Switzerland August-24 CPI Inflation report

Persistently low inflation pressures in Switzerland while the Catch-22 effect boosts housing rental inflation

Key takeaways:

In August, the Swiss Consumer Price Index (CPI) rose by 1.1% year-over-year (y/y), lower than July's 1.3% y/y figure and the consensus forecast of an increase of 1.2% y/y. On a month-over-month (m/m) basis, the headline CPI remained unchanged at 0%, compared with a 0.2% m/m decrease in July.

The Core CPI increased by 1.1% y/y in August, the same rate as in July. However, it showed a month-over-month increase of 0.1%.

The primary driver of rising prices was the services sector, which experienced a 2.2% y/y increase in August. In contrast, the goods sector declined for the fourth time in 2024, with a decrease of 0.7% y/y versus a decline of -0.1% y/y in July.

Housing rentals have trended upward since November 2023. In August, the increase was 4.0 % y/y (highest since November 1993), higher than the 3.4% y/y recorded in the previous three months. This further increase in housing rental inflation is consistent with the Catch-22 effect where monetary policy hikes lead to sectoral inflationary pressures.

These results are consistent with a common dichotomy faced by Central Banks in (major) advanced economies: goods prices are in a deflationary territory while service price inflation is slowly adjusting.

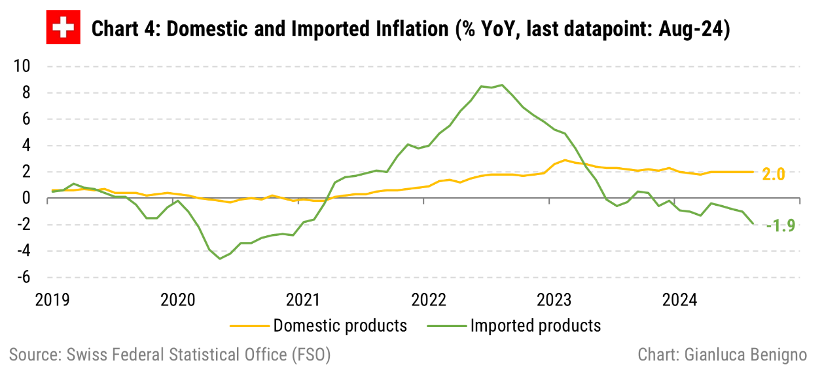

A parallel dichotomy arises in Switzerland by examining import and domestic prices, with import prices declining by 1.9% y/y (versus 1% in July) and domestic prices rising at 2% y/y (the same rate as in July).

From the SNB perspective, further interest rate cuts and foreign exchange rate intervention would be needed to limit deflationary pressures arising from import prices.

Related Posts

The SNB’s Challenging Rebalancing Act (analysis of SNB policy and Catch-22 effect for the SNB)

The SNB sets the time (analysis of SNB policy and Catch-22 effect for the SNB)

Switzerland July 24-CPI Inflation Report (previous release);

UK July 24-CPI Inflation Report (other release);

U.S. July-24 CPI Inflation Report (other release).

Review of the Inflation Release

Consumer prices rose by 1.1% year-on-year (y/y) in August 2024, below July’s increase of 1.3% y/y. On a month-on-month (m/m) basis, the result was unchanged, following a 0.2% decrease in July.

Core CPI, which excludes fresh and seasonal products as well as energy and fuels, increased by 1.1% year-over-year (y/y) in August (Chart 1), the same increase as in July. On a month-over-month basis, Core CPI increased by 0.1%, compared to a 0.3% decline in July.

Similarly to trends seen in other advanced countries, the services sector, rather than the goods sector, is the main driver of rising prices (Chart 2). In August, services saw a 2.2% y/y increase, the same rate as the 2.2% in July. Meanwhile, the goods sector experienced a decline of 0.7% y/y, following a 0.1% y/y decline in July.

Upon examining the more disaggregated data (refer to Tables 1 and 2), it is evident that, similarly to other advanced economies, housing rentals are the primary driver of inflation (as shown in Chart 3). In Switzerland, this component of the Consumer Price Index (CPI) is adjusted every three months and August is the month in which the new three-month data point is reported. In August the housing rental component increased by 4% year-on-year (the highest increase since November 1993), higher than the previous value of 3.4% y/y reported in July, June, and May.

The upward trend in housing rental is consistent with the Catch-22 effect where monetary policy hikes lead to higher mortgage rates that tend to exacerbate the domestic inflation. Excluding housing rentals, in August, the CPI inflation increased by 0.4.% year-on-year sensibly lower than the 0.8% y/y increase reported in July.

Another important classification from Switzerland's perspective is the distinction between domestic and imported inflation (see Chart 4). Domestic inflation rose by 2% year-over-year, the same rate (2% y/y) reported since April. On a monthly basis, domestic inflation was unchanged at 0% m/m, lower than the 0.2% m/m reported in July 2024. In contrast, imported inflation decreased by 1.9% year-over-year, which is a higher decrease than the -1% recorded in July. On a monthly basis, imported inflation fell by 0.1%, compared to the -1.3% seen in July.

The Swiss Federal Statistical Office also makes available a measure of Harmonized Price Index of Consumer Prices. (The Harmonized Index of Consumer Prices (HICP) is an indicator that the member states of the EU and EFTA calculate based on a harmonized method that allows comparing inflation internationally). The HICP has increased by 1% on a year-over-year basis, slightly below the 1.2% recorded in July.

Summary

Overall, the report confirms the recent trend of deflation in goods and in imported inflation, alongside persistently higher inflation in the domestic and service components. This month's report is the last one before the Swiss National Bank (SNB) monetary policy decision scheduled for September 26th, where a 25 basis-point cut is expected, in line with the cuts made in March and June. Looking ahead a combination of rate cuts and increased foreign exchange intervention seems desirable to rebalance price pressures. Rate cuts are consistent with an action aimed at taming disinflation by indirectly depreciating the Swiss franc (to limit the deflation from imported inflation), and eventually also working by reducing the inflationary pressure from the housing rental component (by reducing mortgage rates). Foreign exchange rate intervention (effectively a restart of balance sheet expansion for the SNB) would be aimed at directly limiting the appreciation of the Swiss franc.

Table 1: CPI by components (% YoY)

Source: Swiss Federal Statistical Office (FSO).

Table 2: CPI by components (% MoM)

Source: Swiss Federal Statistical Office (FSO).