.

CPI excluding fresh food, the Bank of Japan's preferred measure, rose by 3.5% YoY in April, above March’s rise of 3.2% YoY, and above the consensus forecasts of 3.4% YoY.

Fresh food inflation eased sharply in April, rising by 3.9% year-on-year after several months of double-digit increases, including 13.9% YoY in March. However, rice prices remain exceptionally elevated, surging 98.4% YoY, marking the seventh consecutive month above 50%. Meanwhile, price increases for fresh vegetables and fresh fruit also moderated, rising by 2.5% and 5.5% YoY, respectively.

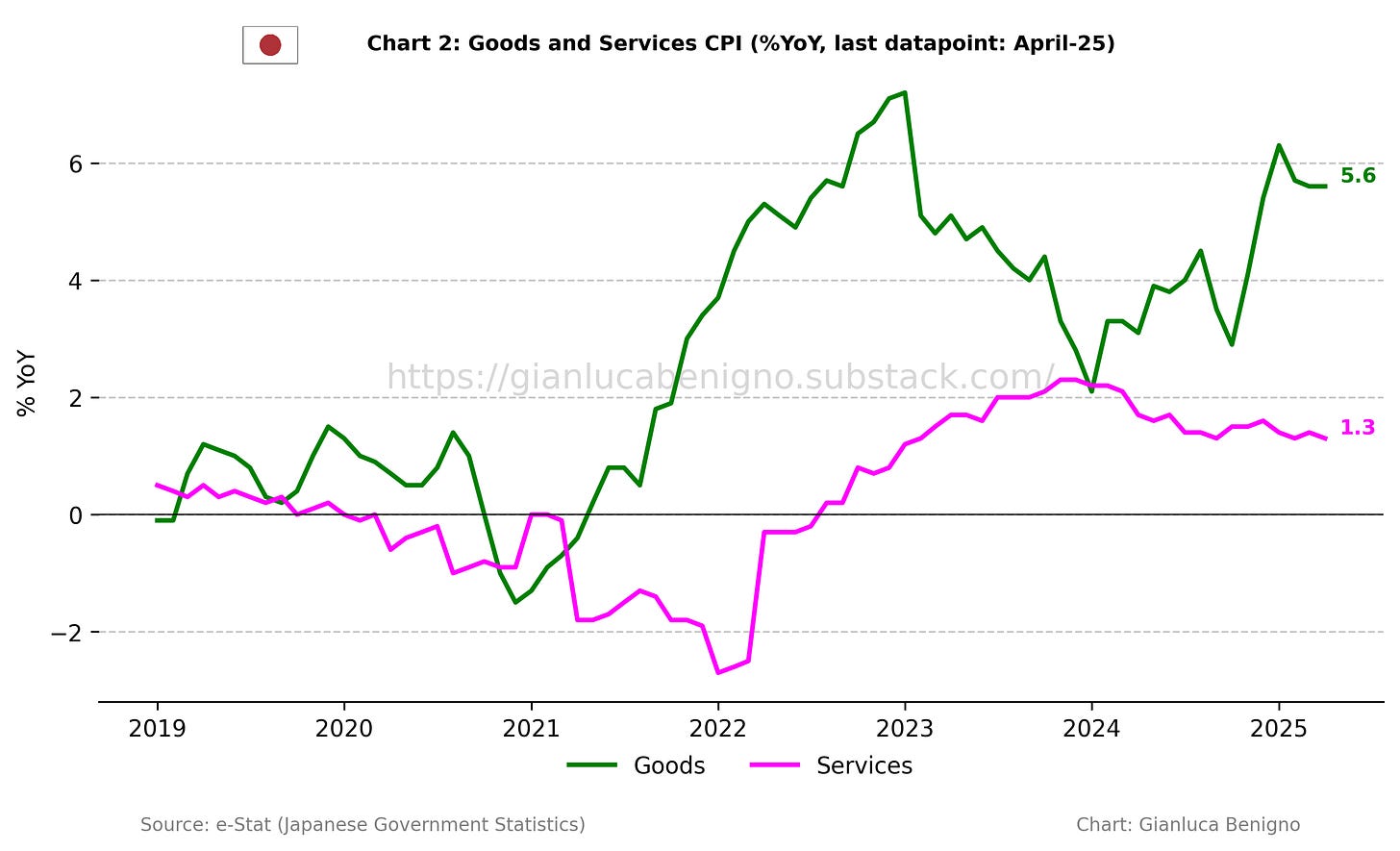

Japan's inflation diverges from patterns seen in other advanced economies. Indeed, it is primarily being driven by the goods sector, which rose by 5.6% YoY in April (versus 5.6% YoY in March), rather than by the services sector, which saw a minor 1.3% YoY rise in April, following March’s 1.4% YoY increase.

The Yen’s appreciation, which began in early 2025, has lost momentum over the past month following the U.S. administration’s moratorium on reciprocal tariffs. So far, there is no evidence that the Q1 2025 appreciation has passed through to goods price inflation.

Inflationary pressures at the level of service inflation less imputed rents, have slowed to 1.7% YoY in April compared to 1.9% YoY in March and February, lower than its peak above 3% in late 2023.

At its May 1st meeting, the Bank of Japan kept its policy rate unchanged at 0.5%, as widely expected. This decision came alongside a downward revision to its economic growth forecast, reflecting weaker global demand and uncertainty surrounding U.S. trade policy. These factors, combined with persistent inflation pressures and recent volatility in long-term bond yields, contribute to a highly uncertain policy outlook—reinforcing the likelihood that the BoJ will proceed cautiously with any further steps toward normalization.

Related Posts

Japan March-25 Inflation Report (previous report);

Japan February-25 Inflation Report (previous report);

Japan January-25 Inflation Report (previous report);

Japan December-24 Inflation Report (previous report);

Japan November-24 Inflation Report (previous report);

Japan October-24 Inflation Report (previous report);

The Bank of Japan's Put (related post);

Post-FOMC Update: The Fed and the Market Shifts (related post).

Review of the Inflation Release

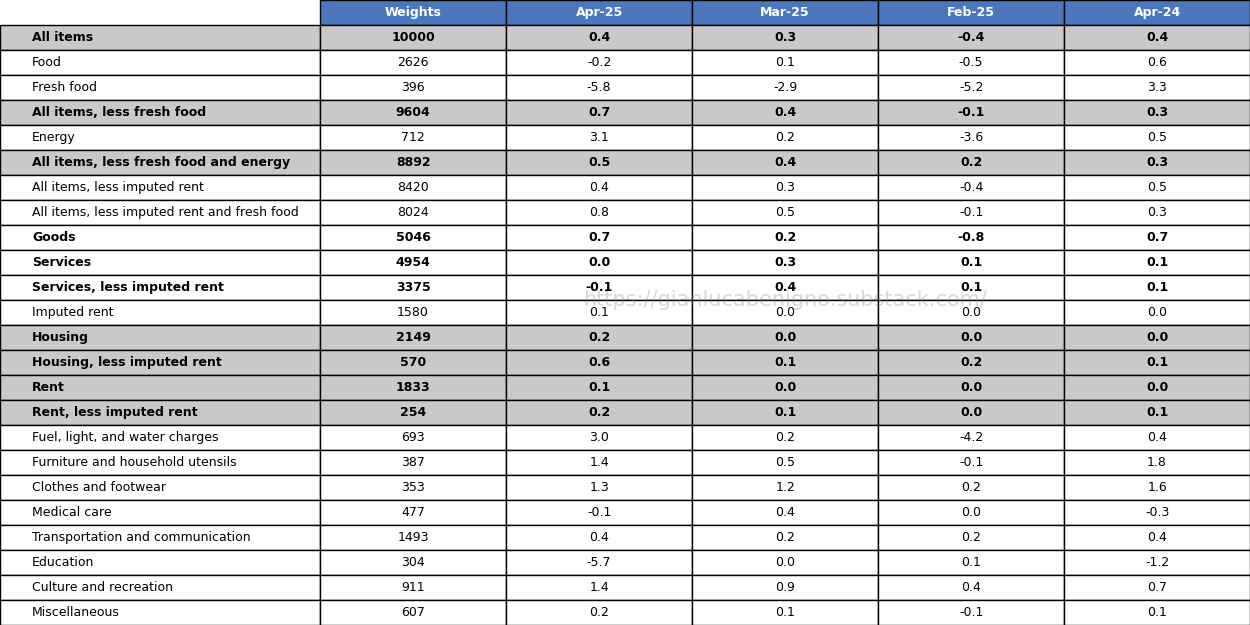

In April 2025, consumer prices increased by 3.6% year-on-year (YoY), just below the consensus expectation of a 3.7% increase and in line with the 3.6% YoY increase recorded in March. On a month-on-month basis (MoM), prices increased by 0.4% in April, compared to March’s 0.3% MoM increase.

Regarding core measures, the Bank of Japan tracks two main core inflation metrics (Chart 1): The Consumer Price Index (CPI) excluding fresh food, and the CPI excluding fresh food and energy.

The first measure, which excludes fresh food, increased by 3.5% YoY in April, above market expectations of a 3.4% YoY rise, and above the 3.2% YoY increase recorded in March. On a month-to-month (MoM) basis, April’s figure rose by 0.7% MoM, higher than March’s 0.4% MoM increase.

The second core measure, excluding fresh food and energy, rose by 3.0% YoY, higher than the 2.9% YoY increase in March. On a month-to-month basis, core prices rose by 0.5% MoM, compared to the 0.4% MoM increase recorded in March. Energy prices, a more volatile component by nature, are still consistently driving up inflation in the country: energy prices increased by 9.3% YoY in April, up from March’s increase of 6.6% YoY following the March phaseout of government subsidies for gas and electricity.

In contrast to many advanced economies, where the services sector is still the main driver of inflation, Japan’s inflation is predominantly fueled by goods inflation (Chart 2). In April, the Goods CPI increased by 5.6% YoY, the same increase as in March. In contrast, the Services CPI rose by 1.3% YoY, slightly lower than the 1.4% YoY increase in March.

On a month-on-month basis (MoM), goods inflation increased by 0.7% MoM in April, compared to March’s 0.2% MoM increase. Conversely, service inflation was flat at 0.0% MoM in April, compared to March’s 0.3% MoM increase.

Further emphasizing Japan's unique position, the shelter component (“imputed rents”) of the CPI increased by 0.3% YoY in April, compared to March’s 0.2% YoY increase. The “imputed rents" measure represents “the rent a person would have to pay to own and occupy a property”, which constitutes the largest part of the CPI's housing component and weighs about 16% of the overall CPI. For a detailed breakdown of Japan's housing and rent components, refer to Tables 1 and 2.

In Tables 1 and 2, we provide a more detailed breakdown of the components of CPI, including CPI inflation excluding imputed rents (Chart 4), which we consider the HICP-equivalent CPI. This measure facilitates international comparisons across countries and blocs, a methodology developed by the European Union Statistical Office. In April, HICP inflation rose by 4.1% YoY versus March’s 4.2% increase. As Chart 4 shows, HICP inflation peaked at the beginning of 2023, reaching just above 5%. In contrast, before the pandemic, HICP inflation fluctuated between 0% and 1% year-over-year.

Summary & Policy Implications

Headline CPI, core inflation (ex. fresh food), and even the trimmed measure excluding both fresh food and energy still remain well above the 2% target, supported by high goods inflation readings.

At its latest monetary policy meeting, the Bank of Japan (BoJ) held its policy rate steady at 0.5%—its highest level since 2008. This decision was supported in part by a downward revision to both CPI and GDP growth forecasts in the BoJ’s baseline scenario. Notably, the Bank expects the inflationary impact of higher import and food prices to subside later in fiscal year 2025.

The current inflation outlook reinforces this view, as monthly readings of food prices and the projected path of energy prices are expected to contribute to disinflation in 2025. However, goods inflation remains persistent, with prices rising by 0.7% month-on-month in April.

The broader monetary policy outlook is further complicated by external factors. Softer growth prospects—evident in the downward revision to the 2025 forecast—alongside ongoing trade negotiations and heightened uncertainty surrounding U.S. policy, present additional challenges for the BoJ. The eventual outcome of the trade agreement with the United States could have significant implications for both inflation dynamics and the broader economic outlook.

Given the broader context, the Bank of Japan is likely to continue with a cautious approach to policy normalization, even as the inflation outlook exerts some pressure for further action. What may prove more significant from the BoJ’s perspective, however, are recent developments in the bond market—particularly the sharp rise in long-term yields. Notably, BoJ board member Noguchi has downplayed the need for intervention, stating that there is no necessity for the Bank to respond to the steep increase in very long-dated yields.

Table 1: CPI by components (% YoY)

Source: e-Stat (Japanese Government Statistics)

Table 2: CPI by components (% MoM)

Source: e-Stat (Japanese Government Statistics)