Switzerland June-25 CPI Inflation Report

A better-than-expected CPI release pushed inflation back into positive territory, with an encouraging 0.2% month-on-month increase.

Key takeaways:

In June 2025, the Swiss Consumer Price Index (CPI) increased by 0.1% year-on-year (YoY), compared to the 0.1% YoY decline recorded in May, and above the consensus forecast of a 0.1% YoY decline. On a month-on-month (MoM) basis, June’s CPI increased by 0.2%, above May’s reading of 0.1% MoM and the consensus forecast of a 0.0%MoM change.

Core CPI increased by 0.6% YoY in June, versus 0.5% YoY in May. On a month-on-month basis (MoM), core CPI increased by 0.1%, the same monthly increase as in May.

As for virtually all previous releases, the services sector remains the primary driver of rising prices, experiencing a 1.1% YoY increase in June, the same increase as in May. In contrast, the goods sector inflation declined by 1.6% YoY in June, lower than May’s 1.9% YoY decline.

Housing rentals have trended upward since November 2023. Since this data is adjusted quarterly, the June release is the same as in May with an increase of 2.6% YoY – sensibly lower than the 3.2% YoY increase recorded in the period from January to March 2025.

These results are consistent with a common dichotomy faced by Central Banks in (major) advanced economies: goods prices are in a deflationary territory while service price inflation is the main contributor of overall inflationary pressures.

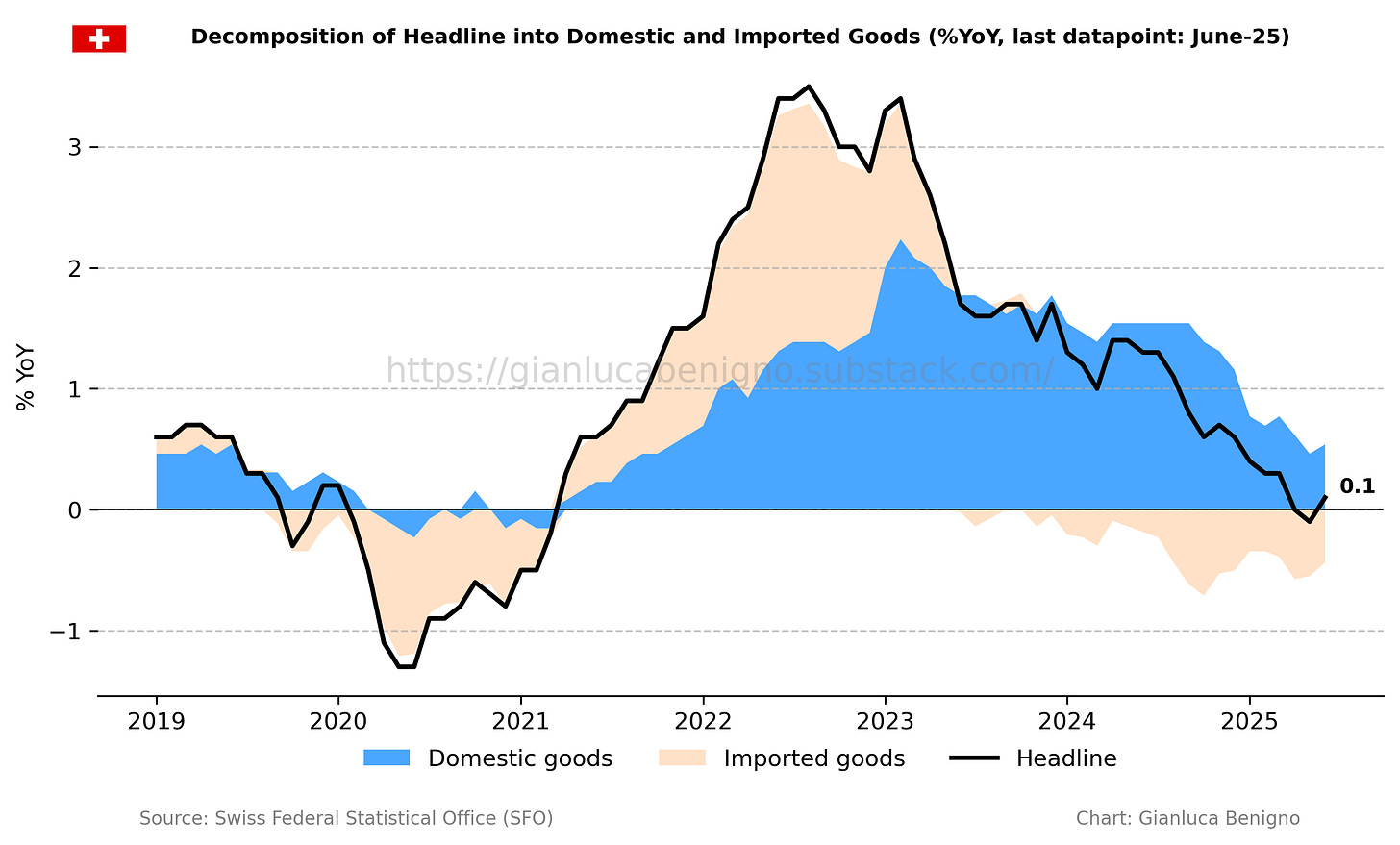

A parallel dichotomy arises in Switzerland by examining import and domestic prices, with import prices decreasing by 1.9% YoY in June (compared to May’s 2.4% YoY decline) and domestic prices rising by 0.7% YoY (versus 0.6% YoY in May and 0.8% in April).

Excluding housing rentals, CPI inflation declined by 0.5% YoY in June, compared to the 0.7% YoY decline recorded in May.

At its policy meeting on June 19th, the Swiss National Bank (SNB) decided to lower the policy rate by 0.25 percentage points, bringing it to 0.0%. With this monetary easing, the SNB aims to counter deflationary pressures stemming from declining import prices, largely driven by the strength of the Swiss franc. However, despite the rate cut, the Swiss franc has continued to appreciate against major currencies, likely due to ongoing trade tensions and geopolitical uncertainty.

The current inflation release is broadly positive, with headline inflation rising on both a year-on-year and month-on-month basis. A smaller deflationary drag from goods, along with positive contributions from clothing and footwear, as well as from restaurants and hotels, played a key role in this outcome.

A strong Swiss franc could reinforce deflationary pressures later in the year and further affect the Swiss National Bank’s (SNB) conditional inflation forecast. An additional factor to consider is the expected disinflationary impact from a further decline in the housing rental component of the inflation index.

Related Posts

Switzerland May 25 CPI inflation report (previous release)

Switzerland April 25 CPI inflation report (previous release)

Switzerland March 25 CPI inflation report (previous release)

Switzerland February 25 CPI inflation report (previous release)

Switzerland January 25-CPI Inflation Report (previous release)

Switzerland December 24 -CPI Inflation Report (previous release)

Switzerland November 24-CPI Inflation Report (previous release)

The SNB’s Forward Looking Compromise (analysis of SNB’s September policy decision)

The SNB’s Challenging Rebalancing Act (analysis of SNB policy and Catch-22 effect for the SNB)

The SNB sets the time (analysis of SNB policy and Catch-22 effect for the SNB)

Review of the Inflation Release

Consumer prices rose by 0.1% year-on-year (YoY) in June 2025, compared to May’s decrease of 0.1% YoY, and above the consensus forecast of a 0.1% YoY decline. On a month-on-month (MoM) basis, consumer prices increased by 0.2% MoM, above May’s 0.1% MoM increase.

Core CPI, which excludes fresh and seasonal products as well as energy and fuels, increased by 0.6% year-on-year (YoY) in June (Chart 1), up from May’s 0.5% YoY figure. On a month-on-month basis, Core CPI increased by 0.1% MoM in June, the same monthly change recorded in the last two months.

Similar to trends seen in other advanced countries, the services sector, rather than the goods sector, is the main driver of rising prices (Chart 2). In June, services increased by 1.1% YoY, the same increase as in May. Meanwhile, the goods sector experienced a decline of 1.6% YoY, above May’s 1.9% YoY decline, showing persistence in good price deflation.

A closer look at the disaggregated data (Tables 1 and 2) confirms that, as in other advanced economies, housing rentals remain the primary driver of inflation (see Chart 3). In Switzerland, this component of the Consumer Price Index (CPI) is updated quarterly, and it increased by 2.6% YoY in Q2, down from 3.2% in the previous quarter. As discussed earlier, movements in housing rents are closely tied to the policy rate. Given the SNB’s rate cuts over the past year, the moderation in rental inflation from its August–October peak is consistent with the adjustment in the policy rate. Still, housing rentals continue to exert significant upward pressure on headline inflation. Stripping out this component, the CPI fell by 0.5% YoY in June, above the 0.7% YoY decline recorded in May.

Another important classification from Switzerland's perspective is the distinction between domestic and imported inflation (see Chart 4). In June, domestic inflation rose by 0.7% year-on-year, compared to the 0.6% increase YoY recorded in May. On a monthly basis, domestic inflation increased by 0.2% MoM, the same increase as in May. In contrast, imported inflation decreased by 1.9% YoY in June, above May’s 2.4% YoY drop. On a monthly basis, imported inflation was flat at 0.0% MoM in June, as in May’s reading.

The Swiss Federal Statistical Office also makes available a measure of the Harmonized Price Index of Consumer Prices (The Harmonized Index of Consumer Prices (HICP) is an indicator that the member states of the EU and EFTA calculate based on a harmonized method and allows for international inflation comparisons). In June, the HICP increased by 0.2% on a year-on-year basis, higher than May’s 0.2% YoY decline.

Summary

The latest inflation data remains broadly consistent with the ongoing disinflationary narrative. Goods prices continue to decline, and imported inflation remains in negative territory, reinforcing the subdued inflation outlook. That said, the current release shows some encouraging signs, including a 0.2% month-on-month increase in headline CPI. However, the persistence of the housing rental component continues to play a significant role in supporting positive readings in both services and domestic inflation.

Although tariffs on Swiss imports remain suspended pending the 9th of July deadline, ongoing trade tensions have led to a renewed appreciation of the Swiss franc since the last policy decision.

The current release is broadly consistent with the inflation outlook presented by the Swiss National Bank (SNB) in its latest monetary policy assessment, published following the June 19th meeting at which the SNB lowered its policy rate to 0.0%. At that time, the SNB’s conditional forecast—based on the adjusted policy rate—projected Q2 inflation at 0.0% YoY, which is broadly in line with the last three months’ releases.

Looking ahead, the SNB forecasts a marginal increase in inflation, with a year-over-year rate of 0.1% in Q3 and 0.3% in Q4. Given the mechanical decline in the housing rental component of the inflation index, a critical factor for the inflation outlook will be the behavior of the Swiss franc.

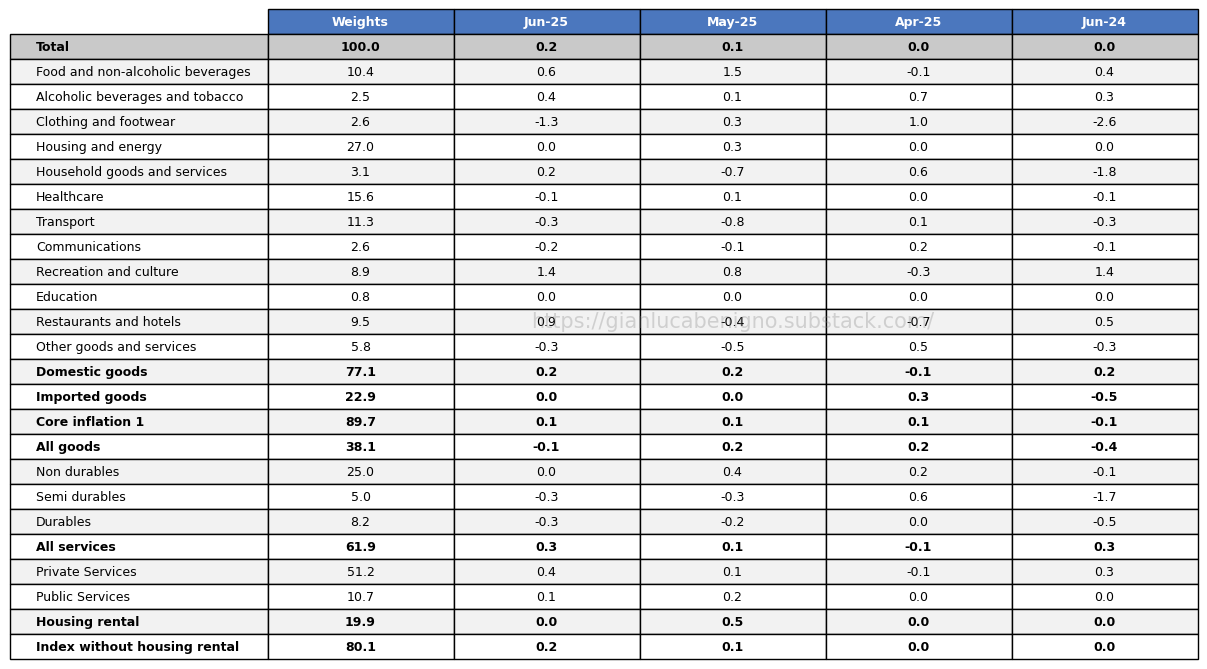

Table 1: CPI by components (% YoY)

Source: Swiss Federal Statistical Office (FSO).

Table 2: CPI by components (% MoM)

Source: Swiss Federal Statistical Office (FSO).