China May-25 CPI Inflation Report

Deflation persists at the consumer level and has deepened further at the producer level

Key takeaways:

China's Consumer Price Index (CPI, non-seasonally adjusted) decreased by 0.1% year-on-year (YoY) in May, the same decline as in April and higher than the consensus forecast of a 0.2% YoY decline.

Core CPI (excluding all food and energy) increased by 0.6% YoY in May, up from the 0.5% YoY increase recorded in April.

Consumer goods inflation fell by 0.5% YoY in May, in contrast to April’s 0.3% YoY decline. Service inflation rose by 0.5% YoY, higher than the 0.3% YoY increase recorded in April.

Among the main categories, Transport and Communication is in sharp deflationary territory with a decline of -4.3% YoY, down from April's decline by 3.9% YoY. This decline is mainly driven by Fuels for Transport Facilities with a decrease of 12.9% YoY. Food and Tobacco inflation is still very low at 0.1% YoY, down from the 0.3% YoY increase recorded in April.

Producer Price inflation (all items) continued its deflationary trend in May, with a 3.3% YoY decline, lower than the 2.7% YoY decline recorded in April and lower than the consensus forecast of a 3.2% YoY decline.

Overall, the data indicate that deflationary pressures persist and have deepened at the producer level while consumer inflation is at a very low level. Persistent producer-level deflation continues to signal ongoing excess capacity in the economy. Looking ahead, the key source of uncertainty for inflation dynamics is the impact of tariffs. The still-high U.S. tariffs on Chinese goods could further intensify deflation at the producer level, potentially transmitting downward price pressures to consumers and reinforcing overall deflationary trends.

Related Posts

China April- 25 CPI Inflation Report (previous release)

China March- 25 CPI Inflation Report (previous release)

China February- 25 CPI Inflation Report (previous release)

China January- 25 CPI Inflation Report (previous release)

China December- 24 CPI Inflation Report (previous release)

Review of the Inflation Release

In May 2025, consumer prices declined by 0.1% year-on-year (YoY), the same decline as in April and higher than the consensus forecast of a 0.2% YoY decline (see Chart 1). On a month-to-month basis (MoM), consumer prices decreased by 0.2% MoM, compared to April’s 0.1% MoM increase.

Core inflation (excluding food and energy prices) rose by 0.6% YoY in May, higher than the 0.5% YoY increase observed in April. On a month-to-month (MoM) basis, core inflation was flat at 0.0% YoY, compared to the 0.2% MoM rise recorded in April.

A relevant split that is provided at the level of China’s release is the distinction between consumer goods and services. In May 2025, consumer goods decreased by 0.5% YoY, lower than the decline of 0.3% YoY in April. On a monthly basis, consumer goods declined by 0.3% MoM, following April’s 0.0% MoM reading.

Service inflation rose by 0.5% YoY in May after posting a 0.3% YoY increase in April. On a monthly basis, service inflation was flat at 0.0% MoM, down from April’s 0.3% MoM rise.

Finally, in the case of China, we also report producer price indexes. Indeed, given China’s prominence in global manufacturing, producer prices provide a good indicator for thinking about global inflationary pressures at the goods level.

We report three categories:

All items

Means of production, and

Consumer goods

In May 2025, producer prices continued their long-running deflationary streak. Producer prices for all items declined by 3.3% YoY, following April’s 2.7% YoY decline. Similarly, producer prices (Means of Production) fell by 4.0% YoY in May, compared to the 3.1% YoY decline reported in April, indicating persistent lower input costs.

Finally, in May 2025, producer prices (consumer goods) declined by 1.4% YoY, following the 1.6% YoY decline recorded in April.

Summary

May’s CPI release held few surprises. Deflation at the producer level persists—and appears to be worsening—while consumer inflation remains stuck at very low levels and flirting with deflation. The overall picture highlights two key challenges for China: one internal, the other external. On the domestic front, weak inflation signals weak consumption, suggesting that further stimulus may be needed to support aggregate demand. While Beijing has recently introduced policy measures, it seems that their impact may prove insufficient or may take time to feed through the economy. Externally, trade tensions remain a critical factor. Producer price deflation reflects excess capacity, which could be exacerbated by continued trade frictions. The outcomes of U.S. trade negotiations—both with China and other partners—will play a key role in shaping the path of producer inflation going forward.

Table 1: CPI by components (% YoY)

Source: National Bureau of Statistics of China

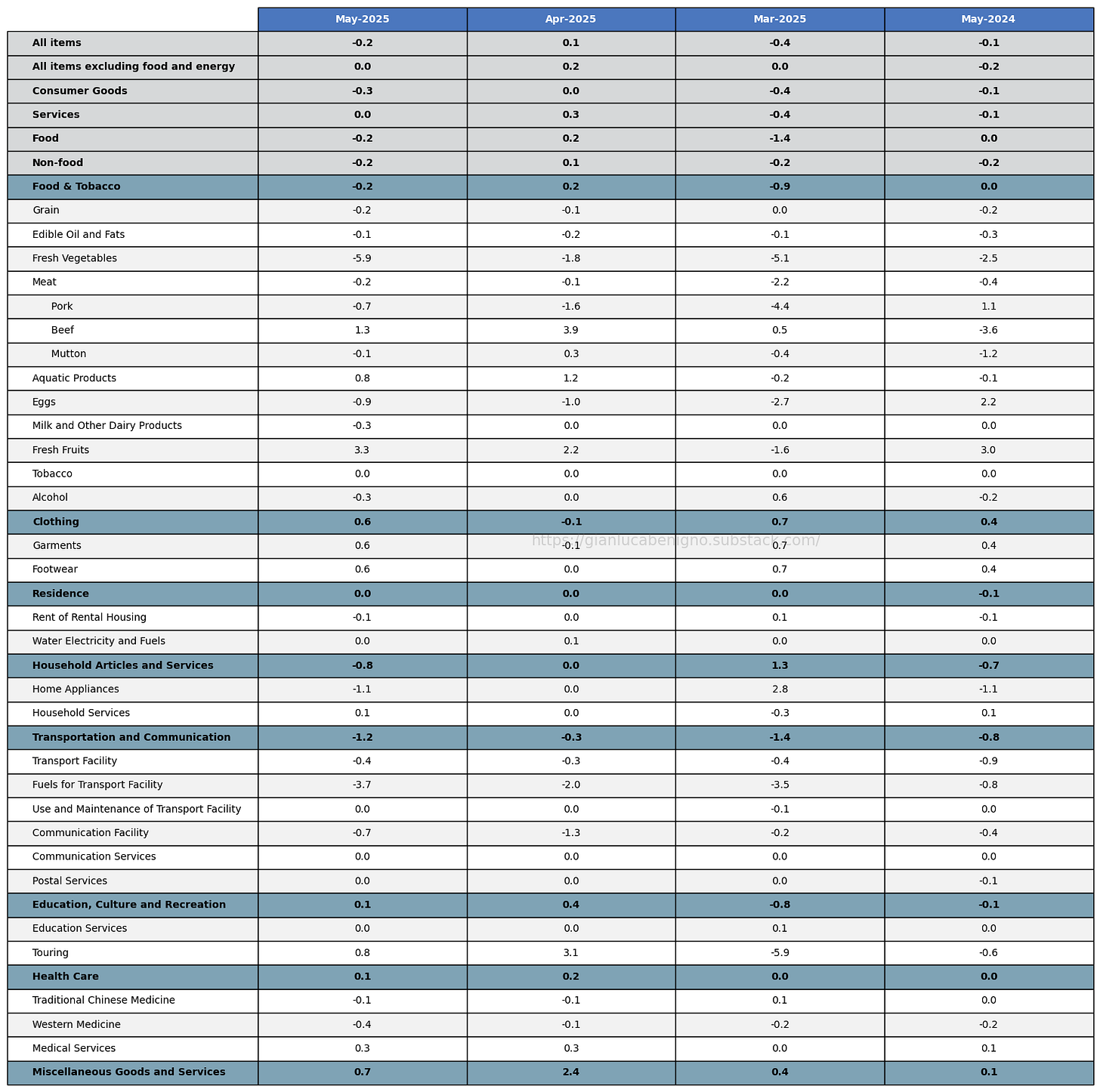

Table 2: CPI by categories (% MoM)

Source: National Bureau of Statistics of China

Table 3: PPI by components (% YoY)

Source: National Bureau of Statistics of China

Table 4: PPI by categories (% MoM)

Source: National Bureau of Statistics of China

This detailed breakdown of China’s May inflation data highlights the persistent deflationary pressures at the producer level alongside very subdued consumer inflation — a combination that underscores ongoing challenges in rebalancing China’s economy.