China April-25 CPI Inflation Report

Deflationary outlook persists at both producer and consumer levels.

Key takeaways:

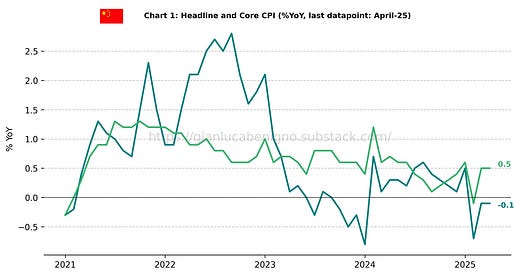

China's Consumer Price Index (CPI, non-seasonally adjusted) declined by 0.1% year-on-year (YoY) in April, the same rate as in March and in line with the consensus forecast.

Core CPI (excluding all food and energy) increased by 0.5% YoY in April, the same rate as in March 2025.

Consumer goods inflation decreased by 0.3 % YoY in April, a slightly lower decline than March’s 0.4 % YoY decline. Service inflation rose by 0.3 % YoY, the same increase as in March.

We note that food and tobacco prices have reversed course, now registering positive readings on both a yearly and monthly basis. Prices rose by 0.3% year-on-year, compared to a 0.6% decline in March, and increased 0.2% month-on-month, compared to the 0.9% fall recorded in March. More broadly, the services categories posted positive monthly changes, marking a turnaround from the declines seen in March 2025 and February 2025.

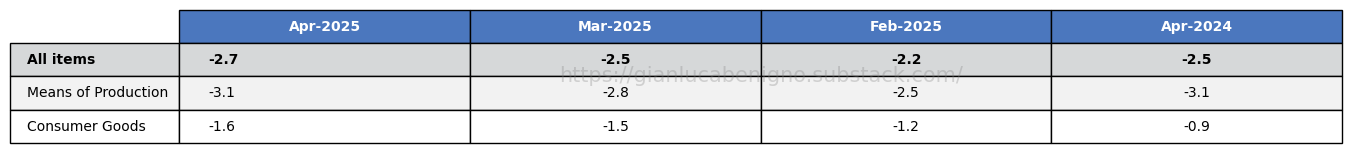

Producer Price inflation (all items) continued its deflationary trend in April, with a 2.7% YoY decline, lower than the 2.5% YoY decline recorded in March but slightly better than the market consensus of a 2.8% YoY decline.

Overall, the data confirms the deflationary outlook at both the producer and consumer levels. Ongoing producer-level deflation continues to reflect persistent excess capacity in the economy. Looking ahead, the key driver of inflation dynamics will be the still uncertain impact of tariffs. The sharp escalation in U.S. tariffs on Chinese goods, could further intensify deflation at the producer level, with downstream effects that reinforce consumer price deflation.

Related Posts

China March-25 CPI Inflation Report (previous release)

China February- 25 CPI Inflation Report (previous release)

China January- 25 CPI Inflation Report (previous release)

China December- 24 CPI Inflation Report (previous release)

Review of the Inflation Release

In April 2025, consumer prices decreased by 0.1% year-on-year (YoY), the same rate as in March 2025 and in line with the consensus forecast. On a month-to-month basis (MoM), consumer prices increased by 0.1 % MoM, compared to March’s 0.4% MoM decline.

Core inflation (excluding food and energy prices) rose by 0.5 % YoY in April, the same rate as in March. On a month-to-month (MoM) basis, it increased by 0.2 %, compared to the flat reading in March.

A relevant split that is provided at the level of China’s release is the distinction between consumer goods and services. In April 2025, consumer goods declined by 0.3% YoY after registering a decrease of 0.4% YoY in March. On a monthly basis, consumer goods were flat at 0.0 %, following March’s 0.4% MoM decline.

Service inflation rose by 0.3% YoY in April after posting a 0.3% YoY increase in March. On a monthly basis, April saw an increase of 0.3% MoM in service inflation, a reversal from March’s 0.4% MoM decline.

Finally, in the case of China, we also report producer price indexes. Indeed, given China’s prominence in global manufacturing, producer prices provide a good indicator for thinking about global inflationary pressures at the goods level.

We report three categories:

All items

Means of production, and

Consumer goods

In April 2025, producer prices continued their long-running deflationary streak. Producer prices for all items declined by 2.7 % YoY, following March’s 2.5% YoY decline. Similarly, producer prices (Means of Production) fell by 3.1% YoY in April, compared to the 2.8% YoY decline reported in March, indicating persistent lower input costs.

Finally, in April 2025, producer prices (consumer goods) declined by 1.6 % YoY, following the 1.5% YoY decline recorded in March.

Summary

April’s CPI release confirms the deflationary outlook. Producer prices continue their deflationary streak, while consumer prices remain stagnant and far from the 2% objective, reflecting weak domestic demand and lingering uncertainty.

The current state of U.S.–China trade tensions has brought trade between the two blocs to a near standstill. If this situation persists, it could further intensify deflationary pressures at both the consumer and producer levels.

Meanwhile, policy authorities have moved to counteract softening demand with a mix of monetary and fiscal support, cutting the PBoC’s policy rate by 10bps, lowering the Reserve Requirement Ratio from 6.6% to 6.2%, and announcing targeted stimulus. These steps reflect a broader push to stabilize prices amid persistent external and internal pressures.

Table 1: CPI by components (% YoY)

Source: National Bureau of Statistics of China

Table 2: CPI by components (% MoM)

Source: National Bureau of Statistics of China

Table 3: PPI by categories (% YoY)

Source: National Bureau of Statistics of China

Table 4: PPI by categories (% MoM)

Source: National Bureau of Statistics of China