UK Update: BOE’s split decision (almost 5-3-1)

Lack of consensus among policymakers and growing monetary policy uncertainty are likely to remain dominant themes in 2025.

Today’s outcome of the Bank of England’s monetary policy decision was a no change for the Bank Rate at 4.75%. This was no surprise. What is surprising is the split in the committee. Financial markets were expecting an 8-1 with Dhingra voting for a cut, while the outcome was a 6-3 with Dhingra being joined by Ramsden and Taylor.

More interestingly the minutes suggest that one member (likely Mann) may be considering a rate hike. The minutes note that “for the other member, the evolution of and prospects for disaggregated measures of activity and inflation could warrant an activist strategy.”

So, it was almost a 5-3-1 split.

What are the implications and the path forward?

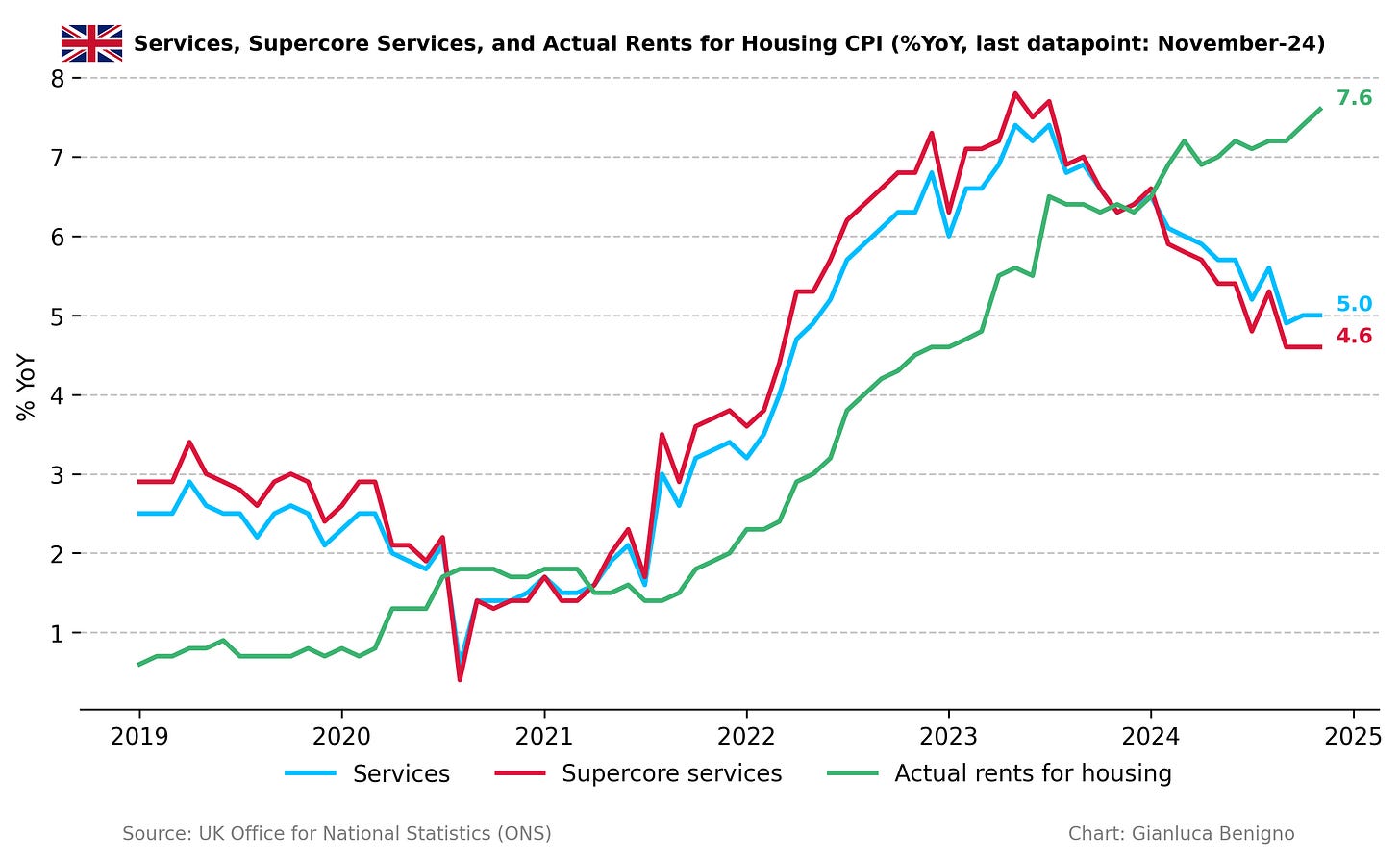

Before today’s meeting, financial markets were pricing two cuts for the BOE into 2025 following the wage data (backward-looking data, as the latest observation is for October 2024) and the persistence of service inflation (the main theme of the MPC's current interpretation of the inflation outlook).

The members who voted for a cut expressed concerns about the impact of an economic slowdown on future inflation. They highlighted that “recent data developments pointed to sluggish demand and a weakening labor market, now and the year ahead, both of which would exert downward pressure on demand, wages, and prices. In the short term, these factors, along with higher uncertainty and weak global conditions, paired with the temporary uptick in headline inflation entailed a policy trade-off.“)

On the other side, five members support a gradual approach to balance the tension between economic weakness and inflationary pressures. They noted that: “Against a backdrop over recent years of a repeated sequence of negative supply shocks, incoming data would help to clarify the potential trade-off between more persistent inflationary pressures and greater weakness in output and employment. For five of these members, recent developments added to the argument for a gradual approach to the withdrawal of policy restrictiveness, while eschewing any commitment to changing policy at a specific meeting.”

As I discussed in “Scenario Analysis as a New Communication Device for Central Banks,” the Bank of England's current narrative is focused on the factors driving the persistence of service sector inflation.

Their three scenarios could be represented as follows:

Scenario 1: Benign Disinflation Scenario. A quicker reduction in monetary policy restrictiveness is needed. I would interpret it as cutting rates by 25 basis points at every meeting.

Scenario 2: Baseline Scenario. A gradual removal of restrictive policy is required, which I would interpret as rate cuts of 25 basis points occurring every other meeting to ensure inflation returns to target sustainably.

Scenario 3: Structural Inflationary Scenario. Monetary policy must remain restrictively tight for an extended period which I interpret as potentially keeping rates unchanged at their current level.

However, the weak performance of the UK economy, with GDP contracting by 0.1% MoM, could shift this narrative. The Bank might begin to consider scenarios where weak growth today leads to low inflation within the policy horizon or even inflation falling below the target, potentially justifying more rate cuts than the market currently anticipates.

Looking ahead, and given the split of the committee, Bailey would be key in determining how fast the Bank of England could cut. Notably, he recently suggested—prior to the release of this week’s wage and CPI data—that a gradual path involving four cuts could be a reasonable projection.

Interestingly in her first speech, Lombardelli leaned more towards the hawkish stance (“But at this point I am more worried about the possible consequences if the upside materialised, as this could require a more costly monetary policy response”).

In any case following the latest decision, financial market seems to interpret today’s decision as overall more dovish with a lower path for the Bank Rate.

So where do MPC members stay?

To understand the pattern looking forward it is in my opinion important to understand where each committee member is placed in terms of the likely scenario. The table at the beginning summarizes my interpretation of the MPC’s views, based on their speeches and voting patterns. It aims to reflect their latest perspectives within the context of the scenario analysis that the MPC has outlined as a framework for policy decisions. I have placed some members between two scenarios when they have explicitly indicated that they perceive inflation risks in both cases.

Unsurprisingly, incoming data will play a crucial role in shaping the views of MPC members. It is also important to consider that new challenges—whether geopolitical or trade-related—could influence their judgment in the future.

Final thoughts

Divergence among policymakers has become a defining feature of the post-pandemic era. The process of normalization, combined with persistently sticky service inflation, has led to non-unanimous votes at the Federal Reserve twice—most recently with even more dissent during yesterday’s FOMC meeting. Similarly, the Bank of England has seen repeatedly split decisions in recent months, while the Bank of Japan's latest vote resulted in an 8-1 outcome, with one member advocating for a rate hike.

This lack of consensus and growing policy uncertainty are likely to remain dominant themes in 2025.

As for the Bank of England, my current view is that its restrictive monetary policy stance risks being more stagflationary than effective at controlling inflation. This approach may exacerbate weak economic growth without adequately addressing the underlying pressures driving inflation.

Rent inflation has now risen to 7.6% YoY, and I suggest it may further contribute to service inflation by propagating through the broader economy. Gradual rate cuts are unlikely to effectively mitigate the impact of this cost channel within the policy horizon, and I suspect its effects are likely to persist in the short term.

Related posts (with links)

UK November-24 CPI Inflation Report (previous release)

UK October-24 CPI Inflation Report (previous release)

UK September-24 CPI Inflation Report (previous release);

UK August-24 CPI Inflation Report (previous release);

Scenario Analysis as Communication Device for Central Banking (related post);

A Quasi-Global Inflation Overview (related post);

The Bank of England’s Wimbledon Edition (related post)

Has Wage Growth Fueled Inflation in the UK? (related post);

At the Core of UK Inflation (construction of supercore inflation and supercore wage index);

FT Alphaville on Catch-22 (short version of the Catch-22 effect);

Is the Bank of England in a Catch-22 Situation (long version of the Catch-22 effect);

Completely agree on understanding where MPC members sit on the three scenarios as the best means to understand the Bank’s trajectory (I took this approach too in my analysis)

What i struggle to see is this being Mann potentially putting a hike on the table - it contradicts her “Boogie Dancing” comments in mid September and in 2023. If not Mann than that leaves either the policymaker considering a hike a different member (unlikely?) or maybe “activist” means something else?

My views are broadly similar:

https://www.linkedin.com/posts/jamesneilbennett_bmi-activity-7275545085432201217-mNyw?utm_source=share&utm_medium=member_ios