Japan March-25 CPI Inflation Report

Rising underlying inflation supports further policy normalization, but the recent appreciation of the yen and heightened external uncertainties may prompt the Bank of Japan to proceed very cautiously.

Key takeaways:

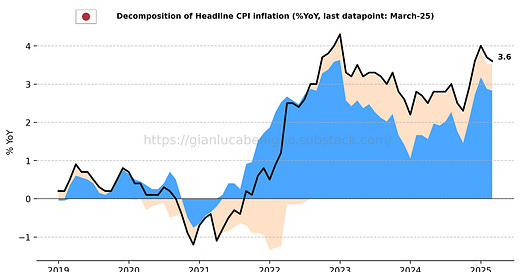

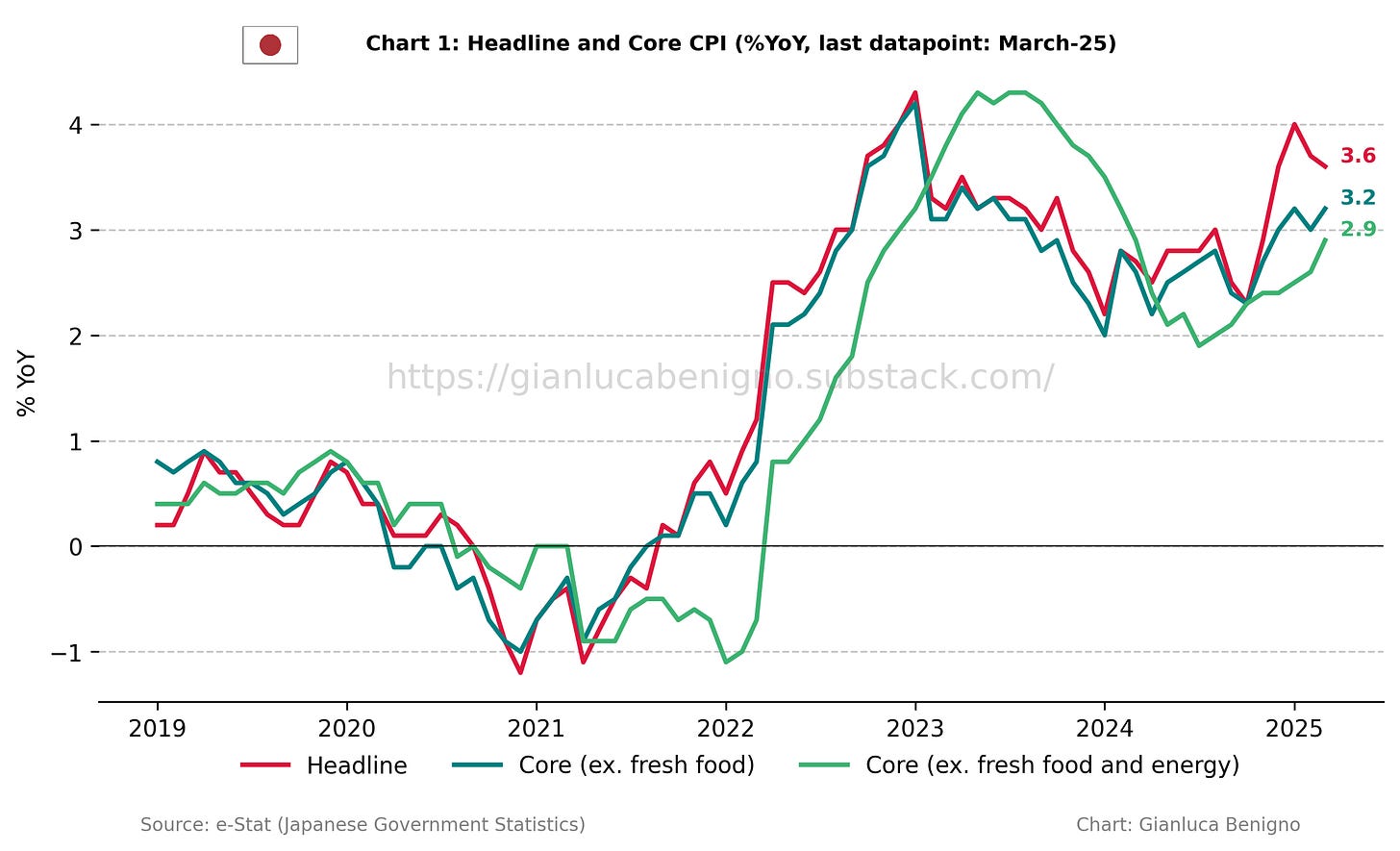

Japan's Consumer Price Index (CPI) increased by 3.6% year-on-year (YoY) in March, lower than the 3.7% YoY rise observed in February and market expectations of a 3.7% YoY increase.

CPI excluding fresh food, the Bank of Japan's preferred measure, rose by 3.2% YoY in March, above market expectations of a 3.0% YoY increase, and above February’s 3.0% increase.

Similarly, CPI excluding fresh food and energy rose by 2.9% YoY in March, compared to February’s figure of 2.6% YoY.

Fresh food inflation continues to be a prominent issue for Japan. In March, fresh food prices surged by 13.9% year-over-year, with rice inflation reaching 92.1% YoY, marking the sixth consecutive month above 50% YoY. Meanwhile, fresh vegetable prices rose by 22.1% YoY, and fresh fruit prices increased by 10.2% YoY.

Japan's inflation diverges from patterns seen in other advanced economies. Indeed, it is primarily being driven by the goods sector, which rose by 5.6% YoY in March (versus 5.7% YoY in February), rather than by the services sector, which saw a minor 1.4% YoY rise in March, following February’s 1.3% YoY increase.

The Yen’s depreciation over the last quarter (and in 2024 as a whole) has been a key driver of goods inflation in the country, given the pass-through effect on imported costs. However, its recent sharp appreciation, driven by market dynamics following the U.S. administration’s announcement of the new tariff regime, may provide some short-term relief by helping to contain goods inflation going forward.

Inflationary pressures at the level of service inflation seem to be consolidating around 2% for service inflation less imputed rent (increasing by 1.9% YoY in March, the same rate as February’s and January’s 1.9% YoY readings).

The BOJ’s next policy decision will be announced on May 1. Markets currently expect the central bank to maintain rates at 0.5%, with only a small probability priced in for a 25 basis point hike. If one of the motivations for raising rates is to curb the depreciation of the yen, the recent currency movements have already achieved part of that objective. Given the broader uncertainty and the ongoing trade negotiations between Japan and the U.S., the Bank of Japan is likely to adopt a very cautious stance in the period ahead.

Related Posts

Japan February 25 Inflation Report (previous release)

Japan January 25 Inflation Report (previous release)

Japan December 24 Inflation Report (previous release)

Japan November 24 Inflation Report (previous release)

Japan October 24 Inflation Report (previous release);

Japan September 24 Inflation Report (previous release);

A Quasi-Global Inflation Overview (related post);

The Bank of Japan's Put (related post);

Post-FOMC Update: The Fed and the Market Shifts (related post).

Review of the Inflation Release

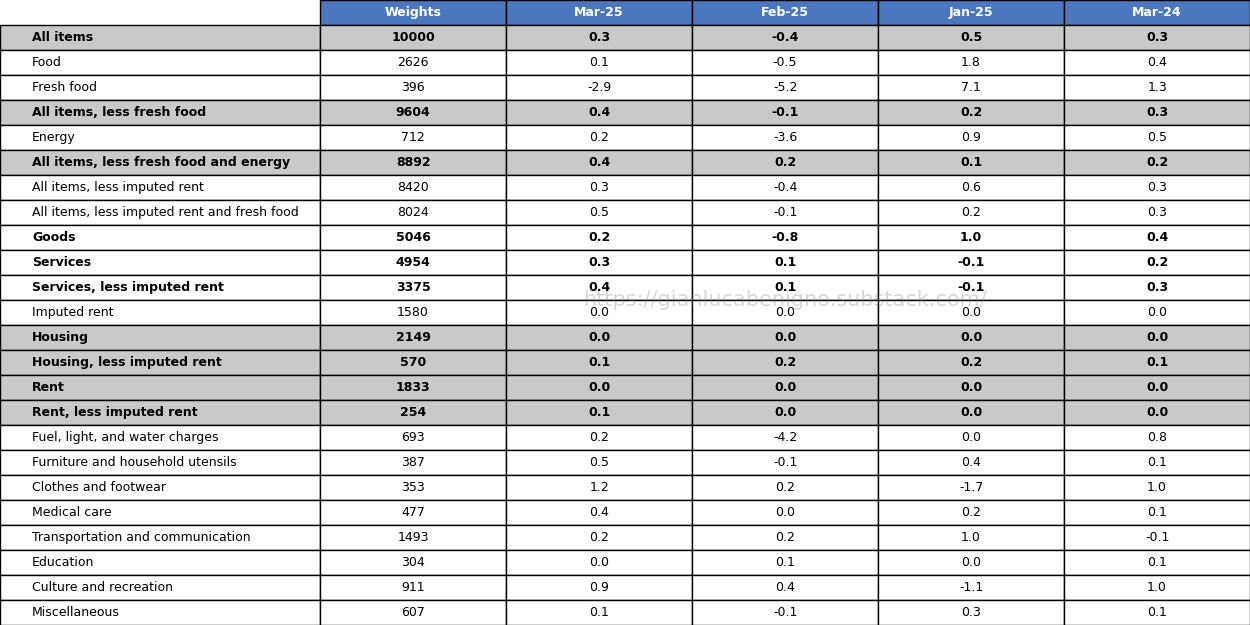

In March 2025, consumer prices increased by 3.6% year-on-year (YoY), below the consensus expectation of a 3.7% increase and the 3.7% YoY increase recorded in February. On a month-on-month basis (MoM), prices increased by 0.3% in March, compared to February’s 0.4% MoM decrease.

Regarding core measures, the Bank of Japan tracks two main core inflation metrics (Chart 1): The Consumer Price Index (CPI) excluding fresh food, and the CPI excluding fresh food and energy.

The first measure, which excludes fresh food, increased by 3.2% YoY in March, above market expectations of a 3.0% YoY rise, and the 3.0% YoY increase recorded in February. On a month-to-month (MoM) basis, March’s figure rose by 0.4% MoM, higher than February’s 0.1% MoM decrease.

The second core measure, excluding fresh food and energy, rose by 2.9% YoY, higher than the 2.6% YoY increase in February. On a month-to-month basis, core prices rose by 0.4% MoM, compared to the 0.2% MoM increase recorded in February. Energy prices, a more volatile component by nature, are still consistently driving up inflation in the country: energy prices increased by 6.6% YoY in March, down from February’s increase of 6.9% YoY.

In contrast to many advanced economies, where the services sector is still the main driver of inflation, Japan’s inflation is predominantly fueled by goods inflation (Chart 2). In March, the Goods CPI increased by 5.6% YoY, compared to the 5.7% YoY increase recorded in February. In contrast, the Services CPI rose by 1.4% YoY, slightly higher than the 1.3% YoY increase in February.

On a month-on-month basis (MoM), goods inflation increased by 0.2% in March, compared to February’s 0.8% MoM decrease. Conversely, service inflation increased by 0.3% MoM, compared to February’s 0.1% MoM increase.

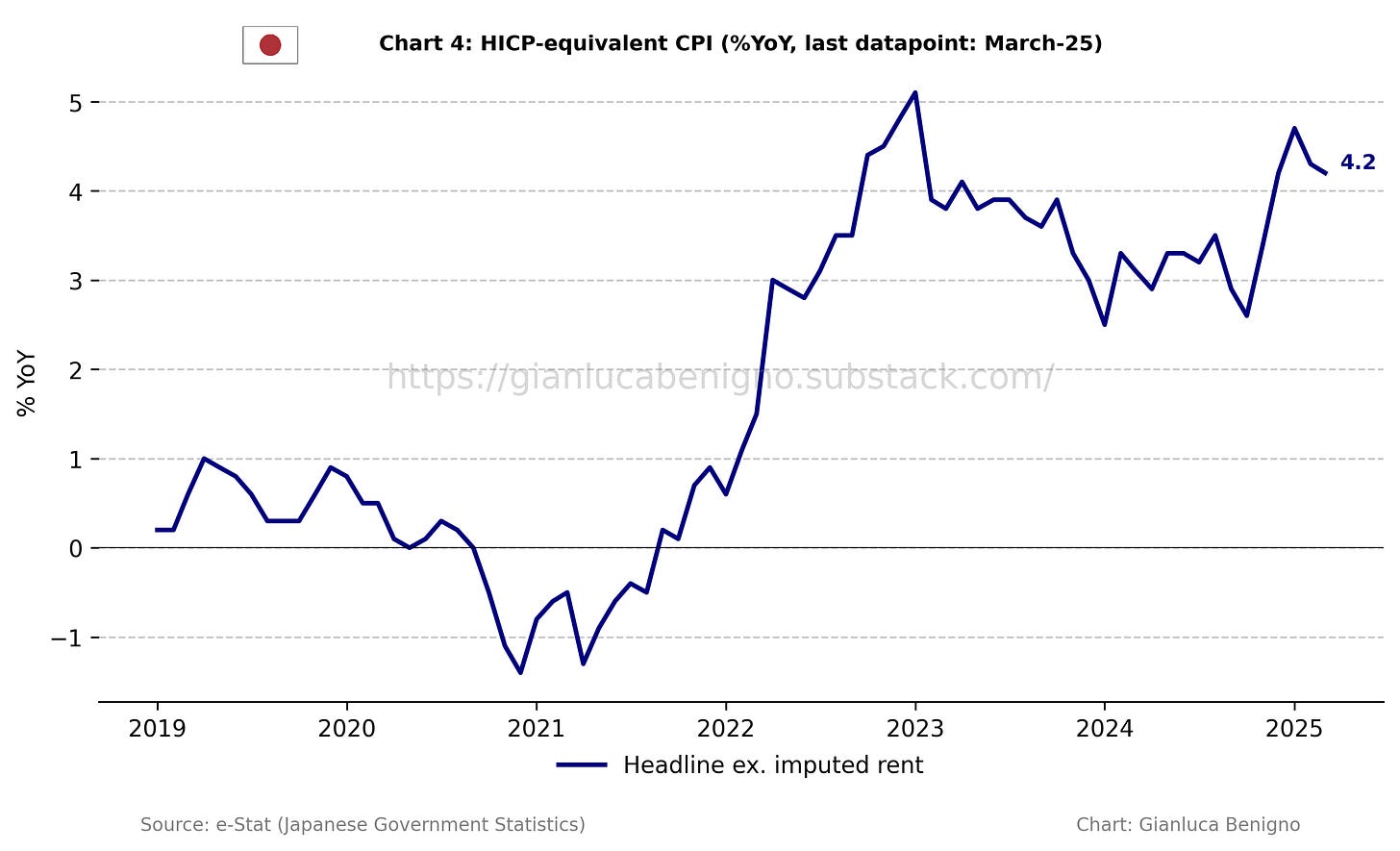

Further emphasizing Japan's unique position, the shelter component (“imputed rents”) of the CPI increased by 0.2% YoY in March, the same rate as February’s 0.2% YoY increase. The “imputed rents" measure represents “the rent a person would have to pay to own and occupy a property”, which constitutes the largest part of the CPI's housing component and weighs about 16% of the overall CPI. For a detailed breakdown of Japan's housing and rent components, refer to Tables 1 and 2.

In Tables 1 and 2, we provide a more detailed breakdown of the components of CPI, including CPI inflation excluding imputed rents (Chart 4), which we consider the HICP-equivalent CPI. This measure facilitates international comparisons across countries and blocs, a methodology developed by the European Union Statistical Office. In March, HICP inflation rose by 4.2% YoY versus February’s 4.3% increase. As Chart 4 shows, HICP inflation peaked at the beginning of 2023, reaching just above 5%. In contrast, before the pandemic, HICP inflation fluctuated between 0% and 1% year-over-year.

Summary and Policy Implications

Headline CPI, core inflation (ex. fresh food), and even the trimmed measure excluding both fresh food and energy all remain well above the 2% target, bolstered by sustained service inflation above 1% since Q4 2024. Strong wage gains, averaging over 5% across firms of all sizes, further reinforce the case for rate hikes.

Overall, the inflation outlook remains supportive of a rate hike at the next policy meeting, consistent with the Bank of Japan's gradual path toward normalizing monetary policy. While underlying price pressures remain firm, the recent appreciation of the yen could help contain goods inflation over the coming months, offering some short-term relief.

However, the broader monetary policy outlook is complicated by rising external risks. Weaker growth prospects—reflected in the downward revision to the 2025 forecast—combined with escalating trade tensions and heightened uncertainty around U.S. policy, add to the challenges facing the BOJ.

While inflation dynamics would warrant further tightening, the Bank of Japan is likely to proceed with caution, carefully weighing these conflicting forces in its policy decisions.

Table 1: CPI by components (% YoY)

Source: e-Stat (Japanese Government Statistics)

Table 2: CPI by components (% MoM)

Source: e-Stat (Japanese Government Statistics)