China June-25 CPI Inflation Report

Producer deflation deepened further, while consumer inflation edged into marginally positive territory.

Key takeaways:

China's Consumer Price Index (CPI, n.s.a.) increased by 0.1% year-on-year (YoY) in June, above the 0.1% YoY decline recorded in May, and higher than the consensus forecast of a 0.0% YoY change.

Core CPI (excluding all food and energy) increased by 0.7% YoY in June, up from the 0.6% YoY increase recorded in May.

Consumer goods inflation fell by 0.2% YoY in June, in contrast to May’s 0.5% YoY decline. Service inflation rose by 0.5% YoY, the same increase as the one recorded in May.

Among the main categories, Transport and Communication is still in deflationary territory with a decline of 3.7% YoY, up from May's 4.3% YoY decline. This decline is mainly driven by Fuels for Transport Facilities with a decrease of 10.8% YoY compared to 12.9% YoY in May. Food and tobacco inflation remained very low at 0.1% year-on-year in June, unchanged from May. However, the meat subcategory shifted into deflation, declining by 4.2% YoY after a 0.7% increase in May.

Producer Price inflation (all items) continued its deflationary trend in June, with a 3.6% YoY decline, lower than the 3.3% YoY decline recorded in May and lower than the consensus forecast of a 3.2% YoY decline.

Overall, the data suggest that deflationary pressures remain entrenched and have intensified at the producer level, while consumer inflation remains subdued, registering only a modest positive reading. Persistent deflation in producer prices points to continued excess capacity in the economy. The inflation outlook remains skewed to the downside, with risks of deflation extending to consumer prices, given the deepening producer-level deflation and the ongoing inability of domestic stimulus measures to translate into sustained consumer demand.

Related Posts

China May- 25 CPI Inflation Report (previous release)

China April- 25 CPI Inflation Report (previous release)

China March- 25 CPI Inflation Report (previous release)

China February- 25 CPI Inflation Report (previous release)

China January- 25 CPI Inflation Report (previous release)

China December- 24 CPI Inflation Report (previous release)

Review of the Inflation Release

In June 2025, consumer prices increased by 0.1% year-on-year (YoY), above the 0.1% YoY decline recorded in May, and higher than the consensus forecast of a 0.0% YoY change (see Chart 1). On a month-to-month basis (MoM), consumer prices decreased by 0.1% MoM, compared to May’s 0.2% MoM decrease and lower than the consensus forecast of a 0.0% MoM change.

Core inflation (excluding food and energy prices) rose by 0.7% YoY in June, higher than the 0.6% YoY increase observed in May. On a month-over-month basis, core inflation was unchanged at 0.0% in June, matching the reading recorded in May.

A relevant split that is provided at the level of China’s release is the distinction between consumer goods and services. In June 2025, consumer goods decreased by 0.2% YoY, lower than the decline of 0.5% YoY in May. On a monthly basis, consumer goods fell by 0.1% MoM, compared to the 0.3% MoM decline observed in May.

Service inflation rose by 0.5% YoY in June, unchanged from May. On a monthly basis, service was unchanged at 0.0% MoM, the same reading as in May.

In the case of China, we also report producer price indexes. Indeed, given China’s prominence in global manufacturing, producer prices provide a good indicator for thinking about global inflationary pressures at the goods level.

We report three categories: All items, Means of production, and Consumer goods.

In June 2025, producer prices continued their long-running deflationary streak. Producer prices for all items declined by 3.6% YoY, following May’s 3.3% YoY decline. Similarly, producer prices (Means of Production) fell by 4.4% YoY in June, compared to the 4.0% YoY decline reported in May, indicating persistent lower input costs.

Finally, in June 2025, producer prices (consumer goods) declined by 1.4% YoY, following the 1.4% YoY decline recorded in May.

Summary

June’s CPI release brought few surprises. Deflation at the producer level persists—and appears to be deepening—while consumer inflation edged marginally into positive territory, remaining close to deflation. The data underscore two key challenges facing China: one domestic, the other external.

Domestically, persistently weak inflation reflects subdued consumption, suggesting that additional stimulus may be needed to support aggregate demand. Policy efforts will need to focus on boosting household confidence and spending.

Externally, producer price deflation highlights ongoing excess capacity, which risks being amplified by trade tensions. Continued frictions in global trade pose risks to industrial output and pricing power. A resolution in trade negotiations would offer greater clarity for the producer inflation outlook and broader economic trajectory.

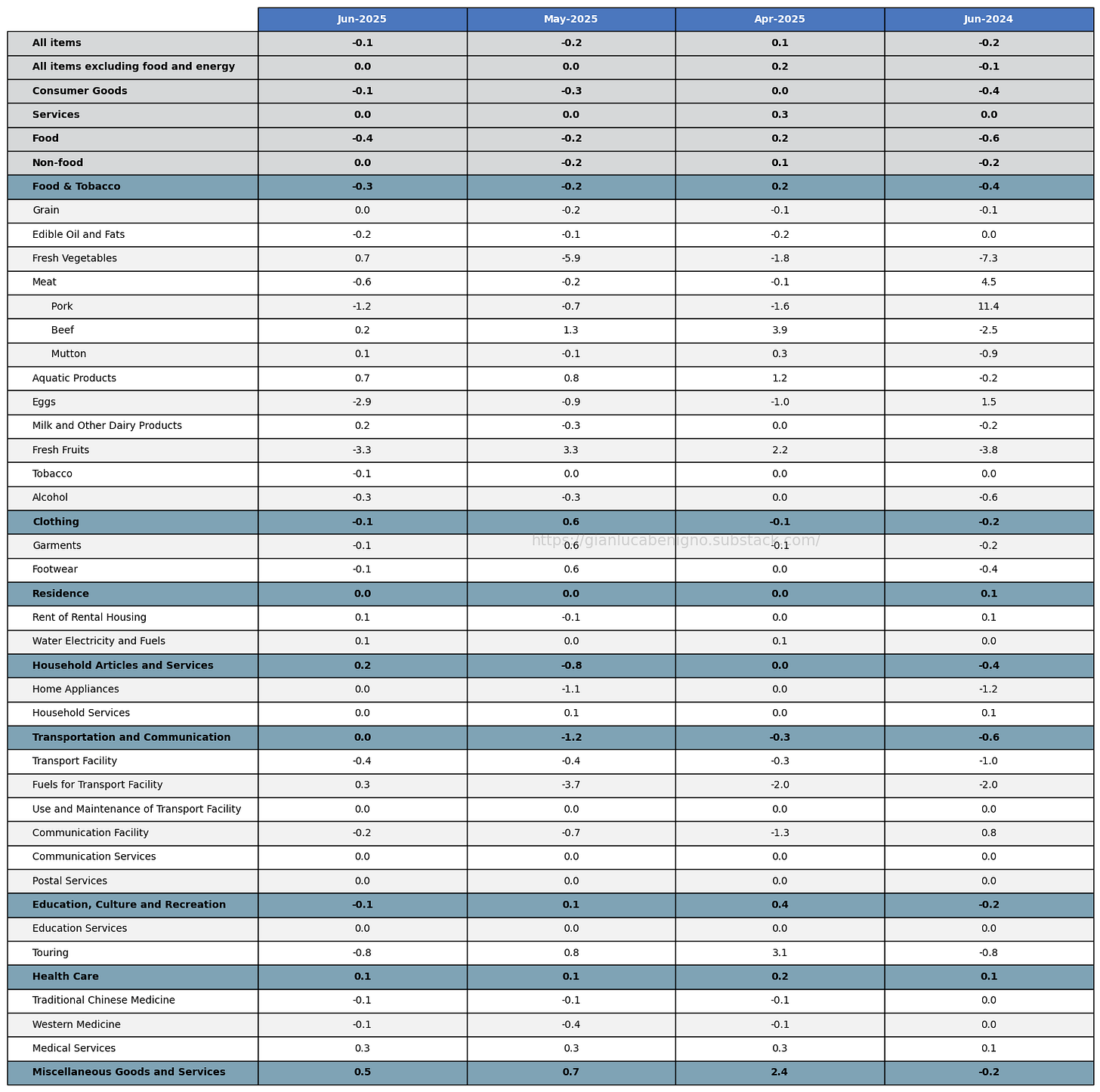

Table 1: CPI by components (% YoY)

Source: National Bureau of Statistics of China.

Table 2: CPI by components (% MoM)

Source: National Bureau of Statistics of China.

Table 3: PPI by categories (% YoY)

Source: National Bureau of Statistics of China

Table 4: PPI by categories (% MoM)

Source: National Bureau of Statistics of China