UK December-24 CPI Inflation Report

A significant improvement in service inflation could facilitate BOE's cut at the upcoming meeting

Key takeaways:

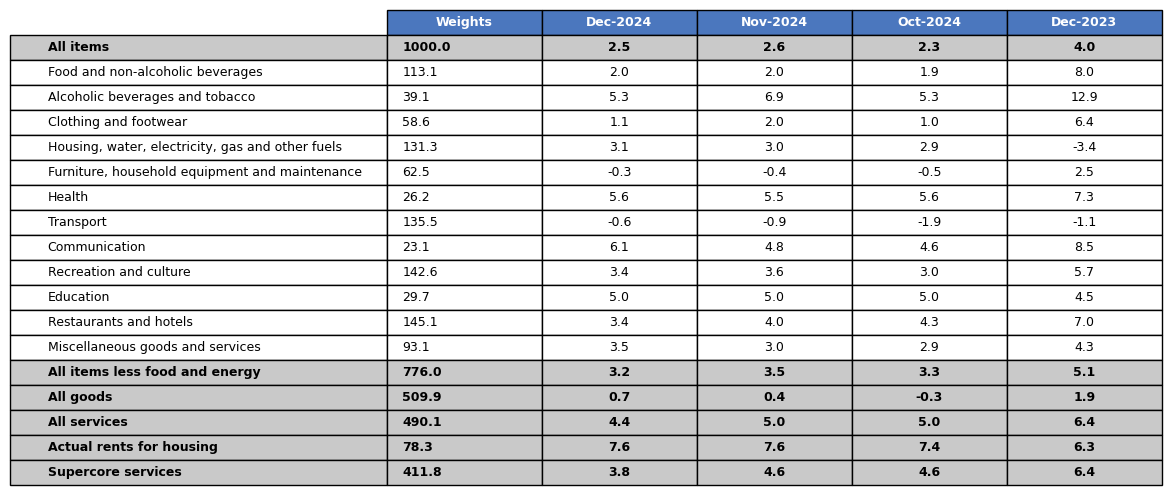

UK Consumer Price Index (CPI) increased by 2.5% year-on-year (YoY) in December, slightly below the market consensus and November’s figure, both at 2.6% YoY.

Core CPI in December increased by 3.2% YoY, lower than the consensus forecast of 3.4% YoY and November’s figure of 3.5% YoY.

Similarly to other advanced economies, inflationary pressures are primarily concentrated in the services sector, which saw an increase of 4.4% YoY in December, significantly lower than the 5.0% YoY recorded in November. Meanwhile, the goods sector inflation has been out of the deflationary territory for the second month, rising 0.7% YoY, following November’s increase of 0.4% YoY.

Within the services sector, the main driver of rising inflation remains the housing component of the CPI. In December, actual rents for housing increased by 7.6% YoY (versus 7.6% YoY in November, 7.4% YoY in October, and 6.3% YoY in December 2023).

Our supercore service inflation, which removes actual rents for housing from services CPI, increased by 3.8% YoY, significantly lower than the 4.6% YoY recorded in November.

This is the last inflation release before the Bank of England's upcoming monetary policy decision on February 6th. What is noticeable is the significant decrease in service inflation (also in our supercore service inflation measure). However, the earnings and working hours release on January 21st could also influence the February decision, especially given the scenario narrative of the BoE and the split in the committee’s voting.

Related posts (with links)

UK November-24 CPI Inflation Report (previous release)

UK October-24 CPI Inflation Report (previous release)

UK September-24 CPI Inflation Report (previous release);

UK August-24 CPI Inflation Report (previous release);

Scenario Analysis as Communication Device for Central Banking (related post);

A Quasi-Global Inflation Overview (related post);

Has Wage Growth Fueled Inflation in the UK? (related post);

At the Core of UK Inflation (construction of supercore inflation and supercore wage index);

FT Alphaville on Catch-22 (short version of the Catch-22 effect);

Is the Bank of England in a Catch-22 Situation (long version of the Catch-22 effect);

Review of the Inflation Release

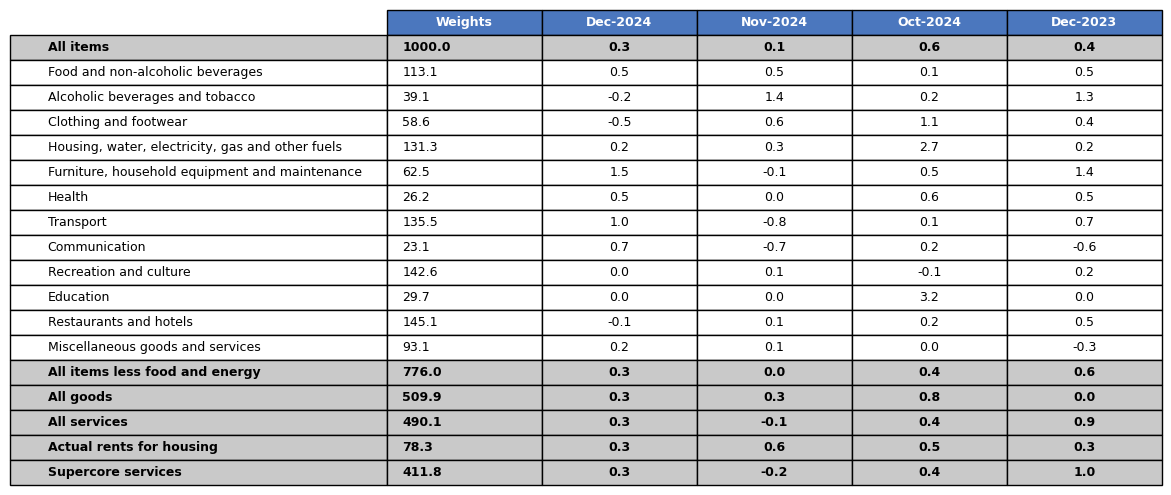

In December 2024, consumer prices increased by 2.5% year-on-year (YoY), slightly below the market consensus and November’s data, both at 2.6% YoY. On a month-on-month (MoM) basis, consumer prices increased by 0.3%, below the consensus forecast of 0.4% MoM, but higher than the 0.1% MoM increase recorded in November.

Core CPI, which excludes food and energy, rose by 3.2% YoY, lower than the consensus forecast of 3.4% YoY and November’s surge of 3.5% YoY (see Charts 1 and 2). On a month-on-month basis, core CPI increased at 0.3%, higher than November’s flat result.

The services sector remains the primary driver of inflation, with an increase of 4.4% YoY in December, sensibly lower than the 5.0% YoY figure observed in November. On a monthly basis, service inflation increased by 0.3% MoM, higher than the 0.1% decline observed in November, but lower than the 0.4% increase recorded in October. Goods sector inflation showed a 0.7% YoY increase in December, higher than the 0.4% increase observed in November. On a monthly basis, goods inflation increased by 0.3% MoM, the same rate as November’s. Chart 3 highlights the dichotomy between the persistent inflation in services and the quicker adjustment in goods prices.

A distinctive feature of inflation developments in the UK has been the ongoing rise in housing inflation (what we refer to as the “Catch-22” effect), which has been the primary driver of inflationary pressures (Table 1). Actual rents for housing rose by 7.6% YoY, the same rate as November and higher October’s figures – at 7.6% and 7.4%, respectively –, consolidating the upward trend of housing prices seen since September 2021, a tail-end effect of the "higher for longer" rates in the UK. On a month-to-month basis, actual rents rose by 0.3% compared to 0.6% MoM in November and 0.5% MoM in October.

Supercore services, as defined in a previous post (see Chart 4), increased by 3.8% YoY, significantly lower than the 4.6% YoY recorded in November. On a monthly basis, it declined by 0.3% MoM in December, higher than the 0.2% MoM decline seen in November.

Policy Implications

The Bank of England’s decision is due at the beginning of February. There is currently no clear consensus in the market regarding the committee’s next decision, though there is a slight bias towards a rate cut. The current release, with a significant moderation on service inflation, could support the rate cut decision. The upward movement of gilt yields and breakeven inflation in the last weeks could also weigh on the MPC decision at the upcoming meeting.

One of the key aspects of the policy decision, as highlighted in the latest Monetary Policy Report, is the persistence of service inflation and its relationship with inflationary wage pressures. The next wage release is due on the 21st of January when we will also update our supercore wage measure. However, the wage release is a lagged data release as it will update November 2024 data. A key driver of overall inflation is still the rental housing component which is still at a very high level.

Market expectations have scaled back rate cuts of the Bank of England for 2025. They are now pricing between two and three rate cuts in 2025. Recall that just about a month ago (before the two latest inflation releases), Governor Andrew Bailey indicated that four rate cuts could be a likely path for 2025. It would be interesting to see how the MPC will weigh this more benign inflation release along with the significant increase in long-term yield that could put further pressure on the fiscal stance and the economic outlook.

Table 1: CPI by components (% YoY)

Source: UK Office of National Statistics (ONS)

Table 2: CPI by components (% MoM)

Source: UK Office of National Statistics (ONS).